Financial News

Surf Air Mobility Reports Second Quarter Financial Results, Exceeding Expectations

Revenue of $32.4 million, up 13.2% Year-Over-Year on a Pro Forma Basis, Exceeding Expectations

Adjusted EBITDA Loss of $11.8 million as Compared with a Loss of $11.1 Million on a Pro Forma Basis in the Prior Year, Materially Outperforming Expectations

LOS ANGELES, August 14, 2024–Surf Air Mobility Inc. (NYSE: SRFM/quote">NYSE: SRFM), a leading regional air mobility platform, today reported financial results for the second quarter ended June 30, 2024.

“Our financial results for the second quarter demonstrate strong execution by the Surf Air Mobility team. Revenue exceeded our expectations and Adjusted EBITDA was materially higher than our initial plan. We remain focused on executing our strategy and on our unwavering commitment to expand our footprint and leadership position in the regional air mobility market,” said Deanna White, Chief Operating Officer and Interim CEO of Surf Air Mobility.

She continued, “In the last 90 days, we have moved rapidly to implement operational improvements and stringent management of operating expenses. These efforts resulted in second quarter positive adjusted EBITDA for our regional airline operations, formerly known as Southern Airways, reversing a longstanding trend. In addition to driving substantive improvement in those operations, we are simultaneously advancing our Technology operations, including the ‘SurfOS’ technology platform and our EP1 Caravan electrification initiative.

She concluded, “We are fundamentally improving our operating model and refining strategies to reduce our cost of operations. In addition, we plan to sub-capitalize key initiatives to drive efficiencies and more effectively manage capital. To that end, we recently announced a ground-breaking new venture, Surf Air Technologies, powered by Palantir Technologies. Together with Palantir, we will develop, market and sell AI-powered software tools to create a category-defining operating system for the advanced air mobility industry. This venture uniquely places Surf Air Mobility at the forefront of innovation in our industry.”

Second Quarter Financial Highlights:

Surf Air Mobility is providing unaudited results for the period ended June 30, 2024, on a quarterly basis, as well as unaudited pro forma results for the period ended June 30, 2023, which assumes the Southern acquisition closed as of the beginning of fiscal year 2023.

Revenue

- Revenue of $32.4 million for the second quarter 2024 rose 13.2% as compared to $28.6 million for the same period of the prior year on a pro-forma basis, exceeding the Company’s expectation of $28.0 – $31.0 million.

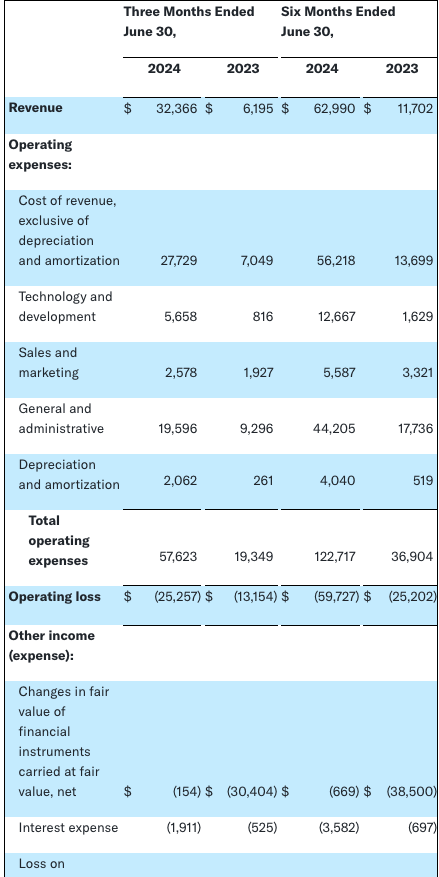

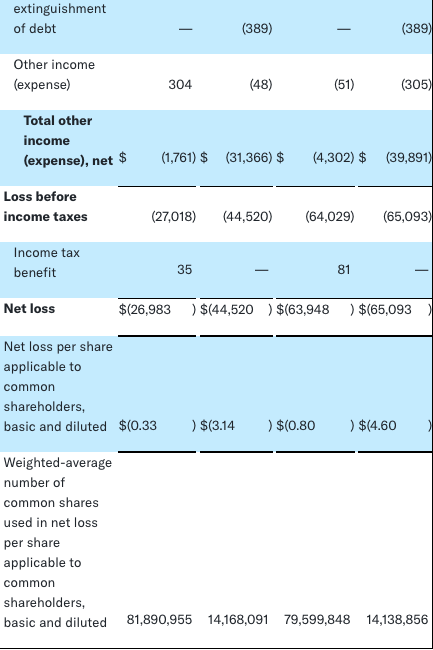

Net Loss

- GAAP Net Loss reduced to $(27.0) million as compared with $(44.5) million in the prior year period, which includes investment in R&D for electrification and software technology, stock-based compensation, transaction costs and other non-recurring items.

