Financial News

Brookfield Renewable: Capitalize on the AI and Green Energy Boom

Brookfield Renewable Partners L.P. (NYSE: BEP) owns renewable energy facilities and green energy assets. It's one of the largest renewable energy platforms in the world. It has a global portfolio of diversified renewable energy assets. Its stock is up 7.6% year-to-date (YTD) but has been on an upswing since bottoming in August 2024. The stock pays a 5.02% annual dividend yield. The Microsoft Co. (NASDAQ: MSFT) power purchasing agreement with Constellation Energy Co. (NASDAQ: CEG) to supply green energy from a Three-Mile Island nuclear reactor has awakened green energy stocks and the awareness of the energy demands of data centers. Data centers are estimated to consume 20% of all the electricity in the United States and 10% globally by 2030.

Brookfield operates in the utilities sector, competing with renewable energy operators and power companies, including the world's largest renewable energy producer and largest electric utility holding company in the United States, NextEra Energy Inc. (NYSE: NEE), Duke Energy Inc. (NYSE: DUK) and The Southern Co. (NYSE: SO).

Brookfield's Portfolio of Assets

Brookfield’s diversified portfolio of assets across various geographies and technologies includes:

- Solar: Brookfield has utility-scale solar power plants, and it continues to shift into solar as new builds cost less than operating existing fossil fuel plants. The cost of solar has fallen by 90% over the past 15 years. Solar energy is limited to daylight hours. Brookfield’s portfolio is 48% allocated to solar technology.

- Wind: Like solar, wind is green and renewable, and the costs of new builds continue to drop. However, wind power is limited by weather constraints. Brookfield owns onshore and offshore wind farms. Wind now comprises 29% of Brookfield’s portfolio.

- Hydroelectric: This was a large portion of Brookfield’s clean and sustainable energy assets owning a large portfolio of hydroelectricity generating stations.

- Storage: Brookfield owns energy storage facilities including those for pumped hydro storage and battery storage facilities. Storage technology comprises 23% of its portfolio.

- Technology investments: Brookfield invests in various technologies ranging from carbon capture, renewable natural gas, green hydrogen, storage, and nuclear transition.

The artificial intelligence (AI)-driven data center growth spurt, combined with the need for sustainable green energy, has created a perfect storm for the company.

Westinghouse Nuclear Investment

Initially, the nuclear power division of Westinghouse Electric Corporation emerged from bankruptcy and was acquired by Brookfield Renewable and uranium producer Cameco Co. (NYSE: CCJ). Westinghouse Nuclear designs, engineers and constructs energy systems, including nuclear reactors. Its AP300 is the only small modular reactor (SMR) based on licensed, operating and advanced reactor technology. Its AP1000 pressurized water reactor (PWR) is the most advanced commercially available nuclear power plant. It has been deployed worldwide, with two in the United States, one in Bulgaria, three in Poland, nine in Ukraine, six in India, and 12 in China.

China Approves Westinghouse to Supply 4 More AP1000 Nuclear Reactors

On Aug. 29, 2024, Westinghouse confirmed that China had approved four more Westinghouse-designed nuclear reactors to be supplied for two Chinese power projects. Two AP1000 reactors are cleared for construction for the Bailong nuclear power project and two AP1000 reactors for the China Nuclear Power Corporation-owned Lufeng nuclear power plant in Guangdong province. The additional four AP1000 reactors will bring the total to 16 in China.

Acquiring 53% of Neoen On Its Way to 100%

Brookfield announced it will be acquiring a 53% stake in French renewable energy production company Neoen S.A. (OTCMKTS: NOSPF). Neoen has 8,000 megawatts of highly contracted or under-construction assets and a 20,000-megawatt advanced-stage pipeline already secured. It will also enhance Brookfield's ability to serve its largest corporate customers globally, including mega-cap technology players with large requirements to support their data center investments driven by cloud and AI technology demand. Upon regulatory approval, Brookfield plans to acquire 100% of Neoen for $6.7 billion.

This adds to Brookfield's large operating fleet and expansive development pipeline, which totals over 230,000 megawatts, of which 65,000 megawatts have permitting status and interconnection in core renewable markets. Brookfield has $4.4 billion of available liquidity at the end of its second quarter of 2024.

