Financial News

No Tricks, Just 3 Sweet Treats for Your Portfolio in October

It's time to look at some sweet treats with Halloween just approaching. Whether the economy is expanding or in recession, a sweet tooth will always crave sweets. The market sell-off has caused these consumer staples stocks to fall into value territory. That's bad for recent investors but great for investors on the fence waiting for lower prices. As the market faces more uncertainty after a jobs report that came in double the estimates, the sell-off in consumer staples may be nearing a bottom. Here are 3 stocks that feed the sweet tooth and could be sweet for your portfolio.

The Hershey Co. (NYSE: HSY)

It’s hard to believe that the largest chocolate company in the U.S. was trading at all-time highs just five months ago at $276.88, recently hitting 52-week lows at $190.13. Hershey is now trading down 14% year-to-date (YTD) at 20X forward earnings. The iconic brand commands a 33% market share in the U.S. chocolate industry, 7% more than the world's largest chocolate company, Mars.

Snack Empire

Hershey's is one of the largest snack companies in the world, selling over 75 brands ranging from Hershey's, Reese's, Bubble Yum, Twizzlers, SkinnyPop, PayDay, Whoppers, to Jolly Ranchers, Skittles, Ice Breakers, KitKat, Cadbury, BarOne, Pirates Booty, Paqui, Dot’s and Brookside. It also licenses its brands for items like cereal, beer and ice cream. The company collects more than 80% of its revenues from North America and 10% from international, serving its products to more than 80 countries.

Sweet Growth

Its iconic status has enabled it to gain a premium in operating margins from competitors. Its gross margins are over 40%. Hershey reported Q2 2023 earnings of $2.01 per share, beating consensus analyst estimates by 10 cents. Revenues grew 5% YoY to $2.49 billion, shy of $2.50 billion analyst estimates. The company raised its quarter dividend to $1.192 per share, up from $1.036 per share.

Hershey President and CEO Michele Buck commented, "Our categories continue to perform well as consumer demand for great-tasting snacks remains resilient globally. We delivered another quarter of strong net sales growth, gross margin expansion and double-digit earnings growth, enabling us to raise our full-year adjusted earnings outlook and increase our dividend by 15%. New capacity and increased brand investment should enable us to sustain this momentum in the second half as we provide consumers…”

Guidance Raised

Hershey raised its full-year 2023 EPS to 11% to 12% YoY, up from 11% or $9.46 to $9.54 billion versus $9.51 billion analyst estimates. Full-year revenues are expected to grow over 8% YoY to $11.25 billion to $11.26 billion. On Oct. 5, 2023, Walmart Inc. (NYSE: WMT) surprised investors when U.S. chief John Furmer said that the huge trend of GLP-1 weight loss drugs drives the pullback in snack revenues.

Analyst Actions

On Aug. 11, 2023, Argus reiterated its Buy rating on HSY but lowered its price target to $270 from $315. On Sept 13, 2023, Cowen started coverage at Outperform with a $250 target. On Sept. 22, 2023, HSBC started coverage of HSY at a Buy with a $248 price target.

Hershey analyst ratings and price targets are at MarketBeat. Hersey peers and competitor stocks can be found with the MarketBeat stock screener.