- Net loss of $(27.0) million for the second quarter of 2024, compared to $(16.7) million for the same period of the prior year on a pro-forma basis, which includes investment in R&D for electrification and software technology, stock-based compensation, transaction costs and other non-recurring items.

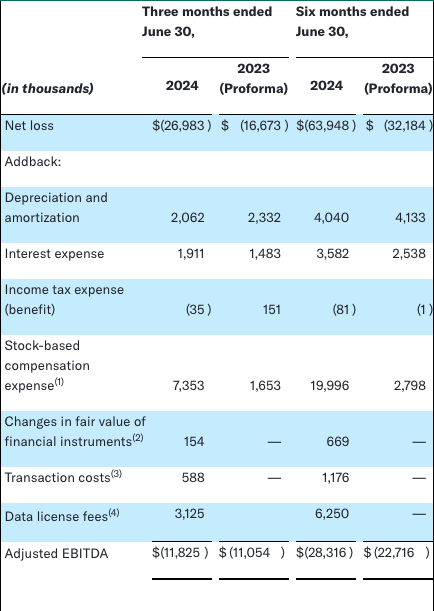

Adjusted EBITDA

- Adjusted EBITDA of $(11.8) million for the second quarter 2024, compared to $(11.1) million for the same period of the prior year on a pro-forma basis, materially outperforming our expectation of $(18.0) million to $(16.0) million. Adjusted EBITDA includes investment in R&D for electrification and software technology.

- See the Adjusted EBITDA table for the reconciliation from Net Loss to Adjusted EBITDA.

Developments on Key Initiatives:

Mobility

- Revenue for the second quarter rose 13.2% over the prior year period on a pro-forma basis, driven by a 13.8% increase in Scheduled service revenue and an 11.8% increase in On Demand service revenue. The increase in Scheduled service revenue was primarily driven by the launch of subsidized flight operations on the Lanai route in Hawaii and the Purdue and Williamsport routes. The increase in On Demand service revenue was driven by a 13.1% increase in departures over the comparable period. As part of its initiatives to drive profitability during the second quarter, the Company proactively discontinued unprofitable routes from its Scheduled service.

- In addition to the above, operational improvements implemented within regional airline operations, including Southern Airways post-merger integration cost savings, drove positive adjusted EBITDA for the quarter.

- In May 2024, the FAA Reauthorization Act became law. This act positively impacts the Essential Air Service (“EAS”) program by raising the subsidy cap from a maximum of $200 per passenger to a maximum of at least $650 per passenger. As expected, revenue for the second quarter does not reflect any benefit from the act.

- As of June 30, 2024, Surf Air Mobility supported 20 communities under the EAS program having added Lanai, Hawaii during the quarter. The FAA Reauthorization Act requires that the total cost of an air carrier’s proposal to be equally weighted with other factors such as local recommendations, including frequency of service, and interline agreements. This focus on cost favors Surf Air Mobility’s low-cost Caravan fleet.

- Textron Aviation aircraft deliveries remain on track for the third and fourth quarters of 2024.

Software

- Yesterday, the Company announced its plan to form a new venture, Surf Air Technologies LLC, and entered into an agreement with Palantir Technologies Inc. to power the operating system for the Advanced Air Mobility industry.

- Surf Air Mobility made significant strides in the development of its software adding exciting new features to its platform: a Pilot check-in mobile app which validates crew eligibility, a large language model – “Ask Sam” – to leverage A.I. for operational documents, and digitized flight logs that allow pilots to log hand-written flight data with a click of a button.

Electrification

- Aircraft electrification program remains on track to complete the conceptual design phase by the fourth quarter of 2024 and STC in 2027.

- Surf Air Mobility is also actively pursuing other strategic initiatives with partners and affiliates, including the creation of one or more joint ventures or partnerships, to separately capitalize the Company’s electrification and other related efforts.

Capital Structure Update:

- Surf Air Mobility is actively working with a leading investment bank to secure additional, non-dilutive or less-dilutive capital in the form of a credit facility. These efforts are on-going, and the Company will timely report any material developments to investors.

