Financial News

John Bean (NYSE:JBT) Beats Q3 Sales Targets

Food processing and aviation equipment manufacturer John Bean (NYSE: JBT) beat Wall Street’s revenue expectations in Q3 CY2024, with sales up 12.4% year on year to $453.8 million. The company expects the full year’s revenue to be around $1.73 billion, close to analysts’ estimates. Its non-GAAP profit of $1.50 per share was also 6.8% above analysts’ consensus estimates.

Is now the time to buy John Bean? Find out by accessing our full research report, it’s free.

John Bean (JBT) Q3 CY2024 Highlights:

- Revenue: $453.8 million vs analyst estimates of $442.2 million (2.6% beat)

- Adjusted EPS: $1.50 vs analyst estimates of $1.41 (6.8% beat)

- EBITDA: $81.7 million vs analyst estimates of $81.06 million (small beat)

- The company reconfirmed its revenue guidance for the full year of $1.73 billion at the midpoint

- Management reiterated its full-year Adjusted EPS guidance of $5.20 at the midpoint

- EBITDA guidance for the full year is $300 million at the midpoint, below analyst estimates of $302.5 million

- Gross Margin (GAAP): 36.1%, in line with the same quarter last year

- EBITDA Margin: 18%, up from 16.5% in the same quarter last year

- Free Cash Flow Margin: 14.3%, up from 8.1% in the same quarter last year

- Market Capitalization: $3.11 billion

"We are pleased with our third quarter execution, which enabled record quarterly revenue, adjusted EBITDA, and adjusted EPS from continuing operations," said Brian Deck, President and Chief Executive Officer.

Company Overview

Tracing back to its invention of the mechanical milk bottle filler in 1884, John Bean (NYSE: JBT) designs, manufactures, and sells equipment used for food processing and aviation.

General Industrial Machinery

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand for general industrial machinery companies. Those who innovate and create digitized solutions can spur sales and speed up replacement cycles, but all general industrial machinery companies are still at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

