Financial News

Custom Truck One Source’s (NYSE:CTOS) Q3 Earnings Results: Revenue In Line With Expectations

Truck and heavy equipment distributor Custom Truck One Source (NYSE: CTOS) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 3% year on year to $447.2 million. The company’s outlook for the full year was also close to analysts’ estimates with revenue guided to $1.85 billion at the midpoint. Its GAAP loss of $0.07 per share was 141% below analysts’ consensus estimates.

Is now the time to buy Custom Truck One Source? Find out by accessing our full research report, it’s free.

Custom Truck One Source (CTOS) Q3 CY2024 Highlights:

- Revenue: $447.2 million vs analyst estimates of $448.4 million (in line)

- EPS: -$0.07 vs analyst estimates of -$0.03 (-$0.04 miss)

- EBITDA: $80.21 million vs analyst estimates of $85.11 million (5.8% miss)

- The company dropped its revenue guidance for the full year to $1.85 billion at the midpoint from $1.89 billion, a 2.4% decrease

- EBITDA guidance for the full year is $345 million at the midpoint, below analyst estimates of $351.5 million

- Gross Margin (GAAP): 20.5%, down from 24.7% in the same quarter last year

- Operating Margin: 5.2%, down from 8.8% in the same quarter last year

- EBITDA Margin: 17.9%, down from 23.1% in the same quarter last year

- Free Cash Flow was -$96.77 million compared to -$81.23 million in the same quarter last year

- Market Capitalization: $857.4 million

“In the third fiscal quarter, we achieved sequential improvement in net income and a slight increase in Adjusted EBITDA. As discussed in our recent earnings calls, our core T&D markets experienced a slowdown over recent quarters, which particularly impacted our ERS segment. However, this decline has proven to be temporary, and we observed significant improvements in the third quarter, which have continued into the fourth quarter. Through late October, OEC on rent has increased by over $200 million, or 20%, since the end of the second quarter. While a portion of this growth can be attributed to our customers’ recovery and restoration work associated with recent weather events, the majority stems from non-storm-related work in our core T&D and vocational end-markets. We are optimistic about fiscal 2025 and believe we are well-positioned to benefit from secular tailwinds driven by AI and data center investments, electrification, and utility grid upgrades,” said Ryan McMonagle, Chief Executive Officer of CTOS.

Company Overview

Inspired by a family gas station, Custom Truck One Source (NYSE: CTOS) is a distributor of truck and heavy equipment, including sales, rentals, and custom modifications.

Specialty Equipment Distributors

Historically, specialty equipment distributors have boasted deep selection and expertise in sometimes narrow areas like single-use packaging or unique lighting equipment. Additionally, the industry has evolved to include more automated industrial equipment and machinery over the last decade, driving efficiencies and enabling valuable data collection. Specialty equipment distributors whose offerings keep up with these trends can take share in a still-fragmented market, but like the broader industrials sector, this space is at the whim of economic cycles that impact the capital spending and manufacturing propelling industry volumes.

