Financial News

Mirion (NYSE:MIR) Beats Q3 Sales Targets

Radiation technology company Mirion (NYSE: MIR) reported Q3 CY2024 results topping the market’s revenue expectations, with sales up 8.2% year on year to $206.8 million. Its GAAP loss of $0.07 per share was 40% below analysts’ consensus estimates.

Is now the time to buy Mirion? Find out by accessing our full research report, it’s free.

Mirion (MIR) Q3 CY2024 Highlights:

- Revenue: $206.8 million vs analyst estimates of $203.7 million (1.5% beat)

- EPS: -$0.07 vs analyst expectations of -$0.05 (40% miss)

- EBITDA: $37 million vs analyst estimates of $48.67 million (24% miss)

- EBITDA guidance for the full year is $200 million at the midpoint, in line with analyst expectations

- Gross Margin (GAAP): 44.9%, up from 42.4% in the same quarter last year

- Operating Margin: -0.8%, up from -5.5% in the same quarter last year

- EBITDA Margin: 17.9%, up from -2.3% in the same quarter last year

- Free Cash Flow Margin: 1.9%, down from 7.5% in the same quarter last year

- Market Capitalization: $2.94 billion

“Third quarter results were in-line with our expectations,” stated Thomas Logan, Mirion’s Chief Executive Officer.

Company Overview

With its monitoring devices installed on spacecraft, Mirion (NYSE: MIR) offers radiation technology to government agencies, healthcare providers, and industrial companies.

Inspection Instruments

Measurement and inspection instrument companies may enjoy more steady demand because products such as water meters are non-discretionary and mandated for replacement at predictable intervals. In the last decade, digitization and data collection have driven innovation in the space, leading to incremental sales. But like the broader industrials sector, measurement and inspection instrument companies are at the whim of economic cycles. Interest rates, for example, can greatly impact civil, commercial, and residential construction projects that drive demand.

