Financial News

Australian Business Leaders Express Tempered Optimism Amid Persistent Inflation and Uncertainties Ahead, Annual J.P. Morgan Survey Finds

Midsize businesses cited cybersecurity, the competitive environment and weakening consumer confidence as top challenges for the year ahead

Optimism for the year ahead has climbed among Australian midsize business leaders, with nearly seven-in-ten reporting confidence about the global (69%) and national (68%) economies, up 10% and 9% respectively from 2023, according to J.P. Morgan’s third annual Australia Business Leaders Outlook survey.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240116615259/en/

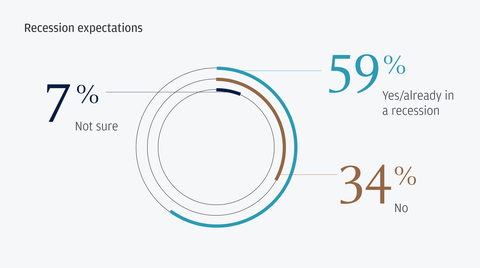

Recession expectations for Australian midsize business leaders (Graphic: Business Wire)

With this confidence, growth is top-of-mind for Australian midsize businesses as a majority expect to see an increase in revenues (82%) and profits (78%)—and also plan to boost capital expenditures (73%, up 12% from 2023) and add headcount (56%). Balancing the hopeful outlook on the horizon, 59% reported bracing for a recession in 2024 or believe the economy is already in one, up 13% from 2023.

“Australian business leaders are clear-sighted about the challenges ahead, while finding confidence in their resilience and experience navigating uncertain economic environments,” said Elizabeth McAlpine, Head of Commercial Banking Industrials and Consumer Coverage, Australia and New Zealand, J.P. Morgan. “While they remain focused on driving growth amid a potential recession, it’s clear they expect a soft landing and are feeling hopeful looking to the future.”

The survey of more than 200 C-suite executives found that more Australian midsize companies are looking to expand internationally, while remaining focused on managing the rising costs of doing business. More than half plan to drive business growth through expansion into new distribution channels (54%) and/or new international markets (53%, up 18% from 2023). These plans are in spite of 74% reporting costs continuing to rise due to inflation.

“Even as they contend with economic headwinds, Australia’s business leaders remain cautiously optimistic as we enter 2024 and will continue to focus on harnessing opportunities for growth and international expansion,” said Robert Bedwell, Chief Executive Officer, Australia and New Zealand, J.P. Morgan.

Riding the Waves of Ongoing Challenges

Australian business leaders indicated cybersecurity and fraud concerns as the most significant challenge they’re facing, closely followed by high competition and weak consumer confidence.

- Nearly one-third of Australian business leaders (28%) indicate cybersecurity and fraud concerns as one of their major challenges anticipated for 2024—ranking higher than U.S. (13%), U.K. (20%) and Germany (18%) survey respondents.

- The competitive business environment (28%) and lack of consumer confidence (26%) are also cited as top challenges Australian business leaders are facing, along with managing cashflow (24%) and the impact of rising interest rates (24%).

Getting Creative with Financing to Fuel Growth

In line with expectations for growth, more than three quarters (77%) of Australian business leaders surveyed expect their credit needs to increase in 2024, up 7% from 2023. While bank lines of credit remain the most common source for financing (66%), the results show an increased reliance on other sources of funding.

- Both venture capital (44%, up 11% from 2023) and private placement of debt or equity (44%, up 11% from 2023) saw rises as a source of financing.

- Nearly half (47%) say they plan to add direct lending or private credit to their financing mix in the year ahead, up 15% from the year before. This is also significantly higher than their counterparts surveyed in other markets (U.S.: 8%, U.K.: 34%, France: 33%, Germany: 37%, India: 34%).

Embracing the Possibilities of Artificial Intelligence

Australia’s midsize business community is finding ways to leverage the rapid advances in artificial intelligence (AI) tools, such as generative AI and language processing software.

- Nearly nine-in-ten (86%) local business leaders saying they already use or are considering using AI for their business.

- Of those already using or considering using AI, over half are already using AI in financial management or accounting (52%), product development (51%) and business operations (49%).

For more information on the 2024 Australia Business Leaders Outlook survey, visit jpmorgan.com/business-leaders-outlook-AUS.

Survey Methodology

J. P. Morgan’s Australia Business Leaders Outlook survey was conducted online from 16 November – 13 December 2023. In total, 209 business leaders (CEOs, CFOs, heads of finance and owners) from Australian midsize businesses (annual revenues generally ranging from $20 million to $2 billion AUD) across various industries participated in the survey. Results are within statistical parameters for validity, and the error rate is +/- 6.6% with a 95% confidence level.

About JPMorgan Chase

JPMorgan Chase & Co. (NYSE: JPM) is a leading financial services firm based in the United States of America (“U.S.”), with operations worldwide. JPMorgan Chase had $3.9 trillion in assets and $328 billion in stockholders’ equity as of December 31, 2023. The Firm is a leader in investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing and asset management. Under the J.P. Morgan and Chase brands, the Firm serves millions of customers in the U.S., and many of the world’s most prominent corporate, institutional and government clients globally. Information about JPMorgan Chase & Co. is available at www.jpmorganchase.com.

© 2024 JPMorgan Chase & Co. All rights reserved. JPMorgan Chase Bank, N.A. Member FDIC. JPMorgan Chase Bank, N.A. is organized under the laws of USA with limited liability. Visit jpmorgan.com/cb-disclaimer for full disclosures and disclaimers related to this content.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240116615259/en/

Contacts

J.P. Morgan Australia, Katie Cooper, katie.cooper@jpmorgan.com

J.P. Morgan Commercial Banking, Bentley Weisel, bentley.r.weisel@chase.com

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.