Financial News

More News

View More

Deckers’ Surprise Blowout Has Wall Street Repricing the Story ↗

Today 11:50 EST

Chevron Earnings Hint at New Highs—Is CVX Ready to Run? ↗

Today 10:56 EST

Is Altria Becoming More Than an Income Stock? ↗

Today 9:22 EST

GE Vernova’s Q4 Was Strong—But the Backlog Number Matters More ↗

January 31, 2026

Recent Quotes

View More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.

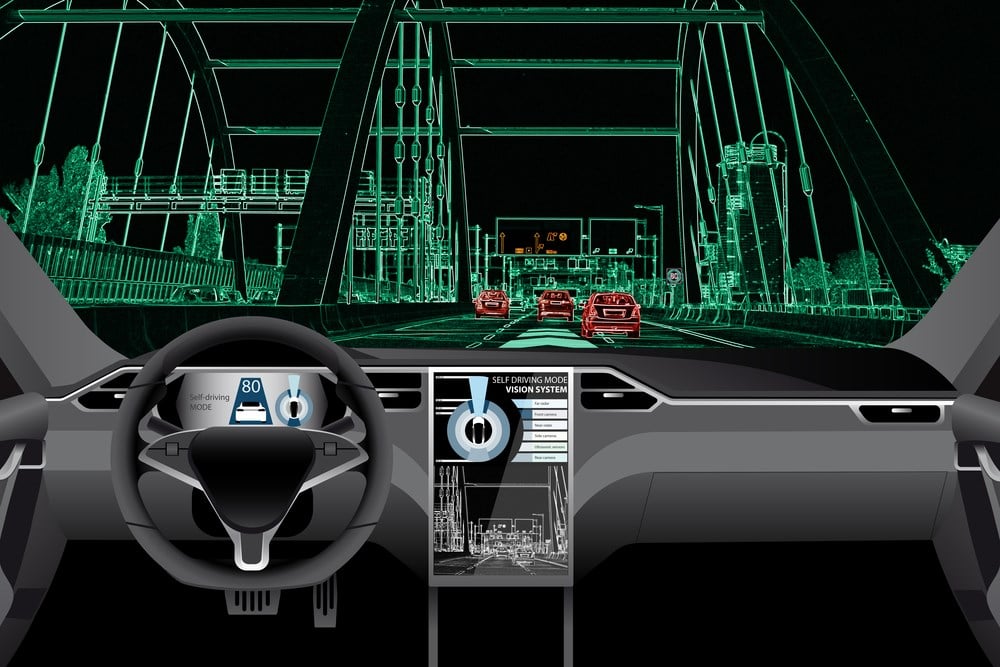

In 2021, many investors learned a painful lesson that the time it would take to make self-driving cars a reality didn’t match up to the hype. But that doesn’t change the fact that the underlying technology behind autonomous driving is still sound. And many companies have big plans to make self-driving cars a reality sooner rather than later.

In 2021, many investors learned a painful lesson that the time it would take to make self-driving cars a reality didn’t match up to the hype. But that doesn’t change the fact that the underlying technology behind autonomous driving is still sound. And many companies have big plans to make self-driving cars a reality sooner rather than later.