Financial News

BlockFi Pacing Toward Over $2 Billion in Annualized Spend With World's First Bitcoin Rewards Credit Card

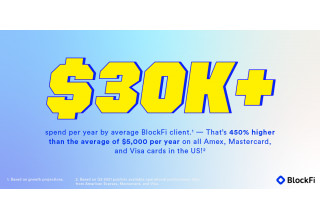

BlockFi, a financial services company dedicated to building a bridge between cryptocurrencies and traditional financial services products, is pleased to share that the BlockFi Rewards Visa® Signature Credit Card has been met with great engagement. Within 90 days of launching the first credit card to give Bitcoin as a reward to cardholders, credit card spend is currently pacing toward over $2 billion in annualized spending based on growth projections, further proving the appetite for the new credit card crypto rewards category that BlockFi is shaping. The average BlockFi client is on track to spend more than $30,000 per year on average, 450% higher than the average of $5,000 per year on all Amex, Mastercard, and Visa cards in the U.S.*

"In just the first 90 days, the BlockFi Rewards Visa® Signature Credit Card has been an incredible success," said Zac Prince, co-founder and CEO of BlockFi. "The fact that cardholders are pacing towards over $2 billion in annualized spend reinforces BlockFi's mission to provide clients with broader access to financial products and services that allow them to invest in cryptocurrency more easily and, in the longer term, possibly set them on a path to build generational wealth."

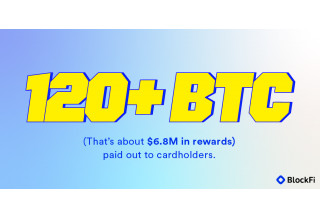

Since launching the card in August 2021, the BlockFi Rewards Credit Card community has grown to over 50,000 cardholders who have amassed over 120 Bitcoin (equivalent to $6.8 million as of price on Oct. 12, 2021) since the last #BlockFiDay, which is the monthly credit card rewards redemption date.

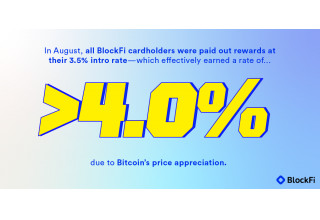

Why Bitcoin as a reward? Bitcoin has outperformed other assets so far in 2021. Even with its price fluctuation, Bitcoin's up 49% on the year, according to recent data published by CoinTelegraph**. In August, BlockFi cardholders who were paid out rewards at their 3.5% intro rate earned an effective rate of over 4.25%, while customers earning the standard 1.5% back were earning a 1.8% effective rate*** due to Bitcoin's recent price appreciation. With the intro rewards rate of 3.5%, cardholders can earn an additional $100 in Bitcoin in their first three months. For comparison, if someone had earned $100 of Bitcoin in 2017, it would be worth over $4,000 in Bitcoin today****. While asset appreciation is never guaranteed, based on historical growth no other rewards card can compete with the upside potential of earning Bitcoin.

Who is using the card? One thing BlockFi has learned from analyzing early spending patterns is that there is no one type of Bitcoiner. As more people continue to adopt the BlockFi Rewards Credit Card as an easy way to earn Bitcoin passively, the company is seeing a variety of ways that people use the card. The top three merchants where people are spending the most and, as a result, earning the most rewards are Costco, Amazon, and Home Depot.

Beyond people earning Bitcoin back on the regular and everyday purchases like their groceries, bills, and home improvement projects, it is also notable that people are using major life events as a way to accumulate and grow their Bitcoin portfolio. One of the largest transactions to date was over $20,000 at Tiffany's, which may have been an amazing engagement ring or anniversary present for some lucky person.

And for the Bitcoin maximalist who just can't find enough ways to earn Bitcoin, Compass Mining has been a top merchant for those who want to earn even more Bitcoin from their home mining rigs.

Where are people most bullish on the Bitcoin rewards? The BlockFi Rewards Credit Card is available in the U.S., excluding New York, and BlockFi cardholders are represented in all 49 states where the card is available, with California, Texas, and Florida being the highest-spending states along with Washington, D.C. California alone accounts for a little over 20% of total spending and, in turn, earning the most Bitcoin rewards.

Bitcoin is part of the future. And BlockFi cardholders know it. El Salvador has taken a historic step by making Bitcoin legal tender. Companies like Tesla, Square, and MicroStrategy have added Bitcoin to their books, and Tesla plans to accept Bitcoin as payment. As the world at large begins to adopt Bitcoin, the BlockFi card offers the easiest way to be a part of the future of money.

Learn more about the BlockFi Rewards Visa® Signature Card here.

To take advantage of earning Bitcoin back on every purchase, create a BlockFi account and apply now.

Media Contact for BlockFi:

Ryan Dicovitsky

Dukas Linden Public Relations

BlockFi@DLPR.com

* Based on Q2 2021 publicly available operational performance data from American Express, Mastercard, and Visa.

** CoinTelegraph, October 2021

*** Based on the price of Bitcoin on Oct. 12, 2021

**** Reward growth based on BTC price beginning on 1/1/17 and growth as of 9/21/21, according to CryptoGround Profit Calculator

Disclaimer: Applying for the BlockFi Bitcoin Rewards Credit Card ("Card") does not guarantee that you will be eligible to receive the Card. Geographic, regulatory, and underwriting restrictions will apply. Fees and terms are subject to change, and additional terms of service will apply to the Card. By applying for the Card, you agree to receive marketing communications pursuant to BlockFi's Privacy Policy.

For more information, please see BlockFi's Terms of Service. BlockFi is not a Bank. Cards are issued by Evolve Bank & Trust, Member FDIC, pursuant to a license from Visa® USA Inc. Rewards are not offered by Evolve Bank & Trust and are instead offered and managed by BlockFi.

Nothing contained in this announcement should be construed as a solicitation of an offer to buy or offer, or recommendation, to acquire or dispose of any security, commodity, investment or to engage in any other transaction. The information provided in this announcement is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. This announcement is not directed to any person in any jurisdiction where the publication or availability of the announcement is prohibited, by reason of that person's citizenship, residence or otherwise.

Neither BlockFi nor any of its affiliates or representatives provide legal, tax or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions.

Rates for BlockFi products are subject to change. Digital currency is not legal tender, is not backed by the government, and crypto interest accounts are not subject to FDIC or SIPC protections. Geographic restrictions and other terms and conditions apply.

Learn more at BlockFi.com.

BlockFi Lending LLC NMLS ID#1737520 | BlockFi Trading LLC NMLS ID#1873137

Related Images

Press Release Service by Newswire.com

Original Source: BlockFi Pacing Toward Over $2 Billion in Annualized Spend With World's First Bitcoin Rewards Credit Card

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.