Financial News

Marriott International is the juggernaut that keeps growing

Leading global hospitality giant Marriott International Inc. (NASDAQ: MAR) stock continues to make new all-time highs as the travel boom continues to rebound. Unlike most industries facing negative normalization and inventory glut after the post-COVID boom in 2021, the NASDAQ: UAL">travel and hospitality industry in the consumer discretionary sector continues to experience positive normalization. It was the epicenter of the industry during the pandemic and arguably one of the last to experience a lasting rebound. Marriott is the largest global hotel chain in the world by revenue, followed by Hilton Worldwide Holdings Inc. (NYSE: HLT) and InterContinental Hotels Group PLC (NYSE: IHG).

Juggernaut ecosystem

Marriott announced full-year 2023 room growth hitting 4.7%, beating the high end of its previous room forecast of 4.5%. Marriott's portfolio is comprised of nearly 8,800 properties, 1.597 million rooms, and 30 brands ranging from luxury hotels like the Ritz-Carlton, St. Regis, W Hotels, JW Marriott, and EDITION to premium including Marriott Hotels & Resorts, Sheraton, Westin to select service like Courtyard and Fairfield by Marriott and SpringHill Suites.

Long-stay properties include Residence Inn by Marriott and Towne Place Suites. The company also partakes in vacation rentals, timeshares, and various lodging options, including property management under the Marriott International brand. Marriott partnered with MGM Resorts International Inc. (NYSE: MGM) to provide its Bonvoy members access to over 40,000 rooms through sixteen MGM Resorts destinations.

Continued worldwide expansion

Despite being the industry's top revenue-generating juggernaut, Marriott continues its aggressive worldwide expansion pipeline. That is currently comprised of 3,400 properties totaling nearly 573,000 rooms, up 15% YoY. This includes 242 properties, of which 40,300 rooms are approved for development as of the end of its third quarter of 2023. The company is seeing global growth in its Apartments by Bonvoy Portfolio, a new brand of apartment-style extended-stay units with the services of a luxury hotel. Despite Marriott guiding down its Q4 2023 top and bottom guidance, the market views its expansion plans as having much more room to grow for the company.

Get AI-powered insights on MarketBeat.

There's more room to grow

Despite the strong growth in 2023, the global hotel industry considered it a "recovery" year, with full recovery expected in 2024. Marriot's revenue per available room (RevPAR) rose 8.8% YoY in Q3 2023 domestically and 21.8% internationally. The travel industry expects international inbound travel volume to grow 18% and inflation-adjusted spending to grow 19% YoY in 2024. Domestic travel is not expected to fully recover until 2025.

Powering forward

Marriott reported a third-quarter 2023 non-GAAP EPS of $2.11, beating consensus analyst estimates by a penny. Revenues grew 11.6% YoY to $5.93 billion, beating $5.86 billion consensus analyst estimates by $70 million. Comparable systemwide RevPAR rose 4.3% in the United States and Canada and 21.8% in international markets YoY. Adjusted EBITDA was $1.142 billion in the quarter, up from $985 million in the year-ago period.

The company added 97 properties comprised of 17,192 total rooms in Q3, comprised of 13,000 rooms internationally and over 4,900 conversions. Eleven properties of 1,494 rooms left the system. The company bought back 4.8 million shares for $950 million in the quarter. Check out the sector heatmap on MarketBeat.

CEO Insights

Marriott CEO Anthony Capuano noted that cross-border travel strength contributed to driving RevPAR growth in the quarter, with the most significant increase coming from international visitors. The most upside is expected to come from Asia Pacific as Greater China is still only at 50% capacity of 2019 levels. Marriott is partnered with Delonix Group to grow its Tribute Portfolio brand in mainland China with at least 100 properties in the coming years. Its Bonvoy loyalty program has grown to 192 million members worldwide, with app downloads rising 19% YoY. Its MGM strategic licensing arrangement will be launched in 2024.

Conversions driving growth

Capuano noted the strong interest in conversions, including multi-unit opportunities, representing 20% of signings and 30% of openings in the third quarter. Conversions can involve acquiring and rebranding existing independent hotels under the Marriott portfolio. They can also be existing properties that are converted into other brands like extended-stay options to adapt to market needs. As of its update on January 24, 2024, conversions for 2023 accounted for 25% of Marriott's room openings. The company signed 184 conversion properties in 2023, representing nearly 65,000 rooms.

Lowering the bar?

On its Q3 2023 earnings report, Marriott issued downside guidance for Q4 2023 with EPS of $2.04 to $2.13 versus $2.19, according to consensus analyst estimates. Comparable systemwide RevPAR growth is expected to be between 6% and 7.5%. Full-year 2023 EPS is expected between $8.50 to $8.59 versus $8.63 analyst estimates. The 37,000 rooms related to its MGM deal will be added to distribution in 2024. Its Q4 2024 earnings report is expected to be released on February 13, 2024, before the market opens.