Financial Outlook

- Third Quarter 2024 revenue, in the range of $25.0 million to $28.0 million.

- Pro forma adjusted EBITDA, in the range of $(13.0) million to $(10.0) million, which excludes the expected impact of stock-based compensation, changes in fair value of financial instruments, and other non-recurring items.

The Company’s expectations for the third quarter reflect the impact of unplanned maintenance on aircraft over the last two months resulting in lower completion factors. Due to these factors, the Company currently expects that its regional airline operations will be marginally unprofitable in the third quarter. The Company is executing a series of actions to improve profitability and is targeting profitable regional airline operations for the full year.

Conference Call

Surf Air Mobility will host a conference call today at 5:00 pm ET. Interested parties can register in advance to listen to the webcast here, or can find a link on the Events & Presentations section of our investor relations website.

Alternatively, listeners may dial into the call as follows:

North America – Toll-Free (800) 715-9871

International (Toll) – (646) 307-1963

Conference ID: 4775356

About Surf Air Mobility

Surf Air Mobility, headquartered in Los Angeles, is a pioneering regional air mobility platform dedicated to transforming regional air travel through electrification. As the largest commuter airline operator in the US, Surf Air Mobility partners with commercial leaders to develop innovative powertrain technology for smaller aircraft, facilitating the electrification of existing fleets and the widespread adoption of electric aircraft. Surf Air Mobility’s mission is to drive substantial cost reductions and environmental benefits to make regional flying more accessible and affordable. Backed by a management team with extensive expertise spanning aviation, electrification, and consumer technology, Surf Air Mobility is poised to advance the future of sustainable air travel.

Forward-Looking Statements

This Press Release contains forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995, including statements regarding the anticipated benefits of the transaction; Surf Air Mobility’s ability to anticipate the future needs of the air mobility market; future trends in the aviation industry, generally; Surf Air Mobility’s future growth strategy and growth rate and its ability to access its financings and expand its business. Readers of this release should be aware of the speculative nature of forward-looking statements. These statements are based on the beliefs of Surf Air Mobility’s management as well as assumptions made by and information currently available to Surf Air Mobility and reflect Surf Air Mobility’s current views concerning future events. As such, they are subject to risks and uncertainties that could cause actual results or events to differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, among many others: Surf Air Mobility’s future ability to pay contractual obligations and liquidity will depend on operating performance, cash flow and ability to secure adequate financing; Surf Air Mobility’s limited operating history and that Surf Air Mobility has not yet manufactured any hybrid-electric or fully-electric aircraft; the powertrain technology Surf Air Mobility plans to develop does not yet exist; any accidents or incidents involving hybrid-electric or fully-electric aircraft; the inability to accurately forecast demand for products and manage product inventory in an effective and efficient manner; the dependence on third-party partners and suppliers for the components and collaboration in Surf Air Mobility’s development of hybrid-electric and fully-electric powertrains and its advanced air mobility software platform, and any interruptions, disagreements or delays with those partners and suppliers; the inability to execute business objectives and growth strategies successfully or sustain Surf Air Mobility’s growth; the inability of Surf Air Mobility’s customers to pay for Surf Air Mobility’s services; the inability of Surf Air Mobility to obtain additional financing or access the capital markets to fund its ongoing operations on acceptable terms and conditions; the outcome of any legal proceedings that might be instituted against Surf Air, Southern or Surf Air Mobility, the risks associated with Surf Air Mobility’s obligations to comply with applicable laws, government regulations and rules and standards of the New York Stock Exchange; and general economic conditions. These and other risks are discussed in detail in the periodic reports that Surf Air Mobility files with the SEC, and investors are urged to review those periodic reports and Surf Air Mobility’s other filings with the SEC, which are accessible on the SEC’s website at www.sec.gov, before making an investment decision. Surf Air Mobility assumes no obligation to update its forward-looking statements except as required by law.

Footnotes

Use of Non-GAAP Financial Measures: Surf Air Mobility uses Adjusted EBITDA to identify and target operational results which is beneficial to management and investors in evaluating operational effectiveness. Pro Forma Adjusted EBITDA is a supplemental measure of Surf Air Mobility’s performance that is not required by, or presented in accordance with, U.S. GAAP. Pro Forma Adjusted EBITDA is not a measurement of Surf Air Mobility’s financial performance under U.S. GAAP and should not be considered as an alternative to net income (loss) or any other performance measure derived in accordance with U.S. GAAP. Surf Air Mobility’s calculation of this non-GAAP financial measure may differ from similarly titled non-GAAP measures, if any, reported by other companies. This non-GAAP financial measure should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with U.S. GAAP.

