Financial News

Pan American Silver Provides Annual Exploration Update

Pan American Silver Corp. (NYSE: PAAS) (TSX: PAAS) ("Pan American" or the "Company") released new exploration drill results for its Jacobina, El Peñon, La Colorada, Huarón and Timmins properties and for its La Colorada Skarn project. These drill results demonstrate continued potential for organic growth of mineral reserves and mineral resources in and around the Company's operations.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20231204487421/en/

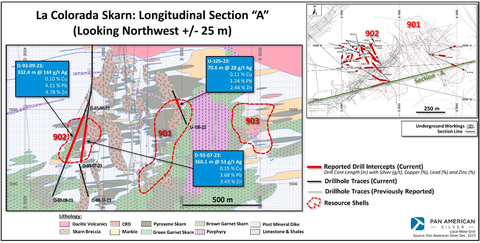

La Colorada Skarn: Longitudinal Section “A” (Graphic: Business Wire)

“The recent exploration drilling at Jacobina continues to reflect the geological potential to expand the resource base close to existing mine infrastructure, specifically in the Maricota and João Belo Sul sectors, both of which have the potential to add higher margin ounces. The large mineral reserve and mineral resource base, together with a study underway to optimize the economic life of mine, underpin the growth potential and strong economics of the Jacobina property,” said Christopher Emerson, Pan American’s Vice President of Exploration and Geology. “We also continue to discover new targets and build new resources at our other mines, such as at La Colorada, El Peñon, Huarón and Timmins. In addition, multiple mineralised intercepts of over 100 metre widths have further expanded and added confidence to the large mineralisation footprint at the La Colorada Skarn project, demonstrating the world-class nature of the deposit.”

Pan American's drill program in 2023 is focused on near-mine exploration and resource conversion throughout its portfolio of operating mines. A total of 373,780 metres has been drilled during the ten months ended October 31, 2023, out of a 450,000 metre drill program planned for 2023. The mineral reserves and mineral resources update as at June 30, 2023, which was released on August 24, 2023, reflects only a portion of the 2023 drill program. The Company plans to incorporate the results of the full 2023 drill program, including results for the Company's other assets not referenced in this news release, in a mineral reserve and mineral resource update as at June 30, 2024.

EXPLORATION HIGHLIGHTS

Jacobina mine, Brazil:

See Table 1 of this news release for drill result highlights

- Continued success in defining mineralisation outside the João Belo Sul mineral resource. Step-out drilling approximately 200 metres to the north returned 4.85 metres at 14.69 g/t Au, including 1.15 metres at 59.25 g/t Au and 7.70 metres at 4.83 g/t Au, including 3.36 metres at 7.45 g/t Au (drill hole JBS00041). These results confirm continuity and higher-grades along a 700 metre strike between João Belo Sul and João Belo mine.

- Exploration drill results at Maricota, close to current infrastructure, show potential for future mineral resource addition over an approximate 2,000 metre strike length by 1,000 metre depth profile, with intercepts at higher-grade than average resource grade, such as 4.69 metres at 23.45 g/t Au, including 1.26 metres at 40.90 g/t Au and 1.52 metres at 35.17 g/t Au (drill hole MRCEX00004).

El Peñon, Chile:

See Table 2 of this news release for drill result highlights

- Nine drillholes within the dacite intrusive unit north of the Pampa Campamento structure returned higher grades outside of the current mineral resource and mineral reserve footprint. Highlights include (estimated true widths): 1.20 metres at 114.50 g/t Au and 72 g/t Ag (drill hole UIP0145), 1.80 metres at 28.90 g/t Au and 205 g/t Ag (drill hole UIP0146) and 1.74 metres at 19.14 g/t Au and 230 g/t Ag (drill hole UIP0149). Mineralisation is defined over an approximate 150 metre vertical extent and remains open both along strike and down plunge to the north.

- At El Valle, drilling confirmed the extension of mineralisation in the El Valle vein and parallel El Valle -30 splay, located northwest of Pampa Campamento. Mineralisation remains open to the south for further expansion within the favourable rhyolite stratigraphy. Drill highlights include 2.30 metres at 46.50 g/t Au and 805 g/t Ag and 0.80 metres at 40.70 g/t Au and 1,775 g/t Ag (drill hole SEV0004).

La Colorada mine, Mexico:

See Table 3 of this news release for drill result highlights

- Exploration drilling on the east extension of the NC2 vein has shown high-grade silver intercepts. Drill highlights from 15,873 metres drilled this year include: 1.05 metres at 2,804 g/t Ag, 1.59% Pb and 1.33% Zn (drill hole U-75-23) and 1.33 metres at 4,067 g/t Ag, 0.76% Pb and 1.82% Zn (drill hole S-84-23). The high-grade zone is now defined by 50 metre-grid drill spacing, from the 498 to 588 level (approximately 100 metre vertical) over a 200 metre strike length. This area remains open to the northeast and to depth with ongoing drilling focused on definition of further extensions.

La Colorada Skarn project, Mexico:

See Table 4 of this news release for drill result highlights

- More than 280,000 metres have been drilled on the project, with 97,000 metres completed since the last mineral resource update issued on September 14, 2022. Recent drilling has focused on the 902 skarn zone with 24 infill drill holes, which follow up on mineralisation reported in prior news releases dated May 2, 2023, November 1, 2022, and July 21, 2022. Results confirm wide zones of high-grade silver mineralisation, as demonstrated by 332.40 metres at 144 g/t Ag, 4.11% Pb and 4.78% Zn, including 89.85 metres at 461 g/t Ag, 10.63% Pb and 11.05% Zn (drill hole D-93-09-23).

- Exploration drilling successfully extended the 902 skarn zone 100 metres to the northwest. Highlights from extensional drilling in this area include 161.10 metres at 96 g/t Ag, 1.86% Pb, and 3.00% Zn (drill hole U-43-23).

Huarón mine, Peru:

See Table 5 of this news release for drill result highlights

- In 2023, drilling and mine sill development focused on the Horizonte zone, an emerging shallow multiple vein system located southeast of the core mine area that is becoming an important production area. Of the 14,510 metres drilled at Huarón, 5,545 metres (38%) were focused on the Horizonte zone. Intercepts from 10 drill holes within three structures in the Horizonte zone all returned positive results that will contribute to future resource models.

Timmins mine (Whitney Project), Canada:

See Table 6 of this news release for drill result highlights

- Drilling in 2022 (39 holes totaling 7,849 metres) and 2023 (26 holes totaling 5,979 metres) tested remnant mineralisation in both unmined veins and wall rock adjacent to historic mined stopes, confirming current resources in Hallnor and historic resources in Broulan Reef zone, 1.5 km to the west. The Hallnor zone is referenced in Pan American's mineral reserves and mineral resources update as at June 30, 2023, under the name of Whitney, a joint venture (82.5% Pan American / 17.5% Newmont Corporation) in which Pan American is the operator. The Hallnor zone is estimated to contain 586,000 ounces of measured and indicated gold mineral resource and 141,400 ounces of inferred gold mineral resource.

- Significant assays in the Hallnor zone include: 1.20 metres at 145.73 g/t Au (drill hole TW22-719), 5.80 metres at 26.64 g/t Au and 3.10 metres at 9.97 g/t Au (drill hole TW22-712), 16.60 metres at 5.39 g/t Au (drill hole TW22-705A), 8.00 metres at 6.76 g/t Au (drill hole TW22-709) and 4.60 metres at 10.43 g/t Au (drill hole TW22-694) (all reported over core lengths).

