Financial News

MarketBeat ‘Stock of the Week’: Intuitive Surgical hits new highs

In the fall of 2023, Intuitive Surgical, Inc. (NASDAQ: ISRG) was among a group of health care provider and food manufacturer stocks crushed by Ozempic fears. The prevailing mindset was that rising demand for obesity drugs would weigh on surgical procedure volumes, rendering the company’s robotic-assisted surgery equipment less necessary. The market couldn’t have been more wrong.

On Thursday, Intuitive Surgical shares gapped up to fresh record highs above $370.00, putting an exclamation point on a 47% bounce off their October 2023 lows. With multiple Wall Street analysts setting $400.00 price targets and fourth quarter financial results set for this week, the rally may have more legs.

Management has been steadfast in its response to concerns around the potential impact of GLP-1 drugs. In Intuitive’s third quarter earnings call, Chief Medical Officer Dr. Myriam Curet conceded that in the short run, prospective bariatric surgery patients could indeed try products like Ozempic and Wegovy to manage weight loss. In the long run, however, she expects few of these patients to remain on the drugs because of their associated costs, side effects and compliance issues. These comments, along with recent news that the U.S. Food & Drug Administration (FDA) is investigating reports of additional dangers linked to GLP-1 drugs, have helped ease ISRG investor worries.

The stock got an added boost when Intuitive offered a sneak peek of its fourth quarter numbers on January 9th. Preliminary Q4 revenue of $1.93 billion represents 17% year-over-year growth. It was driven by higher pricing and procedure volumes — exactly what the market needed to hear amid Ozempic uncertainty. The core instruments and accessories business posted 22% growth and accounted for 59% of total sales.

In response to the upbeat results, several sell-side research firms have reiterated their Buy ratings on ISRG. All five refreshed opinions on the stock have been bullish in 2024. It’s easy to understand why.

Surgery’s robotic present and future

The bigger picture here is that Intuitive is the world’s leading developer of technologies for minimally invasive, robotic-assisted surgery. Supported by technological advancements such as artificial intelligence (AI), it is a market that is projected to double this decade and reach $120 billion by 2030.

Today, surgical robot demand is being driven by the increasing prevalence of chronic diseases and medical conditions that require operating room procedures. While the high price tag of the robots and tools make them unaffordable to most hospitals — especially those in undeveloped countries — their value proposition has improved over the years.

From the patient perspective, robotic surgery typically entails increased precision, lower blood loss, smaller scars and reduced risk of infection. Less post-surgery pain, faster recovery and shorter hospital stays are additional benefits.

Shorter hospital stays are also an advantage for hospitals since they allow them to cycle through more patients and complete more procedures. And since robotic surgery systems are linked to better patient care, hospitals want them because they are a mark of superior quality.

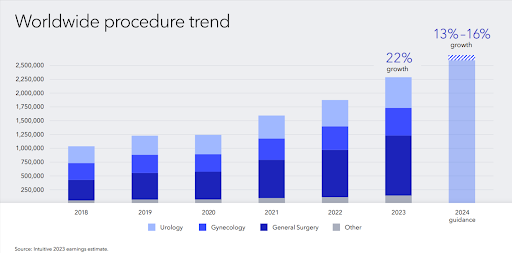

Intuitive’s flagship da Vinci ecosystem, which has been around for 30 years, is considered the gold standard for single port and multiport robotic surgery. More than 14 million procedures have been performed across a range of clinical areas, including general surgery, gynecology and urology. Last year alone, 2.3 million da Vinci surgeries were conducted, a 22% increase from 2022. Management expects procedure volume growth to slow to 13% to 16% this year. This may reflect a temporary ‘Ozempic-effect.’ Still, the fact that da Vinci adoption is growing by double-digit percentages some three decades since inception is impressive.

da Vinci dominance

Intuitive’s da Vinci system is the first FDA-approved operative surgical robot. Rather than being manipulated by a surgeon’s hands, robotic arms control endoscopic instruments, electronically dampening the natural “shake” of the human hand. The arms have ‘EndoWrists’ that can bend and twist like human wrists. Instead of the traditional two-dimension view, surgeons use a three-dimension lens system that magnifies the surgical field by as much as 10 times.

In 2023, there were more 1,600 systems placed at customer sites. This includes both the da Vinci system and the company’s second offering, Ion, which performs minimally invasive peripheral lung biopsies. Its ability to safely collect tissue samples from all 18 segments of the lung is already having a major impact on lung care. At this month’s J.P. Morgan Healthcare Conference, CEO Dr. Gary Guthart highlighted Ion’s potential to improve global lung cancer detection. The system has been cleared for use in the U.S., Europe and Korea, and is awaiting approval in China.