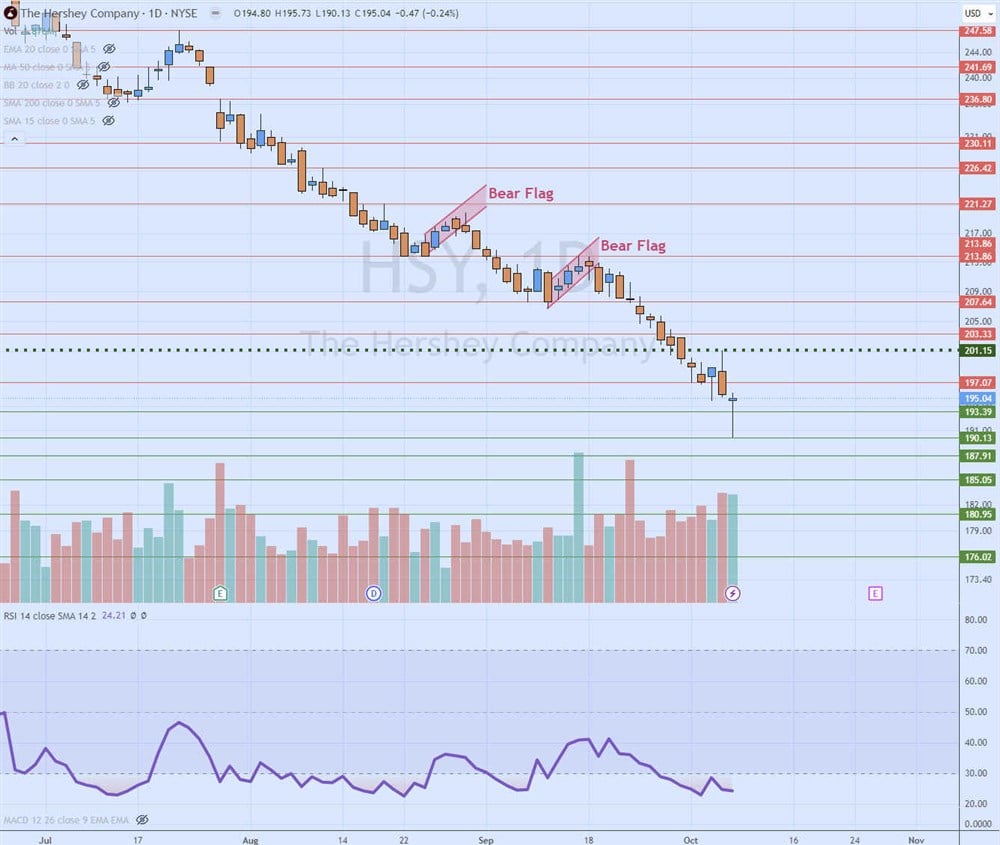

Weekly Bear Flag Breakdowns

The weekly candlestick chart illustrates the bear flag breakdown patterns. HSY is hitting levels not seen since February 2022. HSY formed a bear flag breakdown on Aug. 30, 2023, under $218, then again on Sept. 19, 2023, under $212. Share continued to sell off for 10 weeks until the daily market structure low (MSL) trigger formed at $201.15 but never triggered as it fell again. The relative strength index (RSI) has fallen under the 30-band oversold level. The daily hammer formed on Oct. 6, 2023, making a low of $190.13. Pullback support levels are at $193.39, $190.13, $185.05 and $180.95.

Krispy Kreme Inc. (NASDAQ: DNUT)

Iconic Krispy Kreme donuts are just irresistible to anyone with a sugar tooth. The company also operates Insomnia Cookies. Founded in 1937 and headquartered in Salem, North Carolina, the made-to-order donut chain also sells coffee, tea, milkshakes and ice cream. Krispy Kreme was a former high-flying short squeeze momentum stock in 2000 under the stock symbol KKD. Shares peaked at $49.37 during the dot com bubble in 2000 and filed for bankruptcy in 2004.

History of the Icon

The company went private in 2016 at $21, acquired by JAB Holdings, which also owned Panera Bread, Einstein Bros. Bagels, Caribou Coffee and Keurig Green Mountain. It IPO'ed again in 2021 at $17 per share under its current symbol DNUT. The company operates over 350 stores domestically and over 1,800 worldwide throughout 30 countries. Over 85% of stores are franchised, making Krispy Kreme an asset-light business. The company was continuing to grow its hub and spoke model, expanding into high-traffic grocery store locations, including Kroger Inc. (NYSE: KR), Costco Co. (NASDAQ: COST) and Amazon.com Inc. (NASDAQ: AMZN) Amazon Fresh stores.

Still Growing

Krispy Kreme saw revenues grow 9% YoY to $408.9 million, falling short of $410.74 consensus analyst estimates in its Q2 2023 earnings report. It earned 7 cents per share, in line with analyst estimates. The company grew global points of access by 12.8% to 12,872 in the quarter. The long-term goal is to form 75,000 points of access. GAAP net income was $100,000 compared to a GAAP net loss of $2.4 million in the year-ago period. Tootsie Roll has a 1.18% annual dividend yield.

Krispy Kreme CEO Michael Tattersfield commented, "As we start the third quarter, we have seen continued organic revenue momentum from our second quarter. Our strategic priorities remain unchanged as we continue to drive the capital-light expansion of our Omni-channel model, grow points of access, and lean into new and existing channels. With this momentum, we remain confident in our 2023 outlook and ability to achieve our long-term 2026 targets we highlighted at our Investor Day last year, including growing revenue to $2.15 billion and adjusting EBITDA up to $315 million.”

Krispy Kreme analyst ratings and price targets are at MarketBeat.