- Significant assays from the drilling at Broulan Reef include: 10.00 metres at 38.11 g/t Au (drill hole TW23-747), 8.00 metres at 6.39 g/t Au (drill hole TW23-740), 9.00 metres at 6.38 g/t Au (drill hole TW23-745), 9.0 metres at 3.45 g/t Au (drill hole TW23-743) and 3.00 metres at 4.71 g/t Au (drill hole TW23-730) (all reported over core lengths).

PROPERTY DESCRIPTION AND DRILL RESULT HIGHLIGHTS

Jacobina, Brazil

The Jacobina mine is an underground paleo placer gold mine located in the state of Bahia in northeastern Brazil. The mine has a strong track record of mineral reserve and mineral resource replacement and growth. The mine complex extends over eight kilometres with resources and exploration targets over a 14 kilometre trend where gold mineralisation is hosted in conglomerate reefs that remain open to depth and along strike in multiple areas. The Jacobina property consists of a mining claim, mining concessions and exploration permits over 155 kilometres in a north-south direction and five to 25 kilometres in an east-west direction.

Brownfield exploration drilling totaled 44,006 metres with drilling completed largely at the João Belo Sul, Maricota, João Belo Norte, Moro do Vento, and Serra do Corrego zones. Recent Jacobina exploration results demonstrate upside potential for mineral reserve and mineral resource growth.

Drill results at João Belo Sul, together with the mineral reserves and mineral resources update as at June 30, 2023 that reported an additional 215,000 ounces of indicated gold mineral resource and 81,000 ounces of new inferred gold mineral resource, as well as the addition of 58,000 ounces of probable mineral reserve, affirm the potential for continued mineral reserve and mineral resource growth. Recent infill and exploration drilling at João Belo Sul confirm mineralisation grade and continuity along strike and to depth, particularly along higher-grade ore shoots.

Maricota represents an opportunity to add higher-grade mineral resources close to existing mine infrastructure at the northern end of the Jacobina mine. Exploration drilling, initiated in 2022, continues to extend mineralisation along a strike length greater than two kilometres and to depth, where historic drill results include 9.72 g/t of gold over 1.80 metres (drill hole MVTEX22) and 12.28 g/t of gold over 2.39 meters (CANEX006). The Company is working to complete an initial mineral resource estimate for Maricota in 2024.

Table 1: Jacobina Mine

The following table provides infill and exploration drill result highlights for the João Belo Sul and Maricota Zones of the Jacobina mine. Full infill and exploration drill results not included in this table, together with cross sections and plans, are available at https://panamericansilver.com/operations/exploration/.

Hole |

Sector |

From (m) |

To (m) |

Interval (m) |

Est. True Width (m) |

Au g/t |

JBS00036 |

João Belo Sul |

162.00 |

165.50 |

3.50 |

3.36 |

75.12 |

JBS00036 |

Includes |

163.00 |

164.00 |

1.00 |

0.96 |

255.65 |

JBS00040 |

João Belo Sul |

231.50 |

237.00 |

5.50 |

3.63 |

2.93 |

JBS00040 |

João Belo Sul |

368.56 |

375.71 |

7.15 |

5.58 |

3.83 |

JBS00040 |

Includes |

373.46 |

375.71 |

2.25 |

1.75 |

8.60 |

JBS00040 |

João Belo Sul |

377.00 |

382.00 |

5.00 |

3.90 |

3.20 |

JBS00041 |

João Belo Sul |

412.20 |

418.50 |

6.30 |

4.85 |

14.69 |

JBS00041 |

Includes |

412.50 |

414.00 |

1.50 |

1.15 |

59.25 |

JBS00041 |

João Belo Sul |

424.00 |

434.00 |

10.00 |

7.70 |

4.83 |

JBS00041 |

Includes |

429.63 |

434.00 |

4.37 |

3.36 |

7.45 |

JBS00043 |

João Belo Sul |

393.09 |

411.50 |

18.41 |

12.37 |

2.43 |

JBS00043 |

Includes |

405.38 |

409.50 |

4.12 |

2.77 |

4.44 |

JBS00043 |

João Belo Sul |

432.75 |

439.73 |

6.98 |

4.69 |

2.82 |

JBS00043 |

Includes |

435.50 |

439.73 |

4.23 |

2.84 |

3.69 |

JBS00045 |

João Belo Sul |

316.49 |

323.00 |

6.51 |

6.32 |

2.33 |

JBS00045 |

Includes |

318.50 |

323.00 |

4.50 |

4.37 |

3.10 |

JBS00045 |

João Belo Sul |

422.50 |

428.00 |

5.50 |

5.34 |

4.04 |

JBS00048 |

João Belo Sul |

470.50 |

473.42 |

2.92 |

2.53 |

4.42 |

JBS00050 |

João Belo Sul |

301.95 |

308.50 |

6.55 |

5.59 |

3.10 |

JBS00050 |

Includes |

301.95 |

304.73 |

2.78 |

2.36 |

5.44 |

JBS00050 |

João Belo Sul |

440.50 |

447.73 |

7.23 |

6.03 |

2.16 |

JBS00050 |

João Belo Sul |

458.45 |

466.60 |

8.15 |

6.47 |

2.54 |

JBS00053 |

João Belo Sul |

127.00 |

132.26 |

5.26 |

4.95 |

2.45 |

JBS00053 |

João Belo Sul |

186.00 |

196.50 |

10.50 |

9.77 |

1.73 |

JBS00053 |

João Belo Sul |

305.43 |

309.50 |

4.07 |

3.79 |

3.75 |

MRCEX00004 |

Maricota |

541.35 |

547.50 |

6.15 |

4.69 |

23.45 |

MRCEX00004 |

Includes |

541.35 |

543.00 |

1.65 |

1.26 |

40.90 |

MRCEX00004 |

Includes |

544.50 |

546.50 |

2.00 |

1.52 |

35.17 |

MRCEX00008 |

Maricota |

106.27 |

109.94 |

3.67 |

3.20 |

5.88 |

MRCEX00008 |

Maricota |

112.10 |

123.00 |

10.90 |

9.60 |

1.67 |

MRCEX00008 |

Maricota |

471.57 |

477.00 |

5.43 |

4.13 |

4.68 |

MRCEX00008 |

Maricota |

553.86 |

567.50 |

13.64 |

10.96 |

3.58 |

MRCEX00009 |

Maricota |

212.00 |

219.00 |

7.00 |

2.45 |

3.05 |

El Peñon, Chile

El Peñon is a large, high-grade multi-vein system located in northern Chile. Exploration drilling totaling 48,407 metres, mainly in the core mine area, includes 13,805 metres of infill drilling to convert inferred mineral resources to indicated mineral resources, and 33,748 metres of exploration drilling to define new near-mine inferred mineral resources. Exploration drilling was directed at expanding the mineralisation envelope along multiple core mine structures, most notably Pampa Campamento and El Valle veins in the southwest mine sector. Both areas remain targets for drilling in 2024 and are expected to contribute new mineral resources for the mineral reserve and mineral resource update as at June 30, 2024.

Pampa Campamento is currently one of the most important veins contributing to production at El Peñon. Infill and exploration drilling have extended mineralisation towards the north within an intrusive unit. Step out drilling north of current resources below the 1,400 metre level has extended mineralisation approximately 150 metres vertically. Mineralisation remains open in this area, both down plunge and along strike, as well as in splays such as Pampa Campamento -35, Pampita and Pampa Campamento Oeste.

At El Valle, infill and exploration drilling confirmed mineralisation in the El Valle vein and parallel El Valle -30 splay, where drill holes returned higher grades over horizontal widths ranging up to 2.50 metres. The zones remain open to the south within the favourable rhyolite stratigraphy.

