Financial News

Can These Two Airline Stocks Overcome Gravity And Fly Higher?

Airlines as a group are hardly flying high, but stocks including American Airlines (NASDAQ: AAL) and Delta Air Lines (NYSE: DAL) are at least participating in this week’s market rally.

If you’re like me, and have been flying regularly in the past year, you may have experienced completely full flights and pricey tickets, suggesting higher airline revenue, but also cancellations and delays, which just angers and frustrates customers.

Both Delta and American posted earnings in July. Delta got a small amount of lift after the report, but American is trading slightly below where it closed following its results.

Delta earned $1.44 per share on revenue of $13.8 billion. Those were year-over-year increases of 235% and 94%, respectively.

Despite that yearly gain, Delta missed analysts’ bottom-line estimates, but beat on the top line.

MarketBeat earnings data show that Delta beat bottom-line views in the prior four quarters, but missed in four consecutive quarters in 2020 and 2021. That’s no surprise, as Covid restrictions in the U.S. and internationally curtailed travel.

Among Delta’s highlights:

- Domestic continues to lead the recovery, although international travel is accelerating. Domestic passenger revenue was 3% higher and international passenger revenue was 81% recovered, compared to the June quarter 2019.

- Revenue in Latin America and Transatlantic both exceeded 2019 levels in the month of June and the pace of recovery in the Pacific saw meaningful improvement, driven by Korea and Australia re-openings and the easing of restrictions in Japan.

- Business travel recovery is progressing: Domestic corporate sales for the quarter were about 80% recovered versus 2019, up 25 points compared to the March quarter.

Delta issued some guidance for the December quarter, saying “"With sustained strength in bookings, we expect September quarter revenue to be up 1 to 5 percent compared to 2019 with total unit revenue growth improving sequentially."

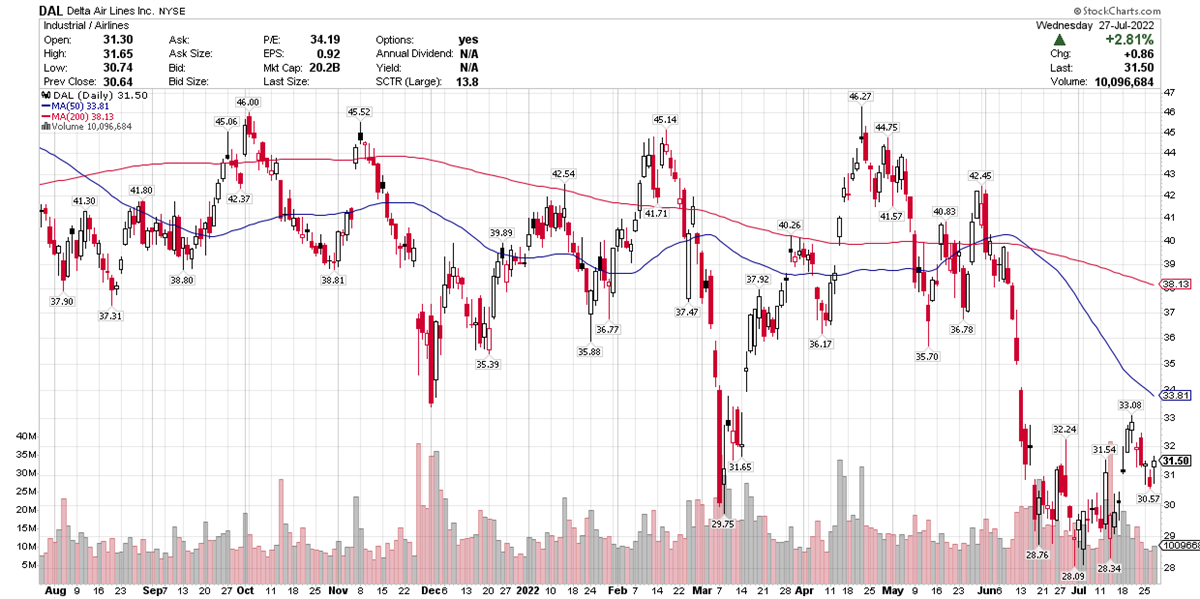

Delta’s chart reflects quite a bit of volatility that hasn’t let up much since the pandemic began. Like the airline industry as a whole, it’s underperforming the S&P 500 index.

Meanwhile, rival American Airlines is also underperforming the broader market, for essentially the same reasons.

American reported second-quarter earnings of $0.76 per share on revenue of $13.4 billion. Those were both improvements over the year-earlier quarter, but the bottom line especially stood out. According to MarketBeat data, American posted losses for the previous nine quarters, beginning with the quarter ended in December 2019 - even before Covid restrictions.

In its report, the company highlighted several developments:

- The company continues to execute on its plan to pay down approximately $15 billion of total debt by the end of 2025.

- In the second quarter, American and its regional partners operated more than 500,000 flights, an 8% increase over the second quarter of 2021, with an average load factor of 87%, which is 10 points higher than the second quarter of 2021.

- Despite a challenging operating environment in June, American’s on-time departure rate, on-time arrival rate and completion factor for the second quarter of 2022 were each improved versus the second quarter of 2019.

American is perhaps beginning a new uptrend, but that’s also true of the broader market. To use a very precise market prognostication term: Who knows?

The stock’s price actually flew highest above the clouds in January 2018, and has been in a long-term downtrend since then.

It staged a rally between October 2020 and March 2021, but could never overcome resistance around $26.

At this point, watch for American to hold above its June structure low of $11.93. That’s the relevant floor to keep an eye on. If the stock can rally from there, it may have potential once the broad market goes into a confirmed rally, and once we have more clues that the economy is improving.

Given the vagaries of fuel prices and a looming recession - which could slash plans for leisure and business travel - it may not be the time to snap up bargains in beaten-down stocks. That’s particularly true in an industry like the airline business, whose success is dependent upon so many variables.

If you’re wondering about the choice of Delta versus American, you may want to consider waiting for broad economic improvements before taking a flier on either. There are plenty of other industries with potential for strength in the near term. Nothing wrong with scooping up shares while a stock is meandering along the bottom, as long as you have conviction in the stock’s potential. However, don’t incur an opportunity cost by investing in a stock that continues to underperform the market, while others are taking off and flying high.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.