Financial News

More Than Half of Teens Think Investing Is Too Confusing; Fidelity Shares Resources to Help Parents Have “The Talk”

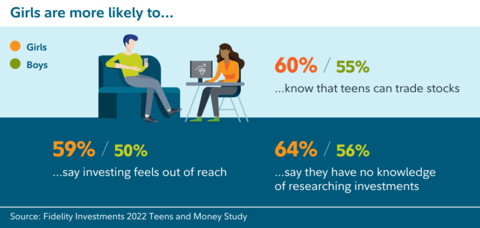

Fidelity Study Finds Teen Girls Are Less Likely to Discuss Investing with Parents

To Help Kickstart Family Conversations, Fidelity Offers New Conversation Guide; Teens Can Then “Learn by Doing” with the Fidelity Youth Account

As part of its ongoing efforts to engage the next generation, Fidelity Investments® today released results of the 2022 Teens and Money Study, revealing that while seven-in-ten teens look up to family members as financial role models, only a third (34%) say that their family regularly talks about investing. What’s more, nearly half say investing “feels out of reach” and only one-in-five teens say they’ve started investing. In fact, many teens mistakenly believe that they can’t trade stocks, according to the study which examines how young people ages 13-17 approach their finances.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220607005350/en/

Fidelity study reveals gender gap in teens and money (Graphic: Business Wire)

Parent-teen conversations about money play a powerful role when it comes to boosting knowledge and confidence; in fact, teens who have talked to their parents about investing are more than twice as likely to say they feel confident about financial topics, and much less likely to feel investing is out of reach. To combat these myths and encourage families to make “money talk” a bigger part of parent-teen relationships, Fidelity developed a new conversation guide to accompany the Fidelity Youth Account, the first-of-its-kind brokerage account that puts saving, spending, and investing decisions into the hands of teens.

“We know that parents help give teens the confidence they crave when it comes to money,” said John Boroff, vice president, Youth Investing at Fidelity Investments. “In fact, teens who have talked to their parents about investing are more likely to have a checking or savings account, talk about investing with friends or teachers, and ultimately start investing. The Fidelity Youth account can help jumpstart these conversations and provide real-world money experience, but it’s critical that parents be ready to have the talk with their teens.”

While typical rites of passage like getting a job, cell phone, or bank account continue to be a big part of teen life, increasingly young people see investing in their future. In fact, of those teens who think about financial topics but do not currently invest, 91% say they will start investing at some point, with more than two-thirds planning to do so before graduating college.

Troublingly, teen girls report lower levels of engagement and confidence with investing, despite being more likely to know that teens can in fact trade stocks. This demonstrates the need for parents to review how they frame investing and money management conversations with their teens, being sure to encourage an interest in financial topics among all children.

“Getting women more engaged with their finances has been a longstanding priority for Fidelity, and the urgency only grows as we see how early the gender gap starts to take root when it comes to investing,” said Kelly Lannan, senior vice president, Emerging Customers at Fidelity. “We know that when women do invest, they have done quite well1. Teen girls have unlimited power in their hands when it comes to building a strong financial future, especially if they get started saving and investing at an early age.”

Family continues to be a recurring theme in the way that Black, Hispanic, and Asian American Pacific Islander communities approach finances; members of these communities have shared with Fidelity2 that not only did their parents instill the importance of financial stability, frugality, and savings, but that advice from older generations has adapted over time to meet their current environment. While systemic barriers to intergenerational wealth exist, parents can make an important contribution to their teens’ futures by talking openly, honestly, and often about money. For example, Black teens are not only more likely than white teens to say they have talked to their parents about investing (51% vs. 44%) but are also more likely to feel confident when thinking about financial topics (31% vs. 21%). Hispanic teens are also leaning into financial topics, with 49% having talked to their parents about investing and 25% feeling confident about financial topics.

The study reveals other bright spots when it comes to the next generation of investors: nearly half of teens (45%) say they expect to be or already are "in it for the long-haul" when it comes to investing. Additionally, nearly three-quarters (73%) say they’ve started educating themselves on trading and investing.