Pan American is currently designing a drill program to address the reserve reconciliation issue identified in 2023.

Table 2: El Peñon Mine

The following table provides infill and exploration drill result highlights for the Pampa Campamento and El Valle vein systems of the El Peñon mine. Full infill and exploration drill results not included in this table, together with longitudinal sections and plans, are available at https://panamericansilver.com/operations/exploration/.

Hole |

Vein |

From (m) |

To (m) |

Interval (m) |

Est. True width (m) |

Au (g/t) |

Ag (g/t) |

UIP0135 |

Pampa Campamento |

270.50 |

272.79 |

2.29 |

1.60 |

9.10 |

96 |

UIP0133 |

Pampa Campamento |

255.95 |

256.88 |

0.93 |

0.80 |

12.37 |

49 |

UIP0137 |

Pampa Campamento |

294.03 |

296.93 |

2.90 |

1.80 |

21.30 |

66 |

UIP0143 |

Pampa Campamento |

304.07 |

306.05 |

1.98 |

1.29 |

20.12 |

73 |

UIP0145 |

Pampa Campamento |

236.11 |

238.00 |

1.89 |

1.20 |

114.50 |

72 |

UIP0146 |

Pampa Campamento |

261.33 |

264.32 |

2.99 |

1.80 |

28.90 |

205 |

UIP0149 |

Pampa Campamento |

253.00 |

255.20 |

2.20 |

1.74 |

19.14 |

230 |

UIP0147 |

Sistema Pampa Campamento |

224.77 |

225.98 |

1.21 |

0.80 |

5.55 |

223 |

UEP0055 |

Pampa Campamento (-35) |

298.62 |

299.64 |

1.02 |

0.70 |

13.60 |

33 |

UEP0056 |

Pampa Campamento (-35) |

254.20 |

256.20 |

2.00 |

1.10 |

5.80 |

20 |

UEP0057 |

Pampa Campamento |

342.71 |

344.20 |

1.49 |

1.10 |

5.10 |

100 |

SIP0040 |

Pampa Campamento |

635.20 |

637.95 |

2.75 |

1.60 |

8.09 |

113 |

SIP0040 |

Pampa Campamento(-10) |

640.56 |

642.88 |

2.32 |

1.10 |

4.14 |

209 |

UIP0086 |

Pampa Campamento Oeste |

50.64 |

51.25 |

0.61 |

0.66 |

7.10 |

243 |

UIP0103 |

Pampa Campamento Oeste |

62.12 |

62.90 |

0.78 |

0.67 |

21.60 |

368 |

UIP0105 |

Pampa Campamento |

343.38 |

345.88 |

2.50 |

1.20 |

8.67 |

235 |

UIP0106 |

Pampita |

99.60 |

100.00 |

0.40 |

0.32 |

20.70 |

1372 |

UIP0112 |

Pampa Campamento |

365.67 |

366.75 |

1.08 |

0.76 |

20.74 |

1020 |

UIP0113 |

Pampita |

157.87 |

158.30 |

0.43 |

0.40 |

38.10 |

20 |

UIP0114 |

Pampa Campamento(-35) |

217.42 |

219.00 |

1.58 |

1.10 |

10.65 |

237 |

UIP0114 |

Pampa Campamento |

371.40 |

373.00 |

1.60 |

0.86 |

9.80 |

31 |

UIP0119 |

Pampa Campamento |

333.66 |

335.88 |

2.22 |

1.28 |

20.25 |

499 |

UIP0120 |

Pampa Campamento Oeste |

50.94 |

52.23 |

1.29 |

0.80 |

10.20 |

287 |

UIP0124 |

Pampa Campamento(-35) |

249.00 |

251.10 |

2.10 |

1.40 |

15.35 |

339 |

UIP0127 |

Pampa Campamento(-35) |

258.45 |

260.23 |

1.78 |

0.70 |

15.27 |

675 |

UEP0044 |

Pampa Campamento |

165.60 |

166.85 |

1.25 |

0.90 |

134.20 |

248 |

UIV0050 |

El Valle |

201.85 |

204.20 |

2.35 |

2.50 |

5.50 |

116 |

UIV0051 |

El Valle |

205.32 |

206.61 |

1.29 |

1.30 |

8.60 |

30 |

UIV0054 |

El Valle |

164.80 |

166.80 |

2.00 |

1.30 |

15.88 |

543 |

UIV0056 |

El Valle |

227.20 |

229.00 |

1.80 |

1.70 |

6.00 |

334 |

SEV0004 |

El Valle (-30) |

228.00 |

231.00 |

3.00 |

2.30 |

46.50 |

805 |

SEV0004 |

El Valle |

269.65 |

270.86 |

1.21 |

0.80 |

40.70 |

1775 |

UEV0031 |

El Valle |

257.00 |

258.56 |

1.56 |

1.69 |

5.30 |

252 |

La Colorada, Mexico

The La Colorada mine is a silver-rich polymetallic mine located in the state of Zacatecas, Mexico. A total of 108 holes for 29,569 metres were drilled on the vein targets (NC2, Veta 3, Recompensa, Amolillo and minor splays) through the mine from both surface and underground with the focus on infill drilling. Exploration success was reported on the high-grade east extension NC2 vein where 39 holes for 15,873 metres were drilled.

Most of the drill holes on NC2 extend the high-grade vein areas to the east, which are now drilled at roughly 50 metre spacing. The high-grade zone is defined from the 498 to 588 level (approximately 100 metre vertical) over a 200-metre strike length. This area remains open to the northeast and to depth with ongoing drilling focused on definition of further extensions.

Table 3: La Colorada Mine

The following table provides the drill result highlights for the La Colorada mine. Full drill results not included in this table, together with cross sections and plans, are available at https://panamericansilver.com/operations/exploration/.

Hole No. |

From (m) |

To (m) |

Interval (m) |

True Width (m) |

Ag g/t |

Pb % |

Zn % |

U-31-23 |

214.35 |

215.75 |

1.40 |

1.13 |

1181 |

1.02 |

3.25 |

U-38-23 |

219.15 |

219.90 |

0.75 |

0.58 |

160 |

1.70 |

14.91 |

U-47-23 |

188.45 |

190.30 |

1.85 |

0.99 |

385 |

5.90 |

15.09 |

U-49-23 |

207.40 |

208.65 |

1.25 |

0.96 |

976 |

1.15 |

2.70 |

U-53-23 |

228.05 |

231.05 |

3.00 |

2.09 |

675 |

1.93 |

5.77 |

U-56-23 |

262.80 |

264.85 |

2.05 |

1.74 |

320 |

5.89 |

15.57 |

S-73-23 |

711.20 |

713.10 |

1.90 |

1.33 |

1455 |

3.43 |

1.26 |

U-75-23 |

242.00 |

243.40 |

1.40 |

1.05 |

2804 |

1.59 |

1.33 |

U-77-23 |

266.95 |

268.10 |

1.15 |

0.98 |

393 |

6.15 |

7.50 |

U-83-23 |

230.25 |

232.50 |

2.25 |

1.89 |

226 |

0.44 |

2.92 |

S-84-23 |

666.50 |

668.20 |

1.70 |

1.33 |

4067 |

0.76 |

1.82 |

S-95-23 |

615.10 |

616.00 |

0.90 |

0.51 |

792 |

0.59 |

1.39 |

S-102-23 |

678.00 |

679.10 |

1.10 |

0.95 |

909 |

2.26 |

5.72 |

S-105-23 |

611.20 |

613.60 |

2.40 |

1.83 |

236 |

0.48 |

1.25 |

U-106-23 |

234.70 |

237.50 |

2.80 |

0.93 |

69 |

4.18 |

7.79 |

U-114-23 |

329.70 |

331.20 |

1.50 |

0.84 |

370 |

1.08 |

4.20 |

S-115-23 |

693.85 |

695.35 |

1.50 |

1.25 |

349 |

3.02 |

7.61 |

S-123-23 |

648.95 |

652.00 |

3.05 |

2.58 |

1171 |

1.04 |

0.81 |

La Colorada Skarn, Mexico

The La Colorada Skarn deposit was discovered in 2018, and is located at depth adjacent to the La Colorada polymetallic mine area in Zacatecas, Mexico. The skarn zone extends from 900 to 1,800 metres below the surface and comprises three distinct bodies (901 main zone, 902 West zone, 903 East zone).