Since 2020, there have been 16,500 Ion procedures performed. Intuitive estimates that lung cancer incidence in the U.S., Europe and China combined is over 1.5 million. This speaks to 1) the enormous opportunity that still lies ahead for Ion, 2) Intuitive’s ability to create a second groundbreaking technology, and 3) the potential for it to diversify into other specialized areas by developing new indication-specific instruments.

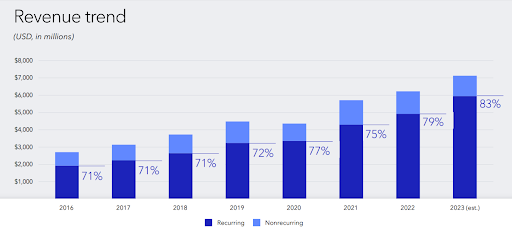

Recurring revenue is gaining importance

As the California-based company sees success with both da Vinci and Ion, it has an underlying financial trend that (besides profitable growth) is highly attractive from an investment standpoint. Recurring revenue — which includes reordered disposable instruments like graspers, scissors and staplers as well as equipment leasing — has grown to become more than 80% of overall revenue. With over 9,000 Intuitive systems in hospitals around the world, continued expansion of the installed base should sustain strong recurring revenue trends.

This recurring revenue base is valuable because it generates steady, predictable cash flow. Not unlike a software-as-a-service (SaaS) model, this leads to 1) less lumpy quarterly financial performances and 2) less dependence on expensive, long-cycled system sales. Genetic sequence machine leader Illumina, which gets roughly 85% of revenue from consumables and services, is a good comparison in the healthcare space.

Worth the premium valuation

It’s hard to deny that Intutive’s first mover advantage and market leadership point to a bright growth outlook. What makes it hard for some fundamental investors to get on board though are the high share price and lofty valuation.

On a trailing 12 months basis, ISRG is trading at 84x earnings. This is about a 35% premium to the health care sector average. The question then becomes, is the premium warranted? Based on Intuitive’s growth history and prospects, that answer is yes.

From 2018 to 2022, earnings per share (EPS) grew at an average annual rate of 20%. Considering a pandemic that limited hospital access for many months was smack in the middle of the period, this is pretty darn good.

What is the company on pace to deliver for 2023? Yep, 20% EPS growth. Although there are other health care stocks (most notably pharmaceuticals and biotechs) that have higher growth rates, they often come with high volatility that stems from FDA drug approvals and clinical trial results. Back to the recurring revenue trait, Intuitive’s steadier 20% profit growth is hard to come by in any sector.

Looked at from a different angle, ISRG is forecast to produce EPS of $6.43 in 2024. This gives it a forward price-to-earnings (P/E) ratio of 58x. Still expensive, but more palatable — especially when stacked up against certain health care equipment names. Insulet, which has a negative three-year EPS growth rate, trades at 104x. Dexcom has similar growth metrics to Intuitive and goes for 88x this year’s earnings.

Depending on management’s full-year guidance, ISRG’s share price and valuation could swing wildly after the January 23rd report. For swing traders (bullish or bearish), this could present a short-term opportunity. For long-term investors, it could make for a more expensive or cheaper entry point.

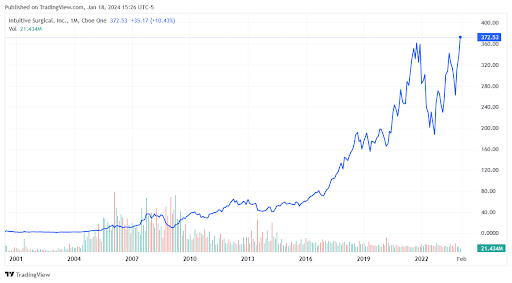

Either way the pendulum swings, ISRG bulls probably need not be too picky about trade timing and limit orders. Over the last 15 years, the stock has generated an annualized return of 26.1% compared to 14.3% for the broader U.S. market. A $1,000 ISRG investment at its June 2000 IPO level would be worth approximately $372,000 today.

More importantly, Intuitive Surgical has a commanding 80% share of a global surgical robotic systems market that has high barriers to entry. As the company expands into new surgery types and geographic markets, the outcome for patients and investors alike will be positive.

Bottom Line

As the pioneer of robotic-assisted surgery, Intuitive Surgical is building on its market dominance by providing physicians with state-of-the-art instruments and systems that make procedures more precise and enable remote operation. With recent obesity drug fears proving to be overblown and daVinci placements growing, expect ISRG to reward growth investors with plenty more record highs in the years to come.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.