Financial News

Despite Ubiquity, Credit and Debit Card Processing Drags Down Small Business Satisfaction With Merchant Services Providers, J.D. Power Finds

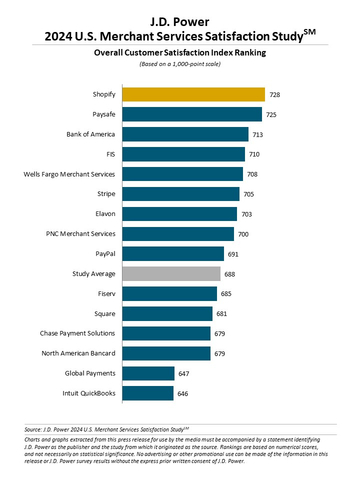

Shopify Ranks Highest in Merchant Services Customer Satisfaction

Small business owners are optimistic about the future, with 88% indicating the financial state of their individual businesses is about the same or better off than a year ago, which should bode well for merchant services providers. According to the J.D. Power 2024 U.S. Merchant Services Satisfaction Study,SM released today, small business financial optimism is correlated with increased sales processed by merchant services providers. There are 94% of merchants that now accept debit or credit cards; 88% that accept digital wallet; and 54% that accept Buy Now, Pay Later (BNPL) payment methods. However, when it comes to small business satisfaction with those services, scores are lowest among merchants for processing widely accepted payment types such as credit and debit card transactions and are highest for processing less widely accepted payment types like BNPL.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240201251966/en/

J.D. Power 2024 U.S. Merchant Services Satisfaction Study (Graphic: Business Wire)

“We’re seeing an interesting disconnect in the merchant services marketplace whereby the most frequently processed forms of payment—credit and debit cards—generate the lowest levels of overall satisfaction among small business owners, while less common payment types such as BNPL, pay by bank and gift cards drive higher satisfaction,” said John Cabell, managing director of payments intelligence at J.D. Power. “Part of that is driven by demographics. Younger, newer business owners are more apt to accept a wide variety of payment types and have higher overall satisfaction with their merchant services providers. However, we’re also seeing some challenges across the board with debit and credit when it comes to delays in account funding, cost and fees and fraud management.”

Following are key findings of the 2024 study:

- Credit and debit reign supreme on usage, but fail to deliver on satisfaction: Overall, 94% of small businesses accept debit or credit card payments. Most merchants have their credit card (81%) and debit card (80%) payments processed by their provider. Despite being the most processed forms of payment, overall merchant services satisfaction scores are lowest across all aspects of the customer experience among small businesses that have credit cards (692 on a 1,000-point scale) and debit cards (694) processed by their provider.

- Satisfaction highest among businesses where BNPL is processed: Slightly more than half (54%) of small businesses accept BNPL and just 27% of merchants report processing BNPL with a profiled brand; satisfaction scores are highest (744) among small businesses that do have this payment type processed. Overall merchant services satisfaction rises as businesses process more payment options, reaching a high score of 793 among the 4% of businesses that cite six different payment types processed.

- Gap emerges between small business innovators and traditionalists: Two distinct categories of small business owners have begun to emerge in the study dataset: innovators, who represent 47% of the study population and are younger, newer business owners who are more likely to accept a wide variety of payment types, and traditionalists, who represent 53% of the study population and are older and prefer cash, checks and in-person purchases. Overall merchant services provider satisfaction is significantly higher among innovators.

- Cost, fraud risk and complexity emerge as top obstacles: Among small business owners who are unwilling to accept credit and debit cards, higher cost of acceptance and higher risk of fraud/theft are top reasons. Among those who are unwilling to accept BNPL, digital wallet or pay-by-bank payments, the primary reasons are difficulty of use/complicated process and too much effort versus other priorities.

Study Ranking

Shopify ranks highest in merchant services satisfaction, with a score of 728. Paysafe (725) ranks second and Bank of America (713) ranks third.

The U.S. Merchant Services Satisfaction Study was redesigned in 2024. It is based on responses from 5,383 small business customers of merchant services providers and measures satisfaction across six factors (in alphabetical order): advice and guidance on running your business; cost of processing payments; data security and protection; managing my account; payment processing; and quality of technology. The study was fielded from September through November 2023.

The brands evaluated are the U.S. merchant services providers with largest market share. Overall satisfaction results reflect overall corporate results, meaning they can include the results of various sub-brands or alternate brand names that operate under the respective corporate brand names. In some cases, brands profiled also currently have or recently have had joint partnerships to provide merchant services to small business clients.

For more information about the U.S. Merchant Services Satisfaction Study, visit https://www.jdpower.com/business/merchant-services-satisfaction-study.

See the online press release at http://www.jdpower.com/pr-id/2024005.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

View source version on businesswire.com: https://www.businesswire.com/news/home/20240201251966/en/

Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.