Exploration drilling has continued to define and expand the current resource. Since the last mineral resource update provided on September 14, 2022, a total of 97,000 metres has been drilled with continued exploration success in expanding mineralisation northwest of ore body 902 while adding infill definition to the high-grade portion of the deposit (see news release dated July 21, 2022). An initial economic study of the La Colorada Skarn project will be released in the fourth quarter of 2023.

A total of 44 new infill and exploration drill holes covering 43,337 metres were completed. This news release includes 34 holes for 33,751 metres drilled since the last drill results update issued on May 2, 2023.

Recent drilling has focused on definition of the 902 skarn zone with 24 infill drill holes designed to follow up on mineralisation reported in news releases dated May 2, 2023, November 1, 2022 and July 21, 2022. Results confirm wide zones of high-silver grade mineralisation highlighted by drill holes D-93-09-23 and D-05-01-23 (see table below for assays). This drilling confirms the high-grade nature of the silver mineralisation, which is now defined by more than 35 drill holes on a 40-metre spaced grid over a strike length of 250 metres.

Exploration drilling also successfully extended 902 ore body mineralisation 100 metres to the northwest with drill hole U-43-23 (see table below for assays).

Table 4: La Colorada Skarn Project

The following table provides infill and exploration drill result highlights for the La Colorada Skarn deposit. Full infill and exploration drill results not included in this table, together with cross sections and plans, are available at https://panamericansilver.com/operations/exploration/.

Hole No. |

Type |

From (m) |

To (m) |

Interval (m) |

Ag g/t |

Pb % |

Zn % |

D-05-01-23 |

High grade infill |

984.30 |

1125.95 |

141.65 |

78 |

3.96 |

5.92 |

Include |

|

1057.00 |

1125.95 |

68.95 |

140 |

7.57 |

11.61 |

And |

|

1400.30 |

1597.85 |

197.55 |

51 |

1.83 |

6.87 |

D-16-01-23 |

Infill |

1376.65 |

1549.35 |

172.70 |

58 |

1.55 |

1.79 |

D-93-07-23 |

Infill |

1071.50 |

1431.55 |

360.05 |

53 |

3.68 |

3.43 |

D-93-08-23 |

Infill |

1166.95 |

1495.40 |

328.45 |

71 |

2.57 |

3.79 |

D-93-09-23 |

Infill |

1025.20 |

1357.60 |

332.40 |

144 |

4.11 |

4.78 |

Include |

|

1131.20 |

1221.05 |

89.85 |

461 |

10.63 |

11.05 |

D-96-13-23 |

Infill |

1077.70 |

1517.20 |

439.50 |

72 |

2.13 |

3.27 |

D-96-14-23 |

High grade infill |

1333.85 |

1552.00 |

218.15 |

41 |

1.04 |

2.57 |

D-96-15-23 |

Infill |

1201.25 |

1411.80 |

210.55 |

55 |

3.02 |

4.05 |

U-103-22 |

Infill |

723.35 |

997.30 |

273.95 |

82 |

2.85 |

3.26 |

U-124-22 |

Infill |

446.70 |

726.10 |

279.40 |

45 |

2.75 |

4.60 |

Include |

|

543.55 |

723.15 |

179.60 |

59 |

3.81 |

6.37 |

U-19-23 |

High grade infill |

414.95 |

882.35 |

293.15 |

27 |

0.55 |

3.19 |

Include |

|

825.95 |

882.35 |

56.40 |

31 |

0.09 |

12.86 |

U-28-23 |

Infill |

540.00 |

970.05 |

430.05 |

28 |

1.17 |

4.00 |

U-30-23 |

High grade infill |

666.75 |

818.05 |

151.30 |

38 |

2.31 |

5.98 |

U-43-23 |

High grade infill |

755.20 |

916.30 |

161.10 |

96 |

1.86 |

3.00 |

U-44-23 |

Infill |

513.40 |

954.45 |

441.05 |

25 |

1.12 |

2.97 |

U-70-23 |

Infill |

558.15 |

963.90 |

405.75 |

37 |

1.16 |

2.49 |

All intervals reported over core lengths |

|||||||

Huarón, Peru

The Huarón mine is a polymetallic (Zn-Pb-Ag-Cu) deposit located in the Cerro de Pasco Department of central Peru. Drilling in 2023 focused on brownfield extensions with 71 holes totaling 14,510 metres. Drilling aimed to define new inferred mineral resources on principal structures in the lower portion of the mine (Tapada vein) as well as the near surface Horizonte zone, an emerging shallow multiple vein system southwest of the core mine area. A large portion of the new resources is defined by sill development (development on the vein structure) in the Cuerpo Andres, Maria, Lucero and other splays southeast of the main mine.

Of the 11 drill holes totaling 1,730 metres completed on the Tapada vein, four holes are extension holes that define high-grade areas, now drilled at roughly 45 to 50 metre spacing. The drilling in 2023 confirms extension of mineralisation above level 0 (4,000 masl) and for at least 50 metres below the deepest mine development drift. The Tapada zone remains open to depth, and to the east and west where current drilling continues to test further vein extensions.

In the Horizonte zone, 21 holes covering 5,545 metres were drilled. Intercepts from 10 drill holes within three structures have all returned positive results that will contribute to future resource models.

On the Cuerpo Andres vein, 11 holes covering 3,756 metres were completed with four holes drilled as extensions in the high-grade areas. Drilling at roughly 45 to 50 metre spacing in the Cuerpo Andres zone confirms extension of mineralisation 25 metres below the lowest mine development drift.

Sill development within the main structures in the Horizontes zone has generated positive results that are expected to convert to new resources. Channel sampling using over 350 individual samples within 184 channels over a cumulative strike length of 415 metres of sill development on the Maria splay, Lucero, Cuerpo Andes and Ochentayuno structures averaged 2.92 metres at 246 g/t Ag, 4.9% Pb, 5.7% Zn.

Table 5: Huarón Mine

The following table provides infill and exploration drill result highlights from the medium, lower and Horizonte sectors of the Huarón mine. Full drill and channel sampling results not included in this table, together with cross sections and plans, are available at https://panamericansilver.com/operations/exploration/.