While less than a quarter of teens overall say they feel “confident” about financial topics, that number increases to one-third among those who talk to their parents about investing. To help teens prepare for their future as investors, parents can incorporate financial conversations into everyday life and provide teens with experiences designed to practice what they’ve learned. Teens demonstrate readiness to take the next step, with nine-in-ten saying it would be helpful to have access to an investing option for teens with no minimum to open an account3.

To help teens and parents along their investing journey, Fidelity offers:

- The Fidelity Youth Account, an award-winning4 brokerage account for teens, includes educational content about saving, spending, and investing in the Youth Learning Center within the app. For a limited time when parents open a Fidelity Youth Account for their teen, they will get a $50 reward. Terms apply.

- A new conversation guide to make money a positive part of daily family discussions.

- Webinars designed for teens and parents to join together, including the recent “Getting a head start: investing for teens and parents” session.

- A Teens and Money learning path with comprehensive content including articles on saving and budgeting and investing basics, and the free online game Five Money Musts.

- Viewpoints articles including Investing basics for teens (five tips to introduce your teens to investing) and Be a great money role model (six tips to help parents avoid common money mistakes with kids and teens).

- A collaboration with The FIVE Network that provides thousands of diverse youth ages 13-17 across 25+ states with an online financial services curriculum, mentorship with members of Fidelity’s Affinity groups focused on engaging Black, Latin, and young professionals, and an introduction to the Fidelity Youth Account to apply what they’ve learned.

- A presence on Reddit, TikTok, and other social channels where teens can easily engage with Fidelity on financial topics.

About the Fidelity Investments 2022 Teens and Money Study

This study presents the findings of an online sample of 2,014 13-17 year-olds. Respondents for this survey were selected from among those who have volunteered to participate in online surveys and polls. Interviewing for this Youth CARAVAN survey was conducted April 19-26, 2022 by ENGINE INSIGHTS, which is not affiliated with Fidelity Investments. The results of this survey may not be representative of all respondents meeting the same criteria as those surveyed for this study. The margin of error is +/- 2.18% at a 95% confidence level.

About Fidelity Investments

Fidelity’s mission is to inspire better futures and deliver better outcomes for the customers and businesses we serve. With assets under administration of $10.5 trillion, including discretionary assets of $4.0 trillion as of April 30, 2022, we focus on meeting the unique needs of a diverse set of customers. Privately held for over 75 years, Fidelity employs more than 58,000 associates who are focused on the long-term success of our customers. For more information about Fidelity Investments, visit https://www.fidelity.com/about-fidelity/our-company.

Important Information

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

Fidelity Investments and Fidelity are registered service marks of FMR LLC.

Fidelity Brokerage Services LLC, Member NYSE, SIPC,

900 Salem Street, Smithfield, RI 02917

Fidelity Distributors Company LLC,

500 Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC,

245 Summer Street, Boston, MA 02110

1032690.1.0

© 2022 FMR LLC. All rights reserved.

Follow us on Twitter @FidelityNews

Visit About Fidelity and our newsroom

Subscribe to emailed news from Fidelity

1 Analysis of the investing behavior of Fidelity retail customers, comparing the annualized return of assets of 5.2 million self-directed retail accounts from Jan 2011 – Dec 2020

2 Fidelity Investments Customer Inclusion Team qualitative study from June – August 2021

3 Zero account minimums apply to retail brokerage accounts only. Account minimums may apply to certain account types (e.g., managed accounts) and/or the purchase of some Fidelity mutual funds that have a minimum investment requirement. See Fidelity.com/commissions and/or the fund's prospectus for details.

4 Fidelity Youth Account was awarded #1 Innovation and New Tool and received multiple star ratings in the Stockbrokers.com 2022 Online Broker Review. Read our review. By clicking this link you are leaving Fidelity.com for another website. The site owner is not affiliated with Fidelity and is solely responsible for the information and services it provides. Fidelity disclaims any liability arising from your use of such information or services. Review the new site’s terms, conditions, and privacy policy, as they will be different from those of Fidelity’s sites.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220607005350/en/

Contacts

Contact for Media Only:

Corporate Communications

(617) 563-5800

FidelityMediaRelations@fmr.com

Deanna Spaulding

(617) 563-8359

Deanna.Spaulding@fmr.com

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.