Financial News

Trex (NYSE:TREX) Reports Bullish Q3

Composite decking and railing products manufacturer Trex Company (NYSE: TREX) announced better-than-expected revenue in Q3 CY2024, but sales fell 23.1% year on year to $233.7 million. On the other hand, the company’s full-year revenue guidance of $1.14 billion at the midpoint came in slightly below analysts’ estimates. Its non-GAAP profit of $0.37 per share was also 15.6% above analysts’ consensus estimates.

Is now the time to buy Trex? Find out by accessing our full research report, it’s free.

Trex (TREX) Q3 CY2024 Highlights:

- Revenue: $233.7 million vs analyst estimates of $225.4 million (3.7% beat)

- Adjusted EPS: $0.37 vs analyst estimates of $0.32 (15.6% beat)

- EBITDA: $67.92 million vs analyst estimates of $59.28 million (14.6% beat)

- The company reconfirmed its revenue guidance for the full year of $1.14 billion at the midpoint

- Gross Margin (GAAP): 39.9%, down from 43.1% in the same quarter last year

- Operating Margin: 23.2%, down from 28.4% in the same quarter last year

- EBITDA Margin: 29.1%, down from 32.7% in the same quarter last year

- Free Cash Flow Margin: 23.3%, down from 49.3% in the same quarter last year

- Market Capitalization: $6.99 billion

“Our third quarter results were ahead of our expectations led by sustained consumer demand for our premium-priced products, for which we estimate sell-through increased by high-single digits year-on-year and contractor lead time continued to average 6 to 8 weeks. As anticipated, sell-through of our lower-priced products was below last year’s levels, consistent with a pullback in spending by consumers in this segment, although the decline was sequentially stable and less pronounced than we had expected. During the third quarter, our channel partners reduced their inventory levels by approximately $70 million, in line with our expectations and seasonal demand trends. Our strong EBITDA margin in the third quarter reflected the benefits of our continuous cost-out programs, which partially offset the impact of lower utilization rates, as well as lower SG&A expenses,” said Bryan Fairbanks, President and CEO.

Company Overview

Addressing the demand for aesthetically-pleasing and unique outdoor living spaces, Trex Company (NYSE: TREX) makes wood-alternative decking, railing, and patio furniture.

Home Construction Materials

Traditionally, home construction materials companies have built economic moats with expertise in specialized areas, brand recognition, and strong relationships with contractors. More recently, advances to address labor availability and job site productivity have spurred innovation that is driving incremental demand. However, these companies are at the whim of residential construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of home construction materials companies.