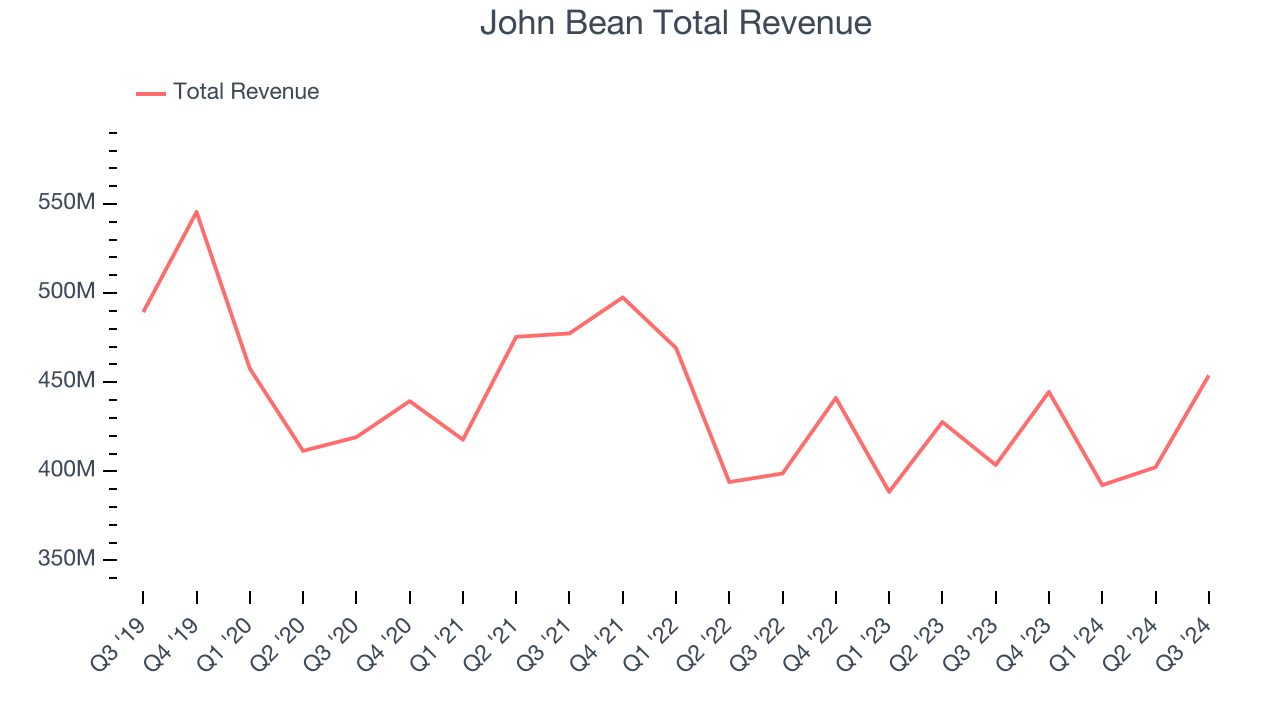

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, John Bean’s revenue declined by 2.7% per year. This shows demand was weak, a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. John Bean’s annualized revenue declines of 1.9% over the last two years align with its five-year trend, suggesting its demand consistently shrunk. John Bean isn’t alone in its struggles as the General Industrial Machinery industry experienced a cyclical downturn, with many similar businesses seeing lower sales at this time.

This quarter, John Bean reported year-on-year revenue growth of 12.4%, and its $453.8 million of revenue exceeded Wall Street’s estimates by 2.6%.

Looking ahead, sell-side analysts expect revenue to grow 5.2% over the next 12 months, an acceleration versus the last two years. Although this projection indicates the market thinks its newer products and services will fuel better performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Operating Margin

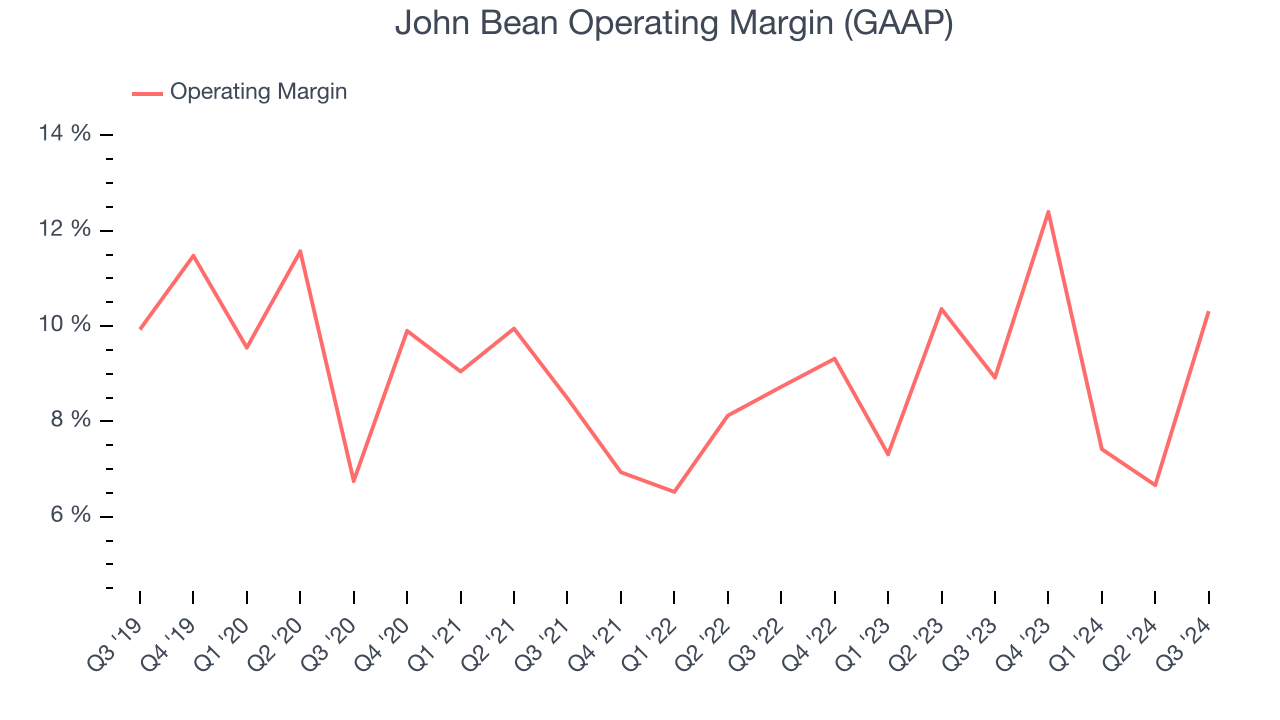

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling them, and, most importantly, keeping them relevant through research and development.