Hole No |

Vein |

Zone |

From (m) |

To (m) |

Interval (m) |

Est. True Width (m) |

Ag g/t |

Cu% |

Pb% |

Zn% |

DDH-U-058-23 |

Cuerpo Andres |

Horizonte |

309.50 |

312.40 |

2.90 |

1.30 |

246 |

0.12 |

5.13 |

3.91 |

DDH-U-061-23 |

Cuerpo Andres |

Horizonte |

38.20 |

39.30 |

1.10 |

0.94 |

261 |

0.01 |

6.40 |

4.36 |

DDH-U-007-23 |

Cuerpo Andres |

Horizonte |

218.05 |

219.20 |

1.15 |

1.09 |

191 |

0.04 |

6.39 |

4.57 |

DDH-U-034-23 |

Cuerpo Andres |

Horizonte |

331.40 |

333.80 |

2.40 |

1.13 |

195 |

0.06 |

3.86 |

2.99 |

DDH-U-007-23 |

Maria Ramal |

Horizonte |

138.35 |

144.00 |

5.65 |

3.55 |

196 |

0.04 |

2.83 |

2.78 |

DDH-U-010-23 |

Maria Ramal |

Horizonte |

125.45 |

128.80 |

3.35 |

2.97 |

133 |

0.04 |

3.27 |

5.11 |

DDH-U-042-23 |

Maria Ramal |

Horizonte |

96.80 |

100.35 |

3.55 |

3.49 |

150 |

0.06 |

3.72 |

8.91 |

DDH-U-045-23 |

Maria Ramal |

Horizonte |

107.20 |

107.90 |

0.70 |

0.60 |

919 |

0.08 |

21.20 |

6.97 |

DDH-U-068-23 |

Cometa Ramal |

Horizonte |

341.40 |

344.50 |

3.10 |

2.78 |

174 |

0.07 |

5.31 |

8.50 |

DDH-U-077-23 |

San Pedro |

Medium |

1.95 |

6.85 |

4.90 |

4.89 |

173 |

0.06 |

2.69 |

4.15 |

DDH-U-032-23 |

Tapada vein |

Lower |

124.20 |

126.00 |

1.80 |

1.00 |

701 |

0.41 |

0.80 |

1.19 |

DDH-U-035-23 |

Tapada vein |

Lower |

113.65 |

123.50 |

9.85 |

7.08 |

453 |

0.56 |

0.74 |

1.75 |

DDH-U-043-23 |

Tapada vein |

Lower |

103.60 |

105.95 |

2.35 |

1.43 |

172 |

1.55 |

0.35 |

2.90 |

DDH-U-047-23 |

Tapada vein |

Lower |

133.95 |

134.70 |

0.75 |

0.46 |

754 |

1.97 |

0.57 |

2.28 |

Timmins Mine (Whitney Project), Canada

The Timmins West and Bell Creek mines, located outside of Timmins, Ontario are Archean orogenic gold deposits associated with greenstone-hosted quartz veins. The Whitney project is located 4.5 kilometres south of the Bell Creek processing plant and adjacent to the Palmour open pit operated by Newmont Corporation. The project is a joint venture (82.5% Pan American / 17.5% Newmont Corporation) in which Pan American is the operator, with historic production, most notably from the Hallnor and Broulan Reef mines, that produced just over 2.3 million ounces of gold. Infill, exploration drilling and technical studies are planned for 2024. The Hallnor zone is referenced in our mineral resource and mineral reserve update as at June 30, 2023 under the name of Whitney.

Drilling in 2022, comprised of 39 holes totaling 7,849 metres, and drilling in 2023, comprised of 26 holes totaling 5,979 metres, tested mineralisation left in both unmined veins and the wall rock of mined stopes in the upper Hallnor zone and Broulan Reef zone 1.5 kilometres west of Hallnor.

Most of the recent drilling at Hallnor targeted areas in the shallow part of the deposit that had previously been the subject of a historic resource estimation calculated based on selective historic sample data. Results from recent drilling confirm historic resource shapes, and in some cases, intersected mineralisation outside of the current resource models. Drilling at Hallnor resumed in the fourth quarter of 2023, after the completion of the Broulan Reef exploration program.

Significant assays from the drilling at Broulan Reef confirm the mineral resources in the upper part of the zone and drill hole TW23-730 intersected mineralisation approximately 50 metres below the historic resource.

Table 6: Timmins Mine (Whitney Project)

The following table provides infill and exploration drill result highlights from the Hallnor and Broulan reef deposits of the Whitney Project. Full infill and exploration drill results not included in this table, together with cross sections and plans, are available at https://panamericansilver.com/operations/exploration/.