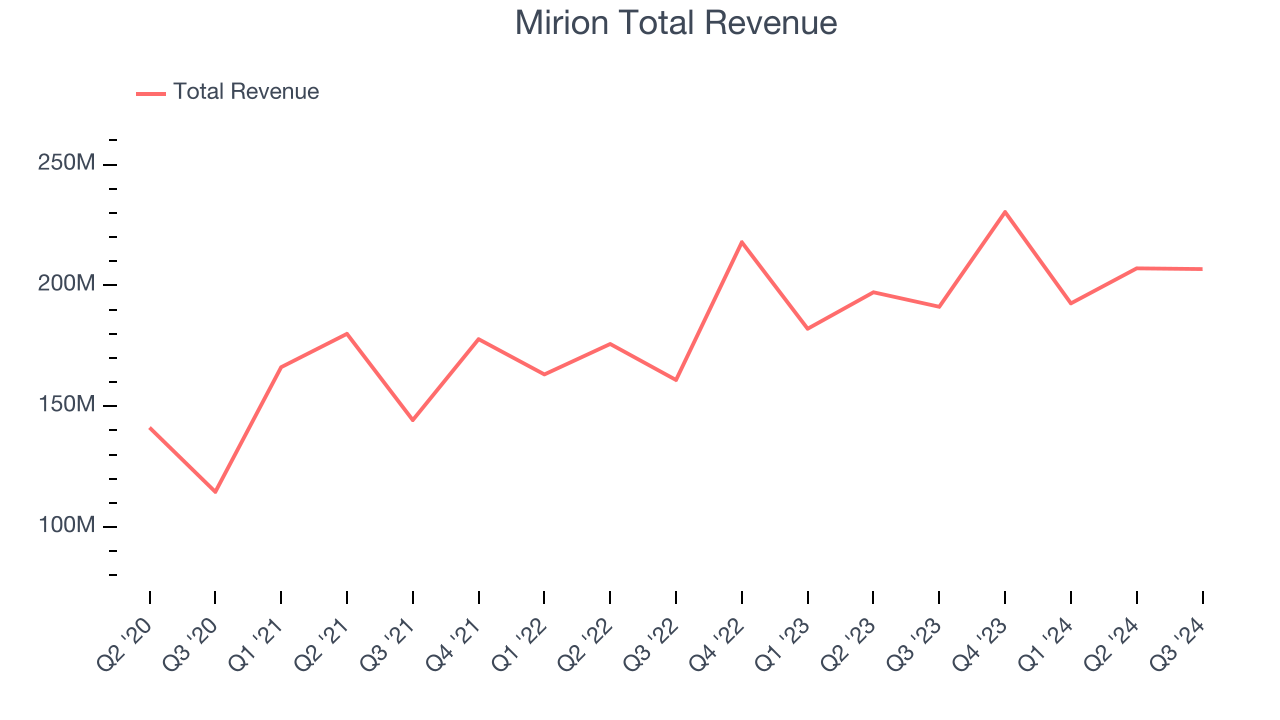

Sales Growth

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Mirion’s 12.8% annualized revenue growth over the last four years was excellent. This is encouraging because it shows Mirion’s offerings resonate with customers, a helpful starting point.

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Mirion’s annualized revenue growth of 11.1% over the last two years is below its four-year trend, but we still think the results were good and suggest demand was strong. Mirion’s recent history shows it’s one of the better Inspection Instruments businesses as many of its peers faced declining sales because of cyclical headwinds.

This quarter, Mirion reported year-on-year revenue growth of 8.2%, and its $206.8 million of revenue exceeded Wall Street’s estimates by 1.5%.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates. This signals Mirion could be a hidden gem because it doesn’t get attention from professional brokers.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

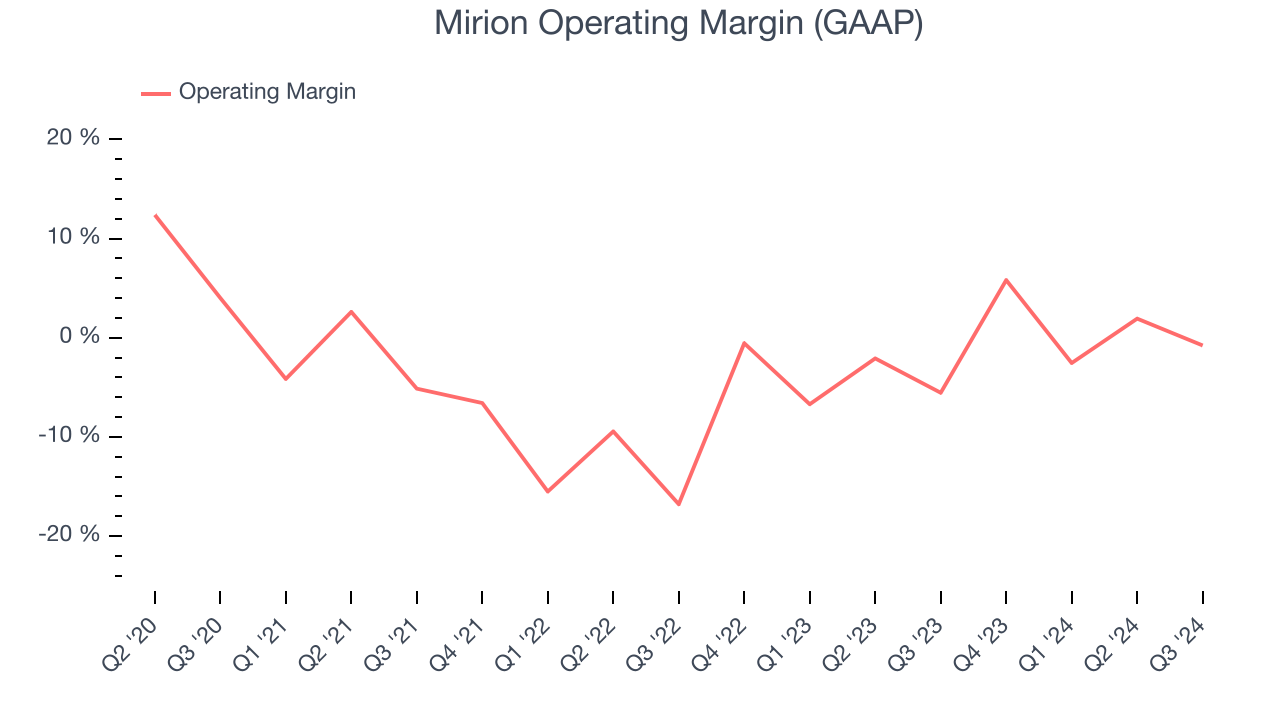

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Although Mirion broke even this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 2.8% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, Mirion’s annual operating margin decreased by 8.1 percentage points over the last five years. The company’s performance was poor no matter how you look at it. It shows operating expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Mirion generated a negative 0.8% operating margin. The company's lack of profits raise a flag.