Sales Growth

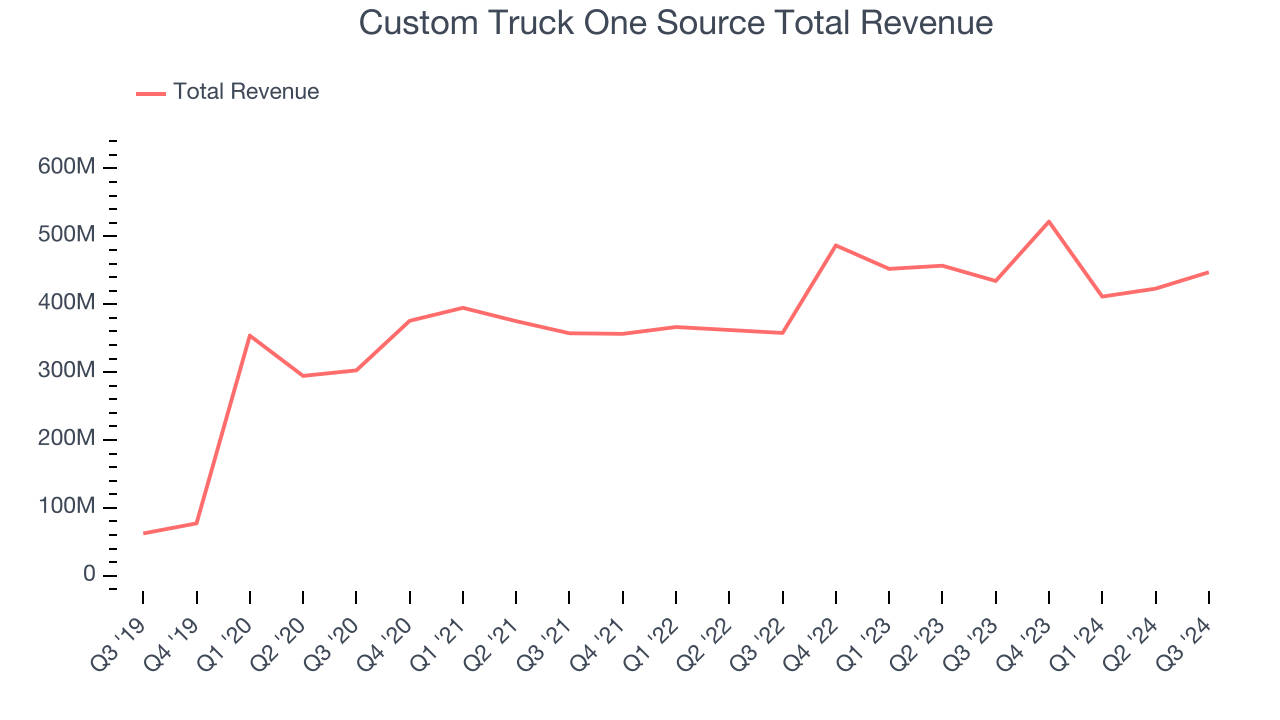

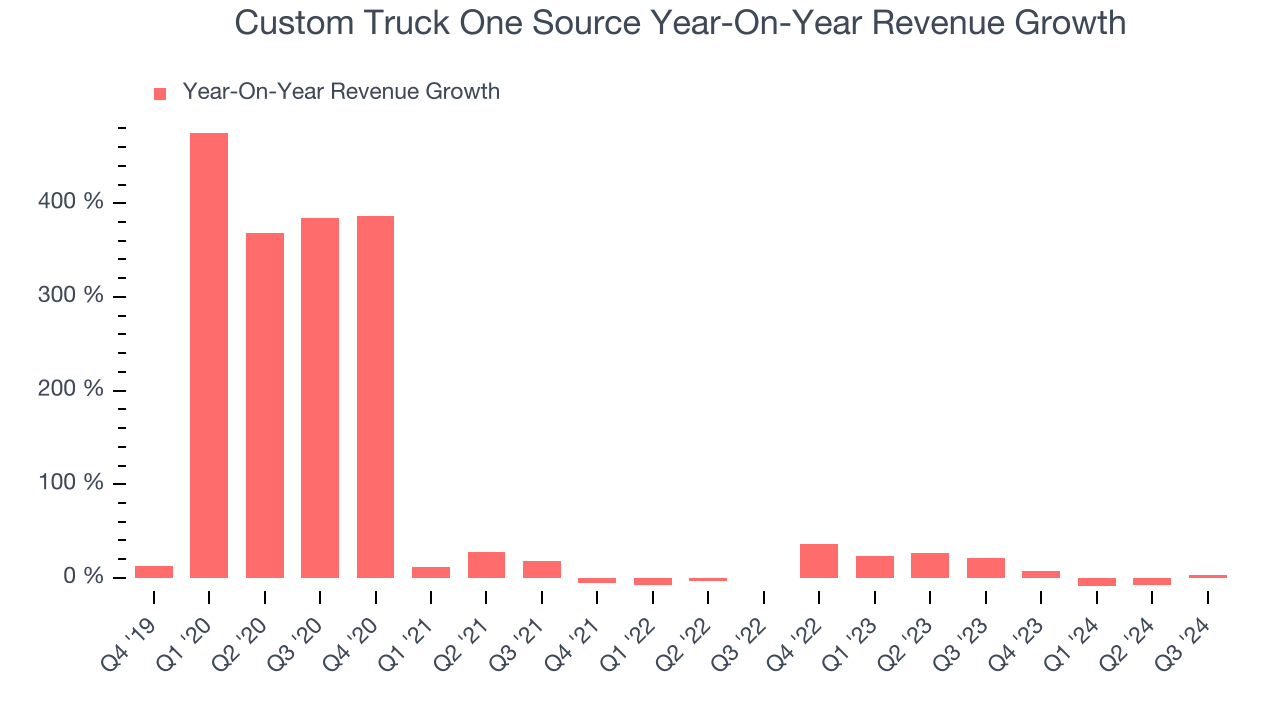

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Thankfully, Custom Truck One Source’s 47.8% annualized revenue growth over the last five years was incredible. This is a useful starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Custom Truck One Source’s annualized revenue growth of 11.8% over the last two years is below its five-year trend, but we still think the results were good and suggest demand was strong.