Hole No. |

Zone |

From (m) |

To (m) |

Int (m) |

Au g/t |

TW22-719 |

Hallnor |

84.00 |

85.20 |

1.20 |

145.73 |

TW22-712 |

Hallnor |

114.60 |

120.40 |

5.80 |

26.64 |

Incl. |

|

118.10 |

118.60 |

0.50 |

265.00 |

|

|

131.50 |

134.60 |

3.10 |

9.97 |

TW22-705A |

Hallnor |

184.00 |

200.60 |

16.60 |

5.39 |

TW22-709 |

Hallnor |

138.50 |

146.50 |

8.00 |

6.76 |

TW22-694 |

Hallnor |

108.40 |

113.00 |

4.60 |

10.43 |

Incl. |

|

110.00 |

110.50 |

0.50 |

48.60 |

and |

|

112.00 |

113.00 |

1.00 |

19.30 |

TW23-747 |

Broulan Reef |

199.00 |

209.00 |

10.00 |

38.11 |

Incl. |

|

201.00 |

202.00 |

1.00 |

190.00 |

and |

|

203.00 |

204.00 |

1.00 |

12.10 |

and |

|

206.00 |

207.00 |

1.00 |

170.00 |

TW23-740 |

Broulan Reef |

104.00 |

112.00 |

8.00 |

6.39 |

Incl. |

|

105.00 |

106.00 |

1.00 |

38.50 |

TW23-745 |

Broulan Reef |

167.00 |

176.00 |

9.00 |

6.38 |

Incl. |

|

175.00 |

176.00 |

1.00 |

45.10 |

TW23-743 |

Broulan Reef |

120.00 |

129.00 |

9.00 |

3.45 |

TW23-730 |

Broulan Reef |

475.00 |

478.00 |

3.00 |

4.71 |

Incl. |

|

477.00 |

478.00 |

1.00 |

11.40 |

All intervals reported over core lengths |

|

|

|

||

DRILL HOLE COLLAR HIGHLIGHTS

Project |

Hole No. |

Zone |

UTM easting |

UTM northing |

Elevation (masl) |

Azimuth (°) |

Inclination (°) |

Total length (m) |

Jacobina |

JBS00036 |

João Belo Sul |

333,935 |

8,748,542 |

1082.90 |

254.0 |

-45.0 |

330.75 |

Jacobina |

JBS00040 |

João Belo Sul |

333,925 |

8,748,390 |

1109.71 |

273.0 |

-81.0 |

437.15 |

Jacobina |

JBS00041 |

João Belo Sul |

334,200 |

8,749,743 |

1033.06 |

310.0 |

-65.0 |

606.25 |

Jacobina |

JBS00043 |

João Belo Sul |

333,928 |

8,748,394 |

1110.68 |

344.0 |

-72.0 |

511.6 |

Jacobina |

JBS00045 |

João Belo Sul |

334,042 |

8,748,339 |

1140.51 |

253.0 |

-53.0 |

501.2 |

Jacobina |

JBS00048 |

João Belo Sul |

334,147 |

8,748,754 |

1080.06 |

236.0 |

-58.0 |

580 |

Jacobina |

JBS00050 |

João Belo Sul |

334,038 |

8,748,337 |

1140.97 |

273.0 |

-69.0 |

511.1 |

Jacobina |

JBS00053 |

João Belo Sul |

333,930 |

8,748,182 |

1089.21 |

273.0 |

-49.0 |

589.15 |

Jacobina |

MRCEX00004 |

Maricota |

334,744 |

8,756,114 |

946.38 |

235.0 |

-70.0 |

639.75 |

Jacobina |

MRCEX00008 |

Maricota |

334,738 |

8,756,119 |

946.24 |

302.0 |

-66.0 |

644.15 |

Jacobina |

MRCEX00009 |

Maricota |

334,708 |

8,755,724 |

396.77 |

47.8 |

-78.8 |

585.1 |

El Peñon |

SEV0004 |

El Valle |

449,924 |

7,302,273 |

1897.22 |

82.0 |

-71.6 |

329 |

El Peñon |

SIP0040 |

Pampa Campamento(-10), Pampa Campamento |

451,250 |

7,302,449 |

1879.97 |

272.5 |

-72.8 |

681.3 |

El Peñon |

UEP0044 |

Pampa Campamento |

450,702 |

7,302,874 |

1563.52 |

43.0 |

-22.9 |

257.3 |

El Peñon |

UEP0055 |

Pampa Campamento (-35) |

450,933 |

7,302,080 |

1599.69 |

36.0 |

-62.8 |

343.2 |

El Peñon |

UEP0056 |

Pampa Campamento (-35) |

450,932 |

7,302,081 |

1599.69 |

27.0 |

-52.6 |

360.8 |

El Peñon |

UEP0057 |

Pampa Campamento |

450,601 |

7,302,889 |

1360.40 |

58.0 |

-33.2 |

434.2 |

El Peñon |

UEV0031 |

El Valle |

449,970 |

7,302,647 |

1650.96 |

125.0 |

-28.3 |

301.25 |

El Peñon |

UIP0086 |

Pampita, Pampa Campamento Oeste |

450,845 |

7,302,393 |

1626.41 |

66.8 |

-33.0 |

131 |

El Peñon |

UIP0103 |

Pampa Campamento Oeste, Pampita |

450,846 |

7,302,394 |

1626.86 |

46.6 |

-11.1 |

152.3 |

El Peñon |

UIP0105 |

Pampa Campamento |

450,933 |

7,302,081 |

1600.00 |

39.0 |

-51.6 |

380.1 |

El Peñon |

UIP0106 |

Pampita, Pampa Campamento Oeste |

450,862 |

7,302,556 |

1690.20 |

75.8 |

-54.5 |

143.55 |

El Peñon |

UIP0112 |

Pampa Campamento |

450,933 |

7,302,080 |

1599.83 |

56.0 |

-53.6 |

434.5 |

El Peñon |

UIP0113 |

Pampita, Pampa Campamento Oeste, Pampa Campamento |

450,845 |

7,302,391 |

1626.79 |

117.9 |

-13.8 |

176.9 |

El Peñon |

UIP0114 |

Pampa Campamento, Pampa Campamento(-35) |

450,933 |

7,302,080 |

1600.00 |

45.4 |

-53.4 |

392.65 |

El Peñon |

UIP0120 |

Pampita, Pampa Campamento Oeste |

450,862 |

7,302,558 |

1690.02 |

63.2 |

-72.7 |

191.4 |

El Peñon |

UIP0124 |

Pampa Campamento(-35) |

450,933 |

7,302,081 |

1599.70 |

37.6 |

-54.2 |

270.55 |

El Peñon |

UIP0127 |

Pampa Campamento, Pampa Campamento(-35) |

450,933 |

7,302,080 |

1599.68 |

35.4 |

-53.7 |

452.5 |

El Peñon |

UIP0133 |

Pampa Campamento |

450,622 |

7,302,899 |

1385.06 |

82.0 |

-17.1 |

292.1 |

El Peñon |

UIP0135 |

Pampa Campamento |

450,622 |

7,302,899 |

1384.85 |

71.0 |

-28.0 |

299.9 |

El Peñon |

UIP0137 |

Pampa Campamento |

450,621 |

7,302,899 |

1384.69 |

71.0 |

-33.3 |

338.3 |

El Peñon |

UIP0143 |

Pampa Campamento |

450,621 |

7,302,900 |

1384.47 |

62.0 |

-33.3 |

368.6 |

El Peñon |

UIP0145 |

Pampa Campamento |

450,621 |

7,302,900 |

1384.98 |

57.0 |

-18.0 |

275.7 |

El Peñon |

UIP0146 |

Pampa Campamento |

450,621 |

7,302,900 |

1384.74 |

67.0 |

-23.7 |

301.2 |

El Peñon |

UIP0147 |

Sistema Pampa Campamento |

450,931 |

7,302,081 |

1599.83 |

19.0 |

-50.6 |

416.4 |

El Peñon |

UIP0149 |

Pampa Campamento |

450,621 |

7,302,901 |

1385.15 |

50.0 |

-20.7 |

305.3 |

El Peñon |

UIV0050 |

El Valle |

449,970 |

7,302,647 |

1651.50 |

132.0 |

-12.4 |

248.55 |

El Peñon |

UIV0051 |

El Valle |

449,971 |

7,302,647 |

1651.53 |

119.0 |

-8.9 |

256.8 |

El Peñon |

UIV0054 |

El Valle |

449,946 |

7,302,403 |

1752.06 |

99.0 |

-58.6 |

257.8 |

El Peñon |

UIV0056 |

El Valle |

449,969 |

7,302,647 |

1651.77 |

150.0 |

-6.7 |

275.5 |

El Peñon |

UIP0119 |

Pampa Campamento |

450,933 |

7,302,081 |

1599.63 |

37.7 |

-50.2 |

391.05 |

La Colorada Mine |

S-102-23(1) |

|

5,772 |

5,501 |

2539.96 |

342.1 |

-60.4 |

758.1 |

La Colorada Mine |

S-105-23(1) |

|

5,806 |

5,769 |

2591.43 |

315.4 |

-76.3 |

680.3 |

La Colorada Mine |

S-115-23(1) |

|

5,773 |

5,499 |

2543.26 |

342.2 |

-65.7 |

761.1 |

La Colorada Mine |

S-123-23(1) |

|

5,772 |

5,501 |

2539.81 |

334.7 |

-53.0 |

793.3 |

La Colorada Mine |

S-73-23(1) |

|

5,773 |

5,501 |

2539.92 |

327.7 |

-61.2 |

713.1 |

La Colorada Mine |

S-84-23(1) |

|

5,773 |

5,501 |

2539.93 |

331.0 |

-55.3 |

747.7 |

La Colorada Mine |

S-95-23(1) |

|

5,807 |

5,769 |

2592.53 |

346.5 |

-80.8 |

761.2 |

La Colorada Mine |

U-106-23(1) |

|

5,328 |

5,537 |

1998.97 |

324.4 |

-71.2 |

380.6 |