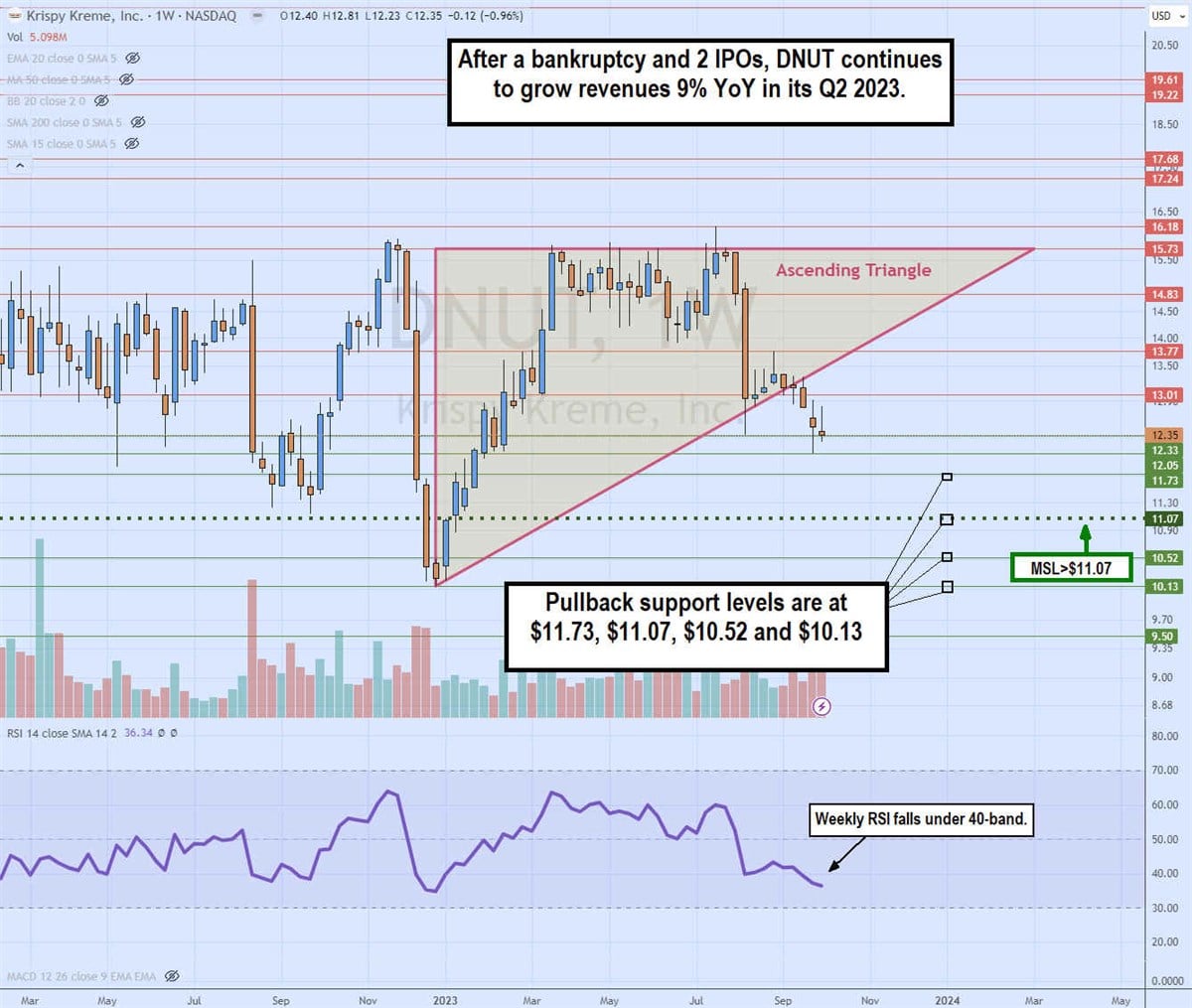

Weekly Ascending Triangle Breakdown

The weekly candlestick chart on KKD illustrates the ascending triangle comprised of the flat-top horizontal trendline at $15.73 and the ascending trending. DNUT broke down through the ascending trendline at $13.01 as the weekly RSI fell under the 40-band. DNUT shares have been losing momentum and altitude. Pullback support levels are $11.73, $11.07 weekly MSL trigger, $10.53 and $10.13.

Tootsie Roll Industries Inc. (NYSE: TR)

The iconic candy company, established in 1896, owns many well-known brands that investors can remember dating back to their childhood days. Who doesn't remember the Tootsie Roll commercials with the owls asking how many licks it takes to get to the center of a Tootsie pop? The company also owns brands like Blow-Pop, Junior Mints, Sugar Daddy and Sugar Babies, Double Bubble and Razzle.

Not Shareholder Friendly

Unfortunately, the company doesn't seem very investor-friendly as it rarely publishes press releases, even for its earnings reports, nor entertains conference calls. Instead, it just files the 10-Q reports. The stock has a dual-class structure, with the majority of shares owned by its CEO and Chairwoman Ellen R. Gordon. She owns 57% of the common shares and 82% of the Class B shares, which have 10 votes. She has an iron grip control on the company. The company website barely acknowledges an investor relations section besides a company financials page. It takes digging to find details from the shareholder letter and the 10-K. Its sales tend to accelerate during the holiday season, especially Halloween. Input costs offset gains in its recent sales.

Steady Sales Growth

The company reported a 12 % YoY revenue increase to $158.83 million for its Q2 2023 ending June 30, 2023. Net earnings were $14.726 million or 21 cents per share. The company ended the quarter with $26 million in cash and cash equivalents.

CEO Gordon commented, “Sales growth in the second quarter and first half of 2023 was driven by effective sales and marketing programs, including seasonal sales programs during these periods. Higher sales price realization was the primary contributor to the sales increase in the second quarter and the first half of 2023; however, higher sales volumes were also achieved in the second quarter and the first half of 2023 compared to the prior year's corresponding periods… The second quarter and first half of 2023 gross profit margins and net earnings were adversely affected by higher costs for ingredients, packaging materials, labor and benefits, and plant manufacturing overhead costs. We also incurred additional costs, including overtime and extended operating shifts for plant manufacturing, to meet our sales demands in 2023.”

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.