Financial News

Is Pinterest Showing Signs of an Improving Ad Market?

Social commerce platform Pinterest Inc. (NASDAQ: PINS) stock has been a stalwart among social media stocks with a 19% year-to-date (YTD) performance and 10.8% one-year performance. Unlike Meta Platform Inc. (NASDAQ: META) Facebook, Alphabet Inc. (NASDAQ: GOOGL) Google, and Snap Inc. (NASDAQ: SNAP), the mature social media platform has kept itself free of controversy and out of the crosshairs of regulators.

Pinterest has grown its global monthly active users (MAUs) to 450 million, mostly comprised of women between 18 to 64 years old. Its global mobile app, which accounts for 80% of its impressions, grew 14% YoY. The company has focused on bolstering its personalization and video content, driving more engagement with a broader audience. Its advertiser mix is also expanding beyond retailers and packaged goods companies.

Shuffles, Collage-Making App

Pinterest continues to expand its target audience to include more Gen-Z users. It released an app called Shuffles to the delight of the Gen-Z population. It's a trendy app that lets users create animated personalized collages comprised of images, cutouts, and music which can then be posted on other social media platforms.

The flexible app has billions of pictures and cutouts available. Each collage piece can be moved around or resized to the user's preference. The app has grown in popularity on the Apple Inc. (NASDAQ: AAPL) App store. It's number 96 in the Apple App store, behind the Pinterest app at number two, as of April 1, 2023. While not available for Android users, Shuffles has a growing wait list in anticipation of it.

GAAP Profits Achieved

On Feb. 6, 2023, Pinterest released its fiscal fourth-quarter 2022 results for the quarter ending December 2022. The company reported an adjusted earnings-per-share (EPS) profit of $0.29, excluding non-recurring items, versus consensus analyst estimates of $0.28, beating estimates by $0.01.

GAAP net income improved to $17 million, while the full-year 2022 GAAP net loss was ($96 million). The company authorized a $500 million stock buyback effective the next 12 months. Revenues rose 3.6% year-over-year (YOY) to $877.21 million, missing analyst estimates of $886.78 million. Global MAUs grew 4% YoY to 450 million. Engagement sessions are growing "significantly faster" than users, which signifies deepening engagement per user, helping drive greater monetization per user.

Converting Intent into Action

Pinterest CEO Bill Ready commented, “2022 was a solid year as we returned to MAU growth, deepened engagement and saw our personalization and relevance investments start to pay off. We’re building upon this foundation by staying focused on growing monetization per user, integrating shopping throughout the core user experience, and increasingly driving operational rigor.” His goal is to convert more intent into action getting users to spend more rather than just window shopping.

Bill Ready was formerly COO of PayPal Holdings Inc. (NASDAQ: PYPL) and Google. He became Pinterest CEO in late June 2022, replacing founder Ben Silberman. This fueled takeover speculation from PayPal during the summer of 2022. The hype has died down now as CEO Ready is proving his muster with his background in e-commerce, NASDAQ: PYPL">payments processing, and end-to-end customer experience.

Flat Guidance

Pinterest expects fiscal Q1 2023 revenue growth in the low single digits, considering lower Forex headwinds than Q4 2022. Non-GAAP operating expenses should fall in the low double digits.

UBS Upgrade

On March 27, 2023, UBS upgraded Pinterest shares to a Buy with a $35 price target, up from Neutral with a $27 price target. Analyst Lloyd Walmsley raised his revenue, and EBITDA estimates for 2024. He cited that the continued improvement in Pinterest's ad tech drives more advertising dollars to the platform as advertisers get more bang for their buck.

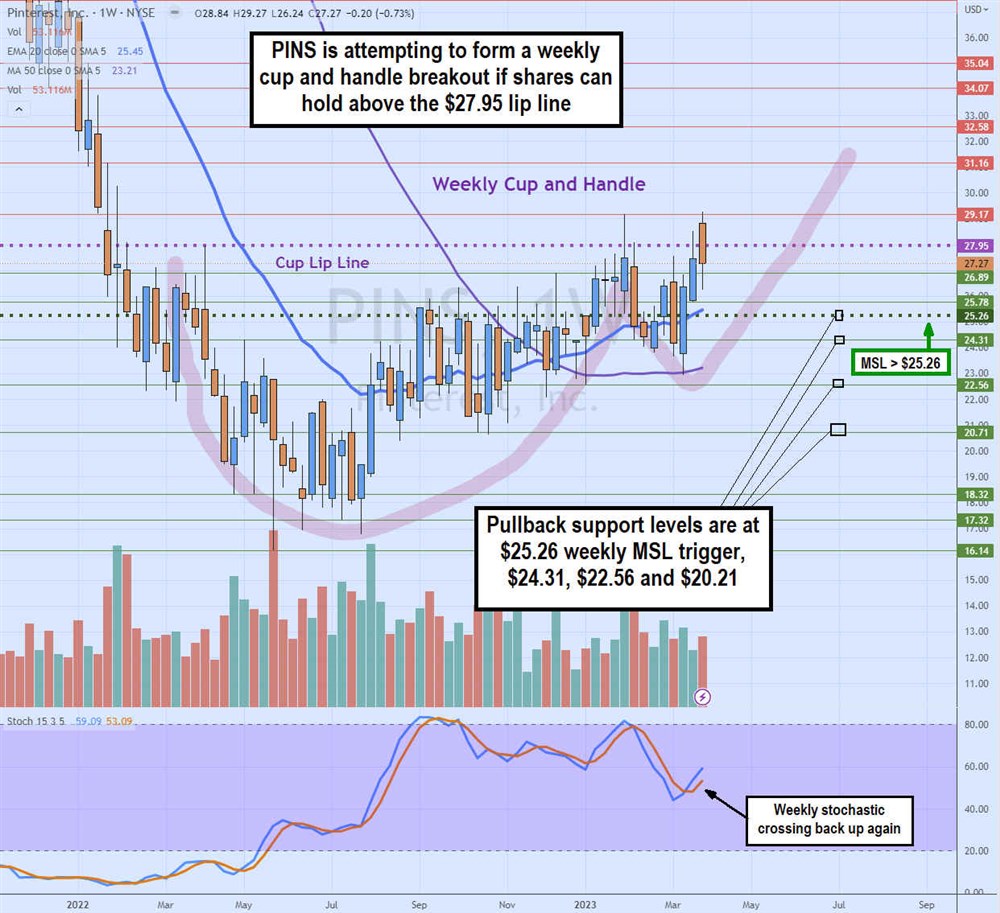

Weekly Cup and Handle Breakout Attempt

The weekly candlestick chart on PINS shows a cup and handle breakdown attempt. The cup lip line was formed at $27.95 in April 2022 as shares fell to a low of $16.13 by May 2022. Eventually, a rounded bottom was formed as shares recovered towards the $25.26 market structure low (MSL) breakout trigger to retest the weekly cup line in January 2023. Shares peaked at $29.17 before falling back to $22.95, where they began to form a handle.

PINS climbed back up through the weekly MSL trigger to attempt a breakout again through the cup lip line at $27.95, which peaked at around $29.17. The weekly stochastic has crossed the 50-band, so momentum is still early. The weekly 20-period exponential moving average (EMA) steadily rises to $25.45, followed by the weekly 50-period MA support at $23.21. Shares must hold above $27.95 to sustain the weekly cup and handle breakout. Pullback support levels are $25.26 weekly MSL trigger, $24.31, $22.56, and $20.21.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.