We can dig further into the company’s revenue dynamics by analyzing its most important segments, Equipment Rental and Aftermarket Parts and Services, which are 33.7% and 8.1% of revenue. Over the last two years, Custom Truck One Source’s Equipment Rental revenue ( lifts, cranes, trucks) averaged 2.8% year-on-year growth while its Aftermarket Parts and Services revenue (maintenance and repair) averaged 3.1% growth.

This quarter, Custom Truck One Source grew its revenue by 3% year on year, and its $447.2 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.6% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates the market thinks its products and services will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

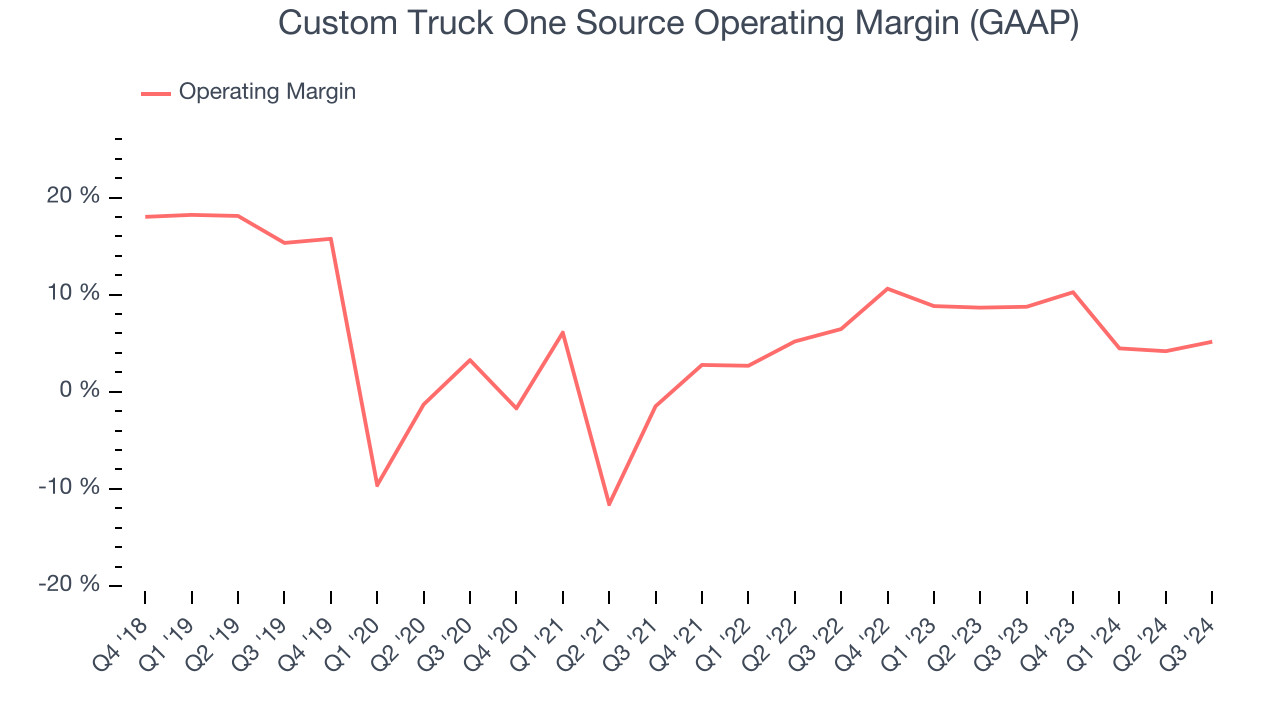

Custom Truck One Source was profitable over the last five years but held back by its large cost base. Its average operating margin of 3.9% was weak for an industrials business. This result is surprising given its high gross margin as a starting point.