La Colorada Mine |

U-114-23(1) |

|

5,332 |

5,538 |

1999.58 |

39.7 |

-3.7 |

392.6 |

La Colorada Mine |

U-31-23(1) |

|

5,327 |

5,538 |

2000.39 |

302.9 |

13.9 |

271.15 |

La Colorada Mine |

U-38-23(1) |

|

5,327 |

5,539 |

2000.34 |

301.0 |

14.7 |

238 |

La Colorada Mine |

U-47-23(1) |

|

4,295 |

4,764 |

1897.24 |

335.6 |

-58.5 |

218.7 |

La Colorada Mine |

U-49-23(1) |

|

5,328 |

5,538 |

2000.12 |

328.6 |

16.8 |

308 |

La Colorada Mine |

U-53-23(1) |

|

5,328 |

5,539 |

2000.69 |

329.6 |

23.8 |

299.7 |

La Colorada Mine |

U-56-23(1) |

|

5,331 |

5,539 |

1998.28 |

44.7 |

-46.2 |

368.3 |

La Colorada Mine |

U-75-23(1) |

|

5,328 |

5,538 |

2001.06 |

339.8 |

26.4 |

293.7 |

La Colorada Mine |

U-77-23(1) |

|

5,332 |

5,538 |

1998.75 |

45.9 |

-36.2 |

371.7 |

La Colorada Mine |

U-83-23(1) |

|

5,332 |

5,538 |

1998.56 |

35.9 |

-39.9 |

278.4 |

La Colorada Skarn |

D-05-01-23(1)(2) |

Infill |

4,623 |

5,603 |

2578.40 |

153.7 |

-76.7 |

1045.25 |

La Colorada Skarn |

D-16-01-23(1)(2) |

Infill |

4,751 |

5,590 |

2612.00 |

233.8 |

-87.5 |

1114.8 |

La Colorada Skarn |

D-93-07-23(1)(2) |

Infill |

4,926 |

5,166 |

2469.70 |

279.1 |

-80.7 |

831.05 |

La Colorada Skarn |

D-93-08-23(1)(2) |

Infill |

4,926 |

5,166 |

2469.70 |

326.0 |

-71.4 |

820.45 |

La Colorada Skarn |

D-93-09-23(1)(2) |

Infill |

4,926 |

5,166 |

2469.70 |

255.1 |

-69.7 |

806.75 |

La Colorada Skarn |

D-96-13-23(1)(2) |

Infill |

4,655 |

5,286 |

2506.40 |

90.9 |

-80.3 |

926.85 |

La Colorada Skarn |

D-96-14-23(1)(2) |

High Grade Ext. |

4,655 |

5,286 |

2506.40 |

261.6 |

-88.0 |

851.25 |

La Colorada Skarn |

D-96-15-23(1)(2) |

Infill |

4,655 |

5,286 |

2506.40 |

128.9 |

-66.6 |

898.2 |

La Colorada Skarn |

U-103-22(1) |

Infill |

4,496 |

5,332 |

2073.50 |

72.6 |

-76.8 |

1139.3 |

La Colorada Skarn |

U-124-22(1) |

Geotech |

5,259 |

5,417 |

2003.60 |

95.6 |

-76.7 |

736 |

La Colorada Skarn |

U-19-23(1) |

High Grade Ext. |

4,496 |

5,332 |

2070.50 |

67.7 |

-85.1 |

1157.9 |

La Colorada Skarn |

U-28-23(1) |

Infill |

4,843 |

5,324 |

1995.50 |

303.0 |

-84.3 |

1079 |

La Colorada Skarn |

U-30-23(1) |

High Grade Ext. |

4,495 |

5,333 |

2070.60 |

43.5 |

-81.8 |

1169.25 |

La Colorada Skarn |

U-43-23(1) |

High Grade Ext. |

4,495 |

5,333 |

2070.60 |

107.4 |

-84.5 |

1176.7 |

La Colorada Skarn |

U-44-23(1) |

Infill |

4,845 |

5,324 |

1998.30 |

305.0 |

-86.0 |

1110.65 |

Huaron |

DDH-U-007-23 |

Cuerpo Andres |

344,775 |

8,781,772 |

4492.05 |

182.5 |

-48.5 |

272 |

Huaron |

DDH-U-010-23 |

Maria Ramal |

344,774 |

8,781,772 |

4492.50 |

181.2 |

-26.0 |

154.55 |

Huaron |

DDH-U-032-23 |

Tapada |

343,781 |

8,781,868 |

4083.23 |

335.2 |

-37.8 |

155.15 |

Huaron |

DDH-U-034-23 |

Cuerpo Andres |

344,774 |

8,781,772 |

4490.74 |

162.2 |

-65.3 |

379 |

Huaron |

DDH-U-035-23 |

Tapada |

343,786 |

8,781,872 |

4083.83 |

19.5 |

-29.5 |

135 |

Huaron |

DDH-U-042-23 |

Maria Ramal |

344,769 |

8,781,773 |

4491.65 |

225.1 |

-28.7 |

150.55 |

Huaron |

DDH-U-043-23 |

Tapada |

343,786 |

8,781,873 |

4082.90 |

6.0 |

-40.1 |

162 |

Huaron |

DDH-U-045-23 |

Maria Ramal |

344,770 |

8,781,774 |

4491.66 |

226.3 |

-43.1 |

158.25 |

Huaron |

DDH-U-047-23 |

Tapada |

343,782 |

8,781,868 |

4083.88 |

322.0 |

-33.9 |

185.4 |

Huaron |

DDH-U-058-23 |

Cuerpo Andres |

344,774 |

8,781,771 |

4493.28 |

194.6 |

23.6 |

334.75 |

Huaron |

DDH-U-061-23 |

Cuerpo Andres |

344,566 |

8,781,627 |

4475.82 |

217.5 |

-42.7 |

365.8 |

Huaron |

DDH-U-068-23 |

Cuerpo Andres |

344,567 |

8,781,627 |

4475.83 |

204.6 |

-46.7 |

375.1 |

Huaron |

DDH-U-077-23 |

San Pedro Ramal |

343,716 |

8,782,756 |

4344.77 |

247.7 |

13.2 |

280.7 |

Timmins |

TW23-730 |

Broulan Reef |

487,549 |

5,372,880 |

288.95 |

335.0 |

-55.0 |

546 |

Timmins |

TW23-740 |

Broulan Reef |

487,043 |

5,373,060 |

292.30 |

335.0 |

-55.0 |

141 |

Timmins |

TW23-743 |

Broulan Reef |

487,167 |

5,373,033 |

291.64 |

335.0 |

-45.0 |

136 |

Timmins |

TW23-745 |

Broulan Reef |

487,167 |

5,373,032 |

291.72 |

335.0 |

-66.0 |

231 |

Timmins |

TW23-747 |

Broulan Reef |

487,219 |

5,373,015 |

291.59 |

335.0 |

-50.0 |

231 |

Timmins |

TW22-694 |

Hallnor |

489,063 |

5,373,543 |

284.00 |

335.0 |

-45.0 |

138 |

Timmins |

TW22-705A |

Hallnor |

489,176 |

5,373,525 |

287.00 |

333.0 |

-53.0 |

240 |

Timmins |

TW22-709 |

Hallnor |

489,061 |

5,373,463 |

285.00 |

333.0 |

-53.0 |

210 |

Timmins |

TW22-712 |

Hallnor |

488,951 |

5,373,462 |

284.00 |

333.0 |

-62.0 |

141 |

Timmins |

TW22-719 |

Hallnor |

488,893 |

5,373,455 |

285.00 |

333.0 |

-59.0 |

117 |

(1) La Colorada drill hole collar coordinates based on a local grid format. |

||||||||

(1)(2) Drill holes started downhole - see detailed collar table for more information. |

||||||||

General Notes with Respect to Technical Information

Grades are shown as contained metal before mill recoveries are applied. The Company has undertaken a verification process with respect to the data disclosed in this news release.

The mineral resource and mineral reserves databases compiling drilling and, in some cases, sampling, have been accumulated at each of Pan American mine sites by the qualified staff.

Samples are analyzed at a variety of laboratories, including by in-house staff at the mine (Jacobina and La Colorada), mine laboratories operated by third party independent commercial labs (Huarón), and commercial laboratories off-site (Timmins, El Peñon and Jacobina ). All the assay data reported in this news release has been subjected to the industry standard quality assurance and quality control ("QA/QC") program including the submission of certified standards, blanks, and duplicate samples. The results are reviewed on a monthly and quarterly basis by management. In general, the assay analytical technique for silver, lead, zinc and copper is acid digestion with either ICP or atomic absorption finish. The analytical technique for gold uses fire assay and atomic absorption spectrometry (AAS) finish. A gravimetric finish would be used if the gold assay exceeds > 10 g/t (or >5 g/t at El Peñon). The results of the QA/QC samples submitted for the resource databases demonstrate acceptable accuracy and precision. The offsite commercial laboratories are independent from Pan American and certified by ISO 17025:2017.