Marriott International analyst ratings and price targets are at MarketBeat. Marriott International peers and competitor stocks can be found with the MarketBeat stock screener.

Daily ascending triangle breakout

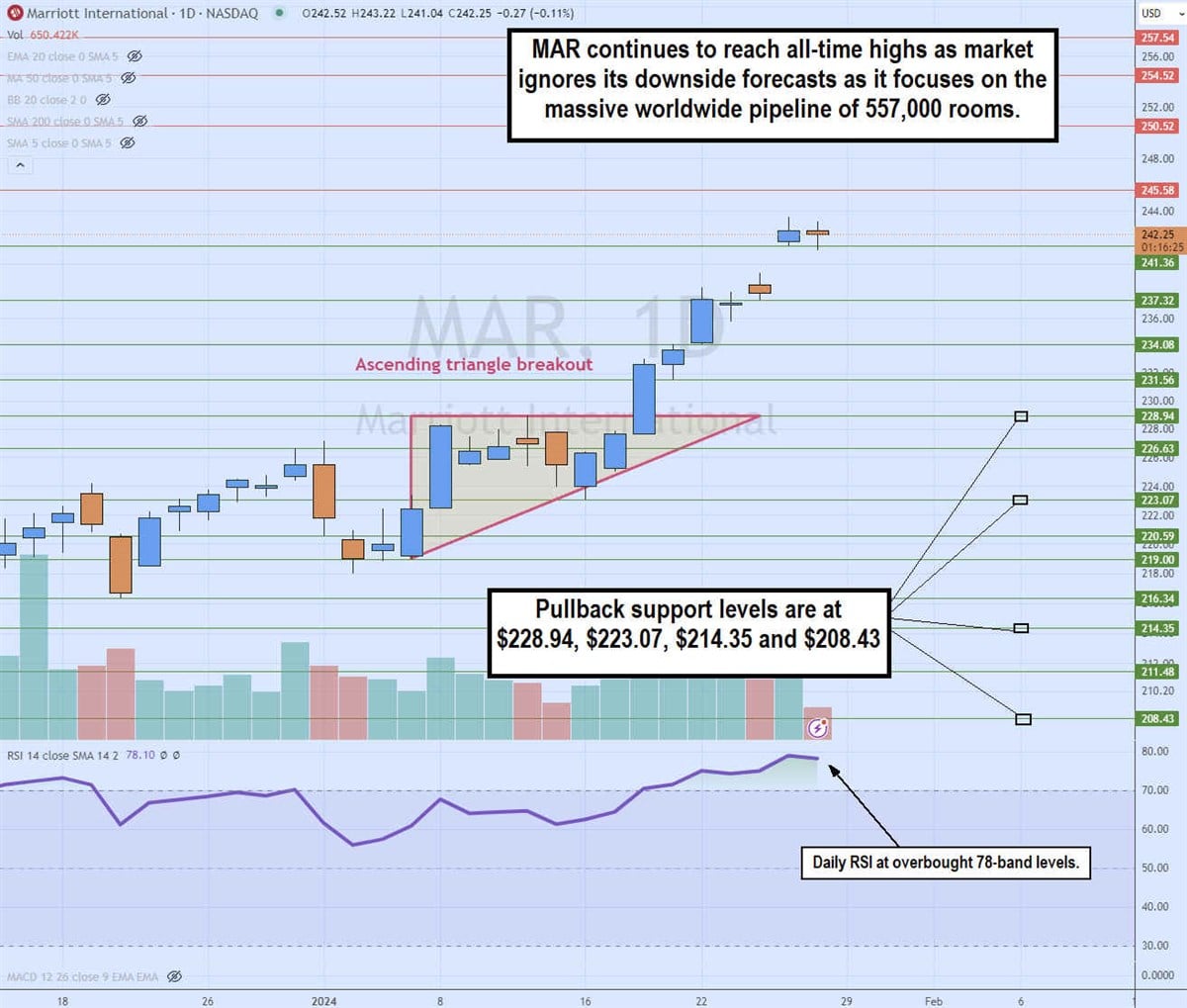

The daily candlestick chart for MAR illustrates an ascending triangle breakout pattern. The ascending trendline comprised of higher lows formed at $219.00 on January 5, 2024, versus the flat-top resistance at $228.94. The breakout formed on January 18, 2024, as the daily relative strength index (RSI) surged through the 80-band. The full-year 2023 business update on January 24, 2024, further propelled MAR shares to gap to all-time highs of $243.53 before a pullback set in. Pullback support levels are at $228.94, $223.07, $214.35 and $208.43.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.