Sales Growth

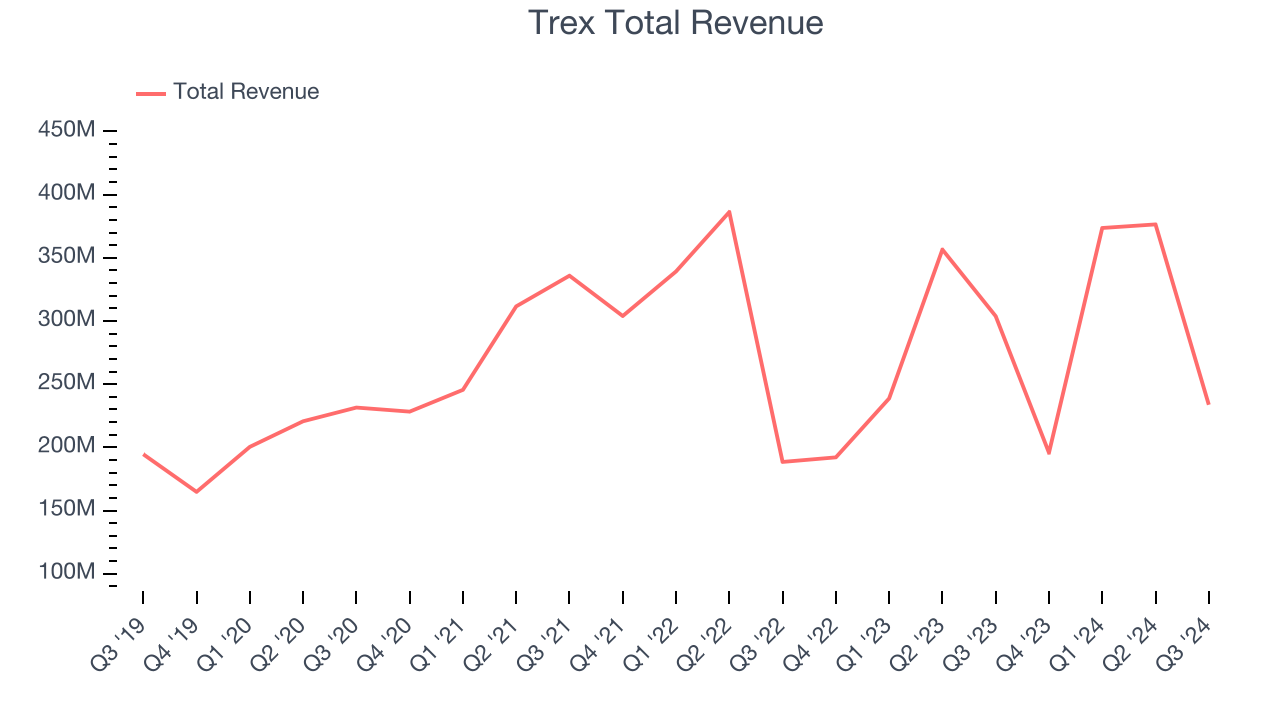

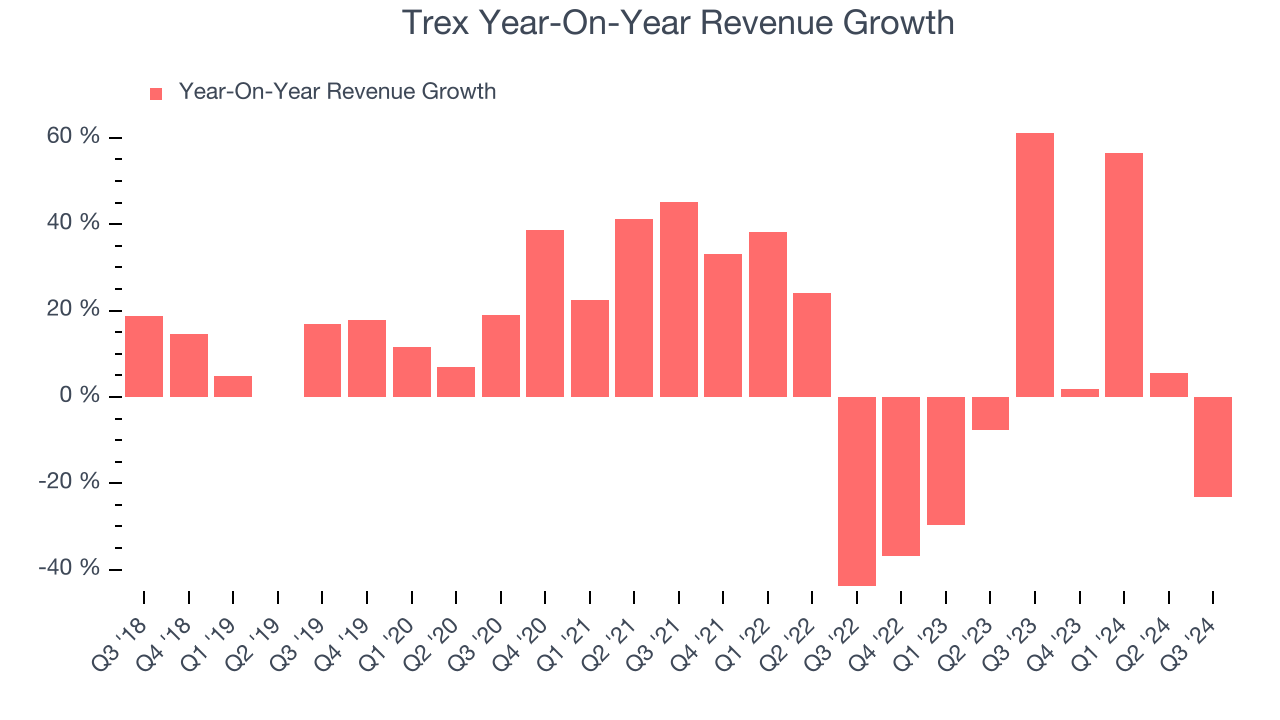

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Trex’s 10.4% annualized revenue growth over the last five years was solid. This is a useful starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Trex’s recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 1.6% over the last two years.

This quarter, Trex’s revenue fell 23.1% year on year to $233.7 million but beat Wall Street’s estimates by 3.7%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection indicates the market believes its newer products and services will fuel better performance, it is still below average for the sector.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