Analyzing the trend in its profitability, John Bean’s annual operating margin might have seen some fluctuations but has generally stayed the same over the last five years. Shareholders will want to see John Bean grow its margin in the future.

In Q3, John Bean generated an operating profit margin of 10.3%, up 1.4 percentage points year on year. The increase was encouraging, and since its operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as marketing, R&D, and administrative overhead.

Earnings Per Share

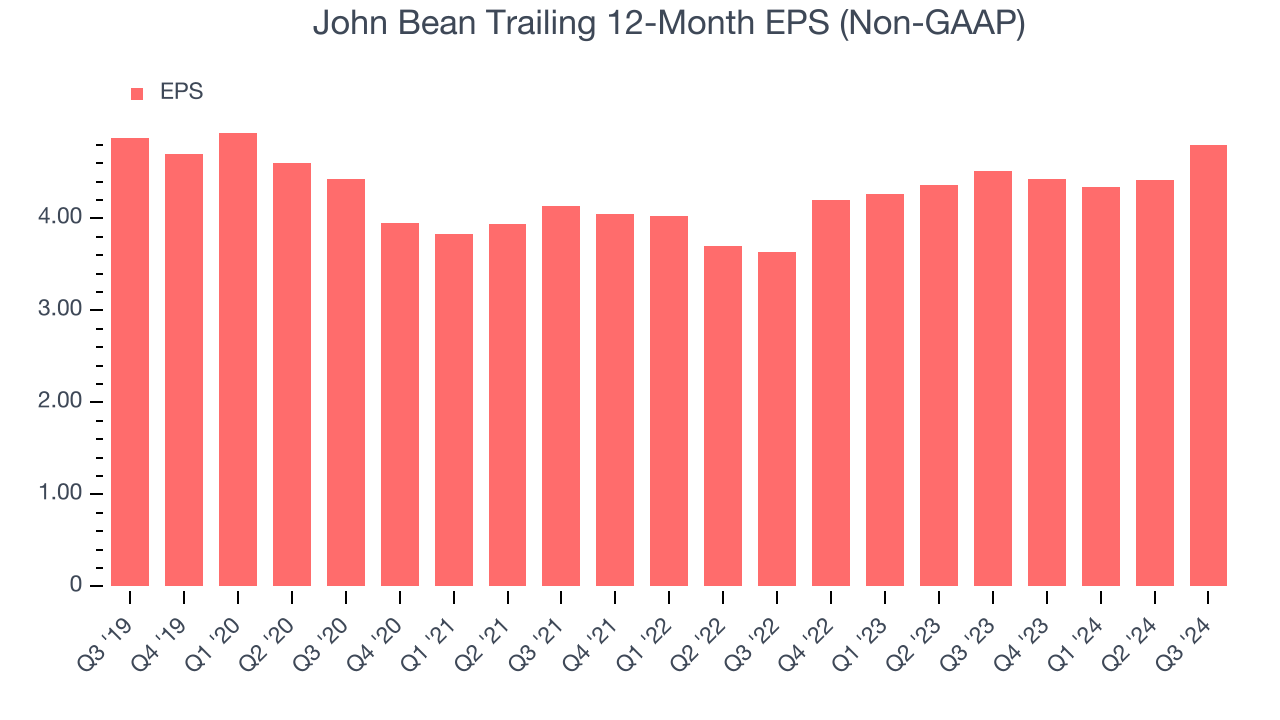

Analyzing long-term revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

John Bean’s flat EPS over the last five years was weak but better than its 2.7% annualized revenue declines. However, this alone doesn’t tell us much about its day-to-day operations because its operating margin didn’t expand.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business. John Bean’s two-year annual EPS growth of 14.9% was great and topped its two-year revenue performance.

In Q3, John Bean reported EPS at $1.50, up from $1.11 in the same quarter last year. This print beat analysts’ estimates by 6.8%. Over the next 12 months, Wall Street expects John Bean’s full-year EPS of $4.80 to grow by 16.5%.

Key Takeaways from John Bean’s Q3 Results

We enjoyed seeing John Bean exceed analysts’ revenue and EPS expectations this quarter. On the other hand, its full-year EBITDA forecast missed Wall Street's estimates. Overall, this quarter had some positives. The stock remained flat at $95.26 immediately after reporting.

Is John Bean an attractive investment opportunity at the current price?We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy.We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.