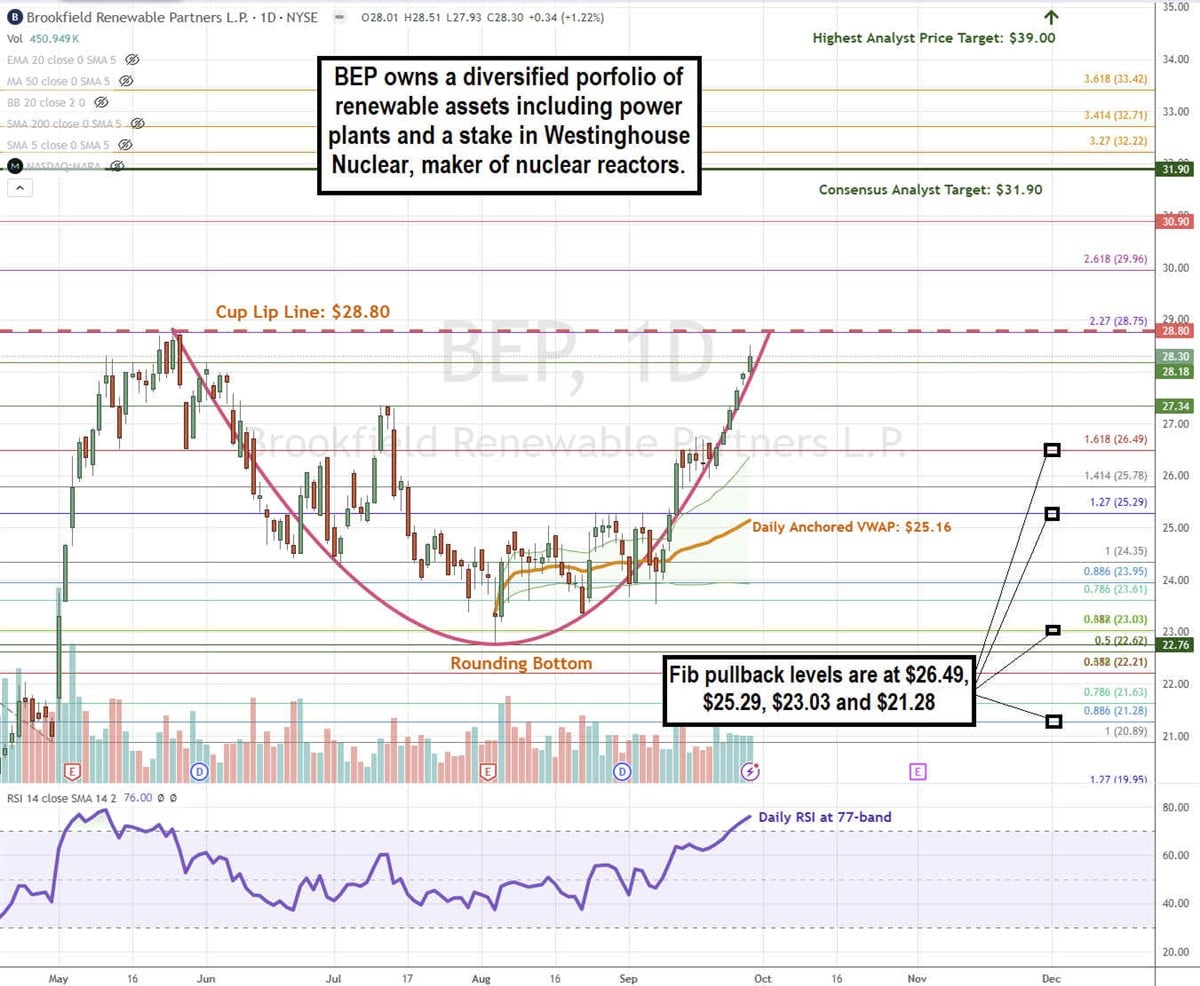

BEP Stock Completes a Daily Cup Pattern

A cup pattern forms on a swing-high lip line that falls to a swing-low, followed by a rounding bottom that rises back up to retest the cup lip line. Afterward, a handle may form on a pullback or a continuation above the cup lip line, which acts as a new floor support.

BEP formed the swing-high lip-line at $28.80 before calling to a swing low of $22.76. It formed a rounding bottom that rises back up towards its lip line to complete the daily cup pattern. The daily anchored VWAP is rising at $25.16. The daily relative strength index (RSI) rose to the 77-band. Fibonacci (Fib) pullback support levels are at $26.49, $25.29, $23.03 and $21.28.

Brookfield Renewable Partner’s average consensus price target is $31.90, and its highest analyst price target sits at $39.00. It has seven analysts' Buy and three Hold ratings.

Actionable Options Strategies: Bullish investors can buy on pullbacks using cash-secured puts at the fib pullback support levels to buy the dip and write covered calls to execute a wheel strategy for income in addition to the 5.02% annual dividend yield.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.