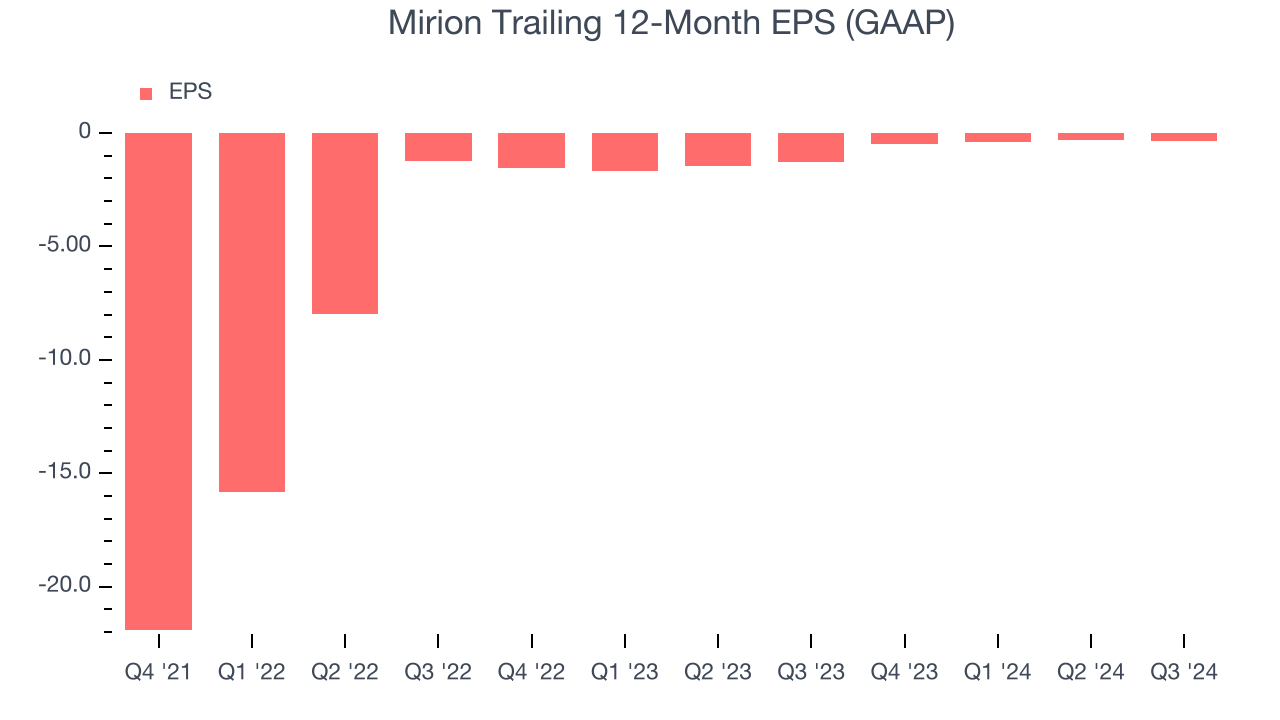

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Although Mirion’s full-year earnings are still negative, it reduced its losses and improved its EPS by 66.2% annually over the last four years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Mirion, its two-year annual EPS growth of 48.2% was lower than its four-year trend. We still think its growth was good and hope it can accelerate in the future.In Q3, Mirion reported EPS at negative $0.07, in line with the same quarter last year. This print missed analysts’ estimates. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data. This signals Mirion could be a hidden gem because it doesn’t have much coverage among professional brokers.

Key Takeaways from Mirion’s Q3 Results

It was good to see Mirion beat analysts’ revenue expectations this quarter. On the other hand, its EBITDA missed and its EPS fell short of Wall Street’s estimates. Full year EBITDA guidance in line with expectations was not enough to get the market constructive on the results. The stock traded down 4.6% to $13.40 immediately following the results.

Mirion’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.