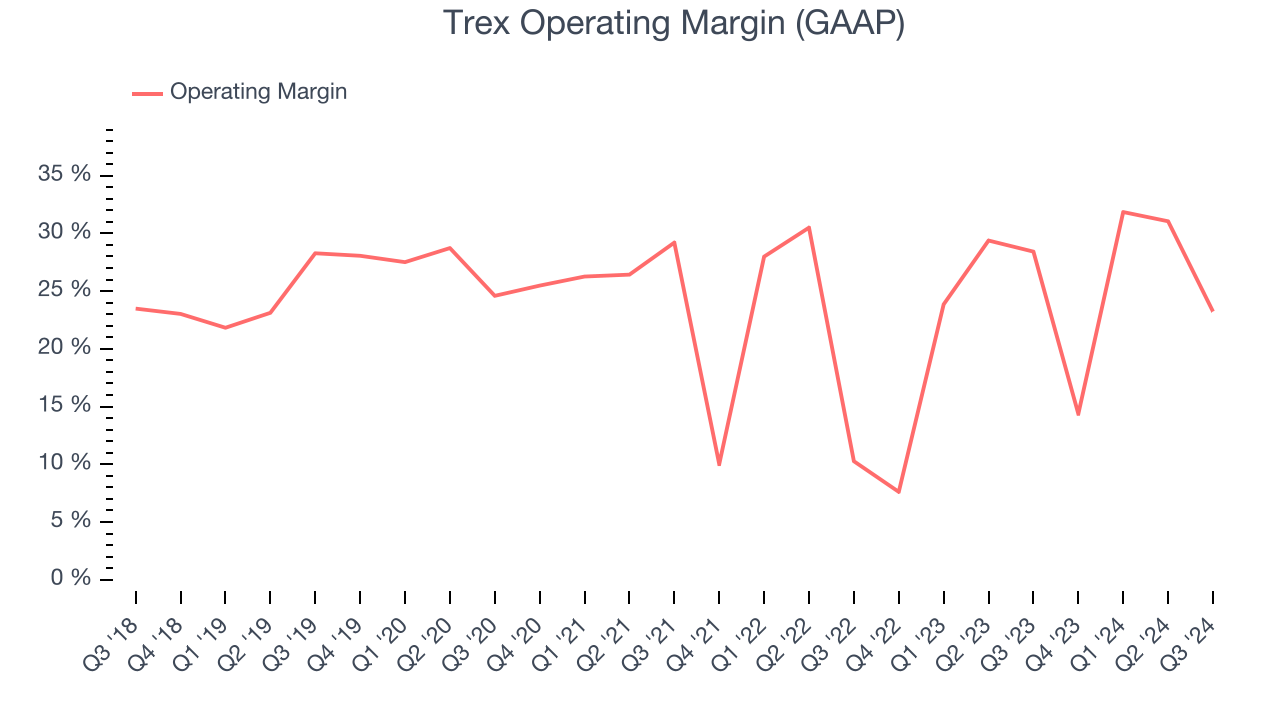

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Trex has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 25.2%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Trex’s annual operating margin might have seen some fluctuations but has generally stayed the same over the last five years, highlighting the long-term consistency of its business.

This quarter, Trex generated an operating profit margin of 23.2%, down 5.2 percentage points year on year. Since Trex’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

