Financial News

Satisfaction with Big 5 Banks in Canada Declines as Satisfaction with Midsize Banks Improves, J.D. Power Finds

RBC Royal Bank and Tangerine Bank Rank Highest in Respective Segments

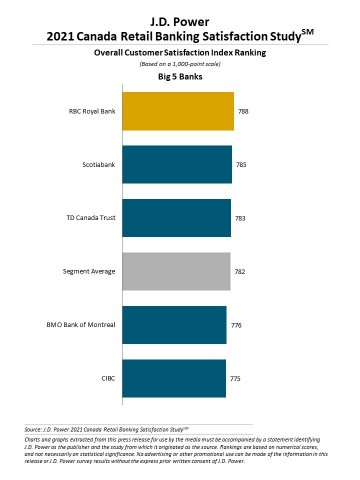

Overall satisfaction among bank customers in Canada declined year over year, especially among customers of Big 5 banks, according to the J.D. Power 2021 Canada Retail Banking Satisfaction Study,SM released today. Overall satisfaction of 787 (on a 1,000-point scale) is down from 790 in 2020, driven by a satisfaction decline of 6 points among customers of Big 5 Banks. In stark contrast, midsize banks improve 12 points in overall satisfaction from a year ago.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210511005007/en/

J.D. Power 2021 Canada Retail Banking Satisfaction Study (Photo: Business Wire)

As many customers were affected by the pandemic, problem resolution emerged as the factor with the greatest decline, dropping 39 points among customers of Big 5 Banks and decreasing 10 points among customers of midsize banks. Other factors that contributed to the industry-wide decline in satisfaction include lack of convenience (-4) and issues around products and fees (-4).

“Nearly four in 10 customers have been financially affected by the pandemic,” said John Cabell, director of banking and payments intelligence at J.D. Power. “The subsequent financial insecurity leads to lower trust and satisfaction, especially around understanding of fees, which trigger disputes and dissatisfaction. If banks want to turn the tide, they should focus on improving interactions with customers, communicating proactively, providing advice and showing support.”

According to the study, 47% of customers felt their bank completely supported them during the pandemic, significantly lower than the 63% of U.S. customers who said they felt supported by their bank. In Canada, the satisfaction level of customers who felt supported by their banks is 132 points higher than those who did not feel supported or only felt partially supported.

Following are additional key findings of the 2021 study:

- Advice lifts customers who were hurt financially: Customers whose financial outlook is worse off than a year ago have overall satisfaction 51 points lower than those who feel they are financially better off. However, worse-off customers who say they received financial advice from their bank in the past year have overall satisfaction that is 71 points higher than those who received no advice—a real benefit that banks can more fully realize in a challenging economy.

- Pandemic pushed digital banking upward: Not surprisingly, the pandemic pushed more customers to utilize digital channels for interacting with their bank, as the percentage of customers moving to digital-only banking rises to 55% from 38% a year ago. Furthermore, high digital engagement among customers is associated with a 25-point increase in satisfaction. This further emphasizes the banks’ need to stay on top of technology advancements and evolve current offerings to meet customer needs.

- Physical branches still matter: Although the number of branch-dependent customers dropped during the pandemic to 23% from 38% and branch incidence also dropped to 41% from 59%, those who visited a bank branch had higher overall satisfaction (+8), trust (+19) and brand advocacy (+7) for their bank than those who did not visit a branch.

Study Rankings

RBC Royal Bank ranks highest in satisfaction among Big 5 Banks for a second consecutive year, with a score of 788. Scotiabank (785) ranks second and TD Canada Trust (783) ranks third.

Tangerine Bank ranks highest among midsize banks for a 10th consecutive year, with a score of 840. Simplii Financial (813) ranks second and ATB Financial (811) ranks third.

The Canada Retail Banking Satisfaction Study, now in its 16th year, measures customer satisfaction with Canada’s large and midsize banks. The scores reflect satisfaction among the entire retail banking customer pool of these banks, representing a broader group of customers than solely the branch-dependent and digital-centric segments.

The study measures customer satisfaction in six factors (listed in alphabetical order): channel activities; communication/advice; convenience; new account opening; problem resolution; and products/fees.

Channel activities include seven sub-factors (listed in alphabetical order): assisted online service; ABM; branch service; call centre service; IVR/automated phone service; mobile banking; and online banking. The study is based on responses from 14,521 retail banking customers of Canada’s largest and midsize banks regarding their experiences with their bank. It was fielded from July 2020 through January 2021.

For more information about the 2021 Canada Retail Banking Satisfaction Study, visit https://canada.jdpower.com/financial-services/canada-retail-banking-satisfaction-study.

See the online press release at http://www.jdpower.com/pr-id/2021045.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power is headquartered in Troy, Mich., and has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business.

About J.D. Power and Advertising/Promotional Rules: http://www.jdpower.com/business/about-us/press-release-info

View source version on businesswire.com: https://www.businesswire.com/news/home/20210511005007/en/

Contacts

Gal Wilder, Cohn & Wolfe; 416-602-4092; gal.wilder@cohnwolfe.ca

Nicole Herback, Cohn & Wolfe; 403-200-1187; nicole.herback@cohnwolfe.ca

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.