On the plus side, Custom Truck One Source’s annual operating margin rose by 7.8 percentage points over the last five years, as its sales growth gave it immense operating leverage.

In Q3, Custom Truck One Source generated an operating profit margin of 5.2%, down 3.6 percentage points year on year. Since Custom Truck One Source’s gross margin decreased more than its operating margin, we can assume its recent inefficiencies were driven more by weaker leverage on its cost of sales rather than increased marketing, R&D, and administrative overhead expenses.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

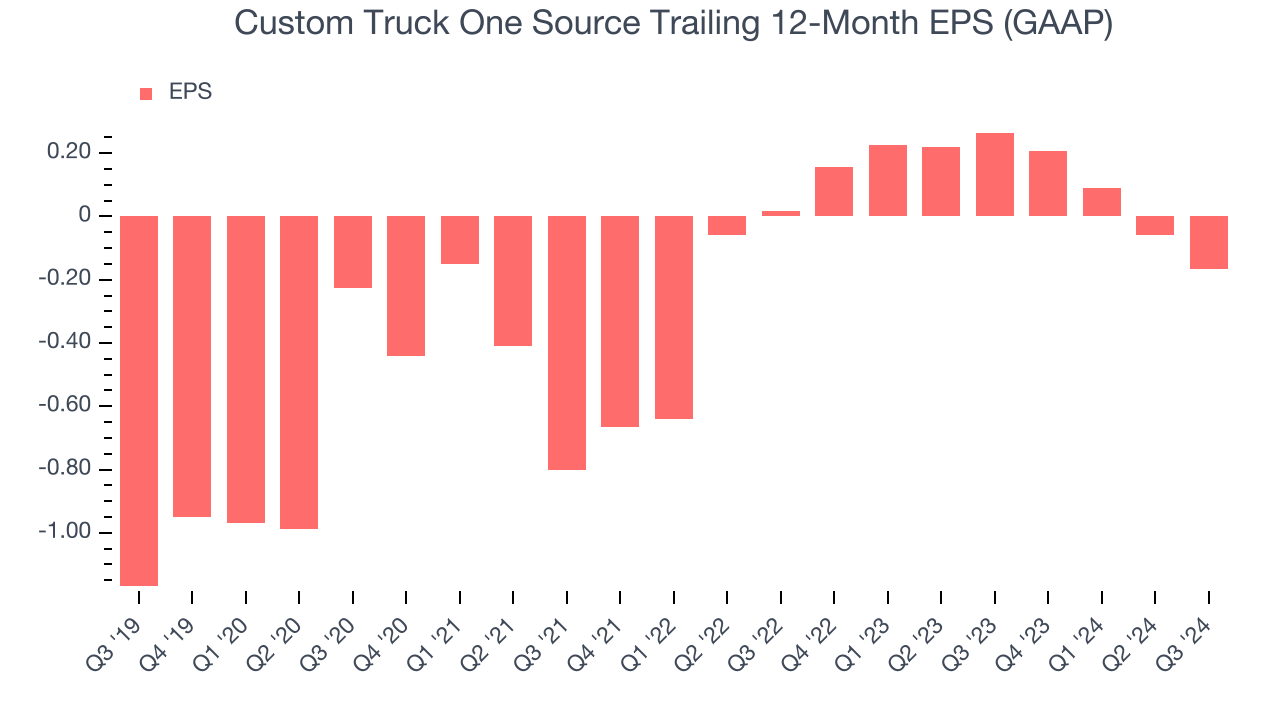

Although Custom Truck One Source’s full-year earnings are still negative, it reduced its losses and improved its EPS by 32.4% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

Sadly for Custom Truck One Source, its EPS declined by 245% annually over the last two years while its revenue grew 11.8%. This tells us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of Custom Truck One Source’s earnings can give us a better understanding of its performance. Custom Truck One Source’s operating margin has declined by 1.3 percentage points over the last two years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, Custom Truck One Source reported EPS at negative $0.07, down from $0.04 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Custom Truck One Source’s full-year EPS of negative $0.17 will reach break even.

Key Takeaways from Custom Truck One Source’s Q3 Results

It was good to see Custom Truck One Source’s full-year revenue forecast beat analysts’ expectations. On the other hand, its EBITDA missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 3% to $3.86 immediately following the results.

Custom Truck One Source may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.