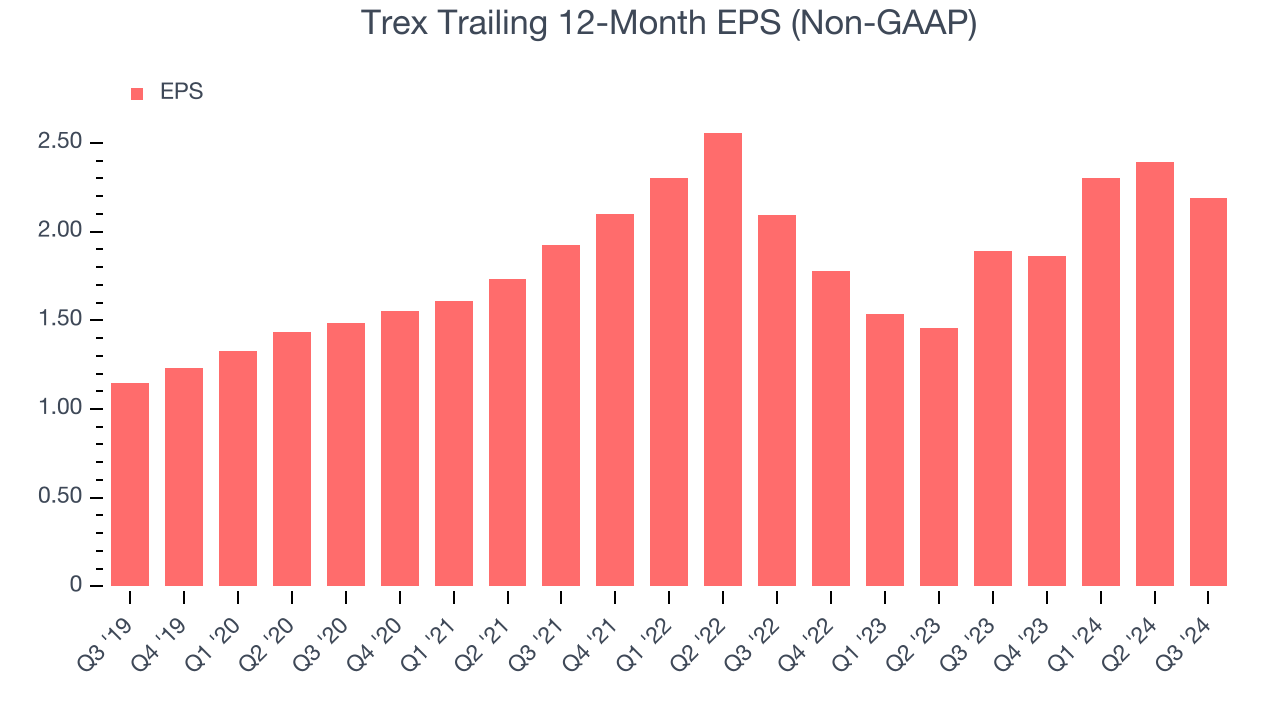

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Trex’s EPS grew at a remarkable 13.9% compounded annual growth rate over the last five years, higher than its 10.4% annualized revenue growth. However, this alone doesn’t tell us much about its day-to-day operations because its operating margin didn’t expand.

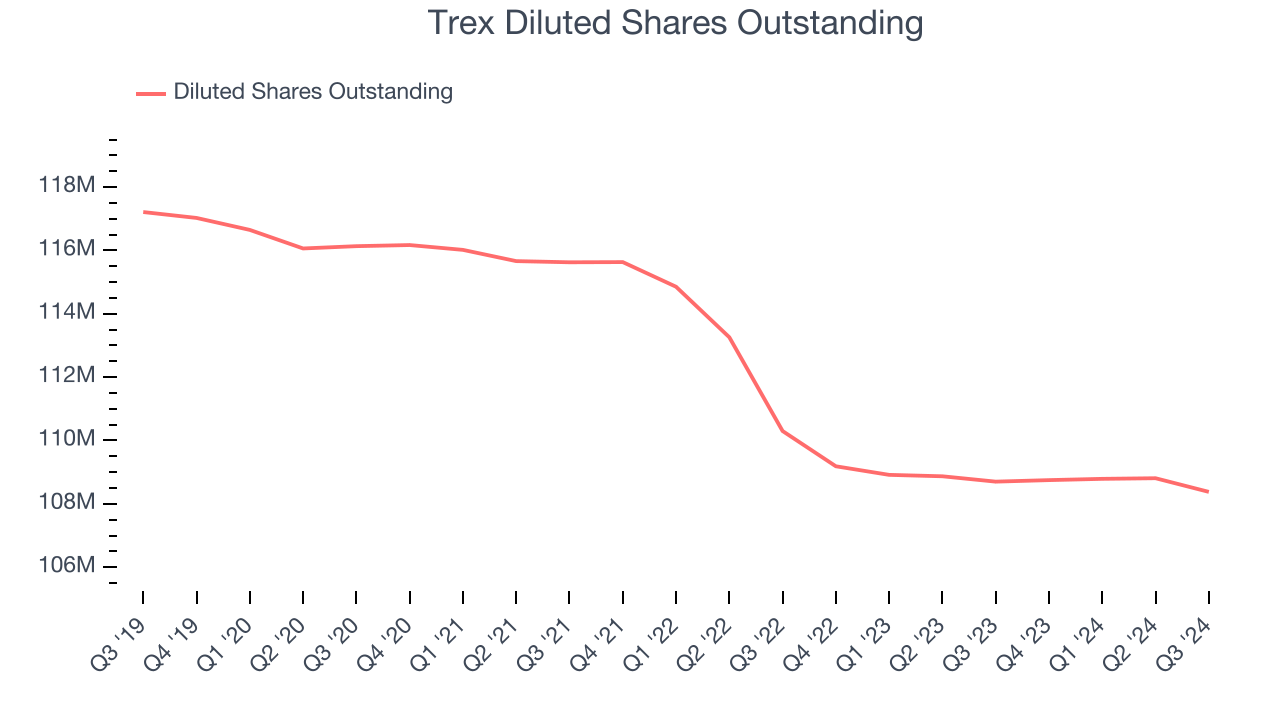

We can take a deeper look into Trex’s earnings quality to better understand the drivers of its performance. A five-year view shows that Trex has repurchased its stock, shrinking its share count by 7.5%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For Trex, its two-year annual EPS growth of 2.2% was lower than its five-year trend. We hope its growth can accelerate in the future.In Q3, Trex reported EPS at $0.37, down from $0.57 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Trex’s full-year EPS of $2.19 to shrink by 7.2%.

Key Takeaways from Trex’s Q3 Results

We were impressed by how significantly Trex blew past analysts’ EBITDA and EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates. For the full year, revenue guidance was reiterated, which is always comforting. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 4.9% to $69.75 immediately after reporting.

Trex had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment.We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.