Non-GAAP financial measures have limitations in their usefulness to investors because they have no standardized meaning prescribed by GAAP and are not prepared under any comprehensive set of accounting rules or principles. In addition, non-GAAP financial measures may be calculated differently from, and therefore may not be directly comparable to, similarly titled measures used by other companies.

Surf Air Mobility presents Pro Forma Adjusted EBITDA because it considers this measure to be an important supplemental measure of its performance and believes it is frequently used by securities analysts, investors, and other interested parties in the evaluation of companies in its industry. Management believes that investors’ understanding of Surf Air Mobility’s performance is enhanced by including this non-GAAP financial measure as a reasonable basis for comparing its ongoing results of operations. Unaudited pro forma financial information for the second quarter and year to date period ended June 30, 2024, assumes the acquisition of Southern Airways closed as of the beginning of 2023.

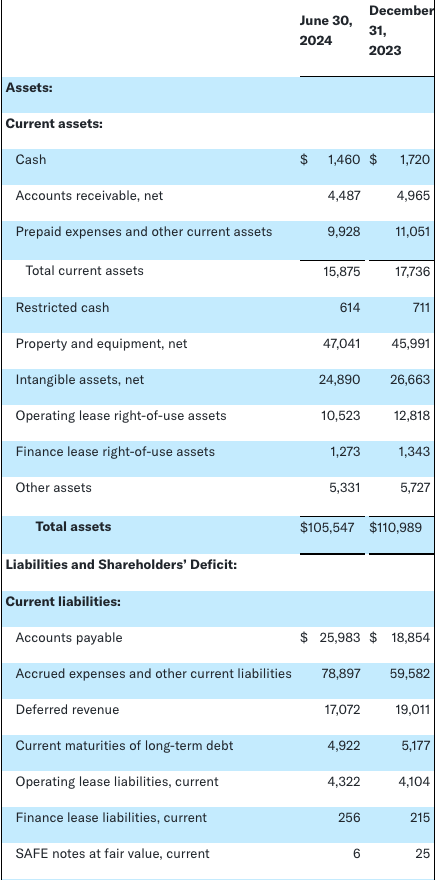

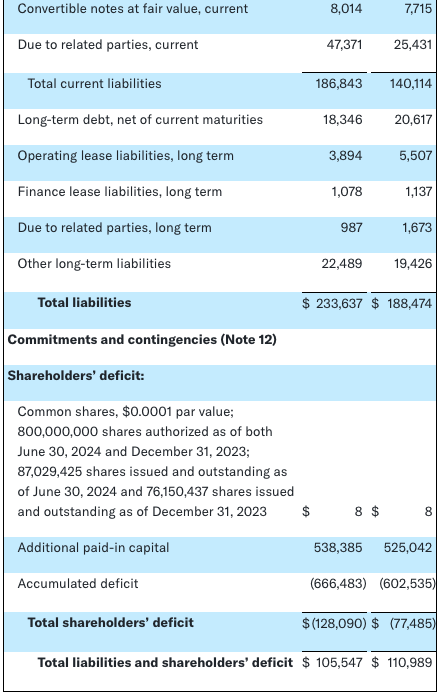

Unaudited Condensed Consolidated Balance Sheets as of June 30, 2024, and December 31, 2023:

Unaudited Condensed Consolidated Statements of Operations for the Three Months and Six Months Ended June 30, 2024 and 2023: (in thousands, except share and per share data):

Unaudited Pro Forma Financial Measures; Reconciliation of Net Loss to Adjusted EBITDA for the Three Months and Six Months Ended June 30, 2024 and Pro forma Net Loss to Pro forma Adjusted EBITDA for the Three Months and Six Months Ended June 30, 2023 (in thousands):

Contacts

For Press:

press@surfair.com

For Investors:

investors@surfair.com

Featured Image @ Freepik

Read more investing news on PressReach.com.Subscribe to the PressReach RSS feeds:- Featured News RSS feed

- Investing News RSS feed

- Daily Press Releases RSS feed

- Trading Tips RSS feed

- Investing Videos RSS feed

Follow PressReach on Twitter

Follow PressReach on TikTok

Follow PressReach on Instagram

Subscribe to us on Youtube

More News

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.