The Qualified Person is of the opinion that the sample preparation, analytical, and security procedures followed for the samples are sufficient and reliable for the purpose of this news release and for the purpose of any future mineral resource and mineral reserve estimates. There were no limitations on the Qualified Persons' verification process. Pan American is not aware of any drilling, sampling, recovery or other factors that could materially affect the accuracy or reliability of the data reported herein.

Mineral resources and mineral reserves are as defined by the Canadian Institute of Mining, Metallurgy and Petroleum.

Mineral Resources that are not Mineral Reserves have no demonstrated economic viability. No mineral reserves have yet been estimated for the Skarn deposit.

See the Company’s Annual Information Form dated February 22, 2023, available at www.sedarplus.com, or Pan American's most recent Form 40-F filed with the United States Securities and Exchange Commission (the "SEC") for further information on the Company’s material mineral properties prior to the completion of the acquisition of Yamana Gold Inc. (“Yamana”), including detailed information concerning associated QA/QC and data verification matters, the key assumptions, parameters and methods used by the Company to estimate mineral reserves and mineral resources, and for a detailed description of known legal, political, environmental, and other risks that could materially affect the Company’s business and the potential development of the Company’s mineral reserves and mineral resources. For further information about the material mineral projects acquired pursuant to the acquisition of Yamana, please refer to Yamana’s Annual Information Form dated March 29, 2023, filed at www.sedarplus.ca, or Yamana’s most recent Form 40-F filed with the SEC.

Technical information contained in this news release with respect to Pan American has been reviewed and approved by Christopher Emerson, FAusIMM, Vice President Exploration and Geology, and Martin Wafforn, P.Eng., Senior Vice President Technical Services and Process Optimization, each of whom is a Qualified Person for the purposes of National Instrument 43-101 - Standards of Disclosure for Mineral Projects (‘‘NI 43-101’’). Pan American Silver Corp is authorized by The Association of Professional Engineers and Geoscientists of the Province of British Columbia to engage in Reserved Practice under Permit to Practice number 1001470.

Cautionary Note to US Investors

This news release has been prepared in accordance with the requirements of Canadian NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards, which differ from the requirements of U.S. securities laws. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects.

Canadian public disclosure standards, including NI 43-101, differ significantly from the requirements of the SEC, and information concerning mineralization, deposits, mineral reserve and resource information contained or referred to herein may not be comparable to similar information disclosed by U.S. companies. The requirements of NI 43-101 for identification of ”reserves” are not the same as those of the SEC, and mineral reserves reported by the Company in compliance with NI 43-101 may not qualify as ”reserves” under SEC standards. Under U.S. standards, mineralization may not be classified as a ”reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made.

About Pan American

Pan American Silver is a leading producer of precious metals in the Americas, operating silver and gold mines in Canada, Mexico, Peru, Bolivia, Argentina, Chile and Brazil. We also own the Escobal mine in Guatemala that is currently not operating, and we hold interests in exploration and development projects. We have been operating in the Americas for nearly three decades, earning an industry-leading reputation for sustainability performance, operational excellence and prudent financial management. We are headquartered in Vancouver, B.C. and our shares trade on the New York Stock Exchange and the Toronto Stock Exchange under the symbol "PAAS".

Learn more at panamericansilver.com

Follow us on LinkedIn

Cautionary Note Regarding Forward-Looking Statements and Information

Certain of the statements and information in this news release constitute "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian provincial securities laws. All statements, other than statements of historical fact, are forward-looking statements or information. Forward-looking statements or information in this news release relate to, among other things: the extent of, and success related to any future exploration or development programs, including with respect to its Jacobina, El Peñon, La Colorada, Huaron and Timmins properties and for its La Colorada Skarn project; expectations regarding testing from surface and underground drilling stations; an initial mineral resource estimate for Maricota in 2024; and release of an initial economic study of the La Colorada Skarn project in the fourth quarter of 2023.

These forward-looking statements and information reflect Pan American’s current views with respect to future events and are necessarily based upon a number of assumptions that, while considered reasonable by Pan American, are inherently subject to significant operational, business, economic and regulatory uncertainties and contingencies. These assumptions include: tonnage of ore to be mined and processed; ore grades and recoveries; prices for silver, gold and base metals remaining as estimated; currency exchange rates remaining as estimated; capital, decommissioning and reclamation estimates; our mineral reserve and resource estimates and the assumptions upon which they are based; prices for energy inputs, labour, materials, supplies and services (including transportation); no labour-related disruptions at any of our operations; no unplanned delays or interruptions in scheduled production; all necessary permits, licenses and regulatory approvals for our operations are received in a timely manner; our ability to secure and maintain title and ownership to properties and the surface rights necessary for our operations; and our ability to comply with environmental, health and safety laws. The foregoing list of assumptions is not exhaustive.

Pan American cautions the reader that forward-looking statements and information involve known and unknown risks, uncertainties and other factors that may cause actual results and developments to differ materially from those expressed or implied by such forward-looking statements or information contained in this news release and Pan American has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: fluctuations in silver, gold and base metal prices; fluctuations in prices for energy inputs, labour, materials, supplies and services (including transportation); fluctuations in currency markets (such as the PEN, MXN, ARS, BOB, GTQ, CAD, CLP, and BRL versus the USD); operational risks and hazards inherent with the business of mining (including environmental accidents and hazards, industrial accidents, equipment breakdown, unusual or unexpected geological or structural formations, cave-ins, flooding and severe weather); risks relating to the credit worthiness or financial condition of suppliers, refiners and other parties with whom Pan American does business; inadequate insurance, or inability to obtain insurance, to cover these risks and hazards; employee relations; relationships with, and claims by, local communities and indigenous populations; our ability to obtain all necessary permits, licenses and regulatory approvals in a timely manner; changes in laws, regulations and government practices in the jurisdictions where we operate, including environmental, export and import laws and regulations; changes in national and local government, legislation, taxation, controls or regulations and political, legal or economic developments, including legal restrictions relating to mining, risks relating to expropriation, and risks relating to the constitutional court-mandated ILO 169 consultation process in Guatemala; diminishing quantities or grades of mineral reserves as properties are mined; increased competition in the mining industry for equipment and qualified personnel; the duration and effects any pandemics on our operations and workforce; and those factors identified under the caption "Risks Related to Pan American's Business" in Pan American's most recent form 40-F and Annual Information Form filed with the United States Securities and Exchange Commission and Canadian provincial securities regulatory authorities, respectively, and those factors identified under the caption “Risks of the Business” in Yamana’s most recent form 40-F and Annual Information Form filed with the United States Securities and Exchange Commission and Canadian provincial securities regulatory authorities, respectively. Although Pan American has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, described or intended. Investors are cautioned against undue reliance on forward-looking statements or information. Forward-looking statements and information are designed to help readers understand management's current views of our near and longer term prospects and may not be appropriate for other purposes. Pan American does not intend, nor does it assume any obligation to update or revise forward-looking statements or information, whether as a result of new information, changes in assumptions, future events or otherwise, except to the extent required by applicable law.

View source version on businesswire.com: https://www.businesswire.com/news/home/20231204487421/en/

Contacts

For more information:

Siren Fisekci

VP, Investor Relations & Corporate Communications

Ph: 604-806-3191

Email: ir@panamericansilver.com

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.