Financial News

2 Stocks to Buy as Microsoft Announces Its New Maia 200 AI Chip (Hint, Neither Is MSFT)

Microsoft’s (MSFT) ambitions to achieve an end-to-end AI infrastructure received a boost when they announced Maia 200, an inference accelerator that will help the company deploy AI at scale. The new chip is built on TSMC’s (TSM) 3nm process and is the most efficient inference system the Windows maker has ever deployed, offering 30% better performance per dollar than the existing infrastructure.

As a reaction to the news, BNP Paribas came out with a list of stocks that could benefit from this major development. Among these stocks, two caught our eye: Broadcom (AVGO) and Marvell (MRVL). This is a classic pick-and-shovel play. Broadcom and Marvell are the two biggest names when it comes to custom chipmaking. Irrespective of whether Microsoft is able to profitably deploy AI at scale, these two benefit. In fact, if Microsoft fails, it is more likely that some other hyperscaler will require the same services from these two companies.

Maia 200 deployments are set to be executed in the second half of the calendar year. If all goes well, that’s when these two companies will see the impact of these new chips on their financial statements.

AI Stock #1: Broadcom (AVGO)

Broadcom is an industry leader when it comes to making complex custom chips for AI workloads. In the past, it has developed chips in collaboration with Google and META as well. The company is headquartered in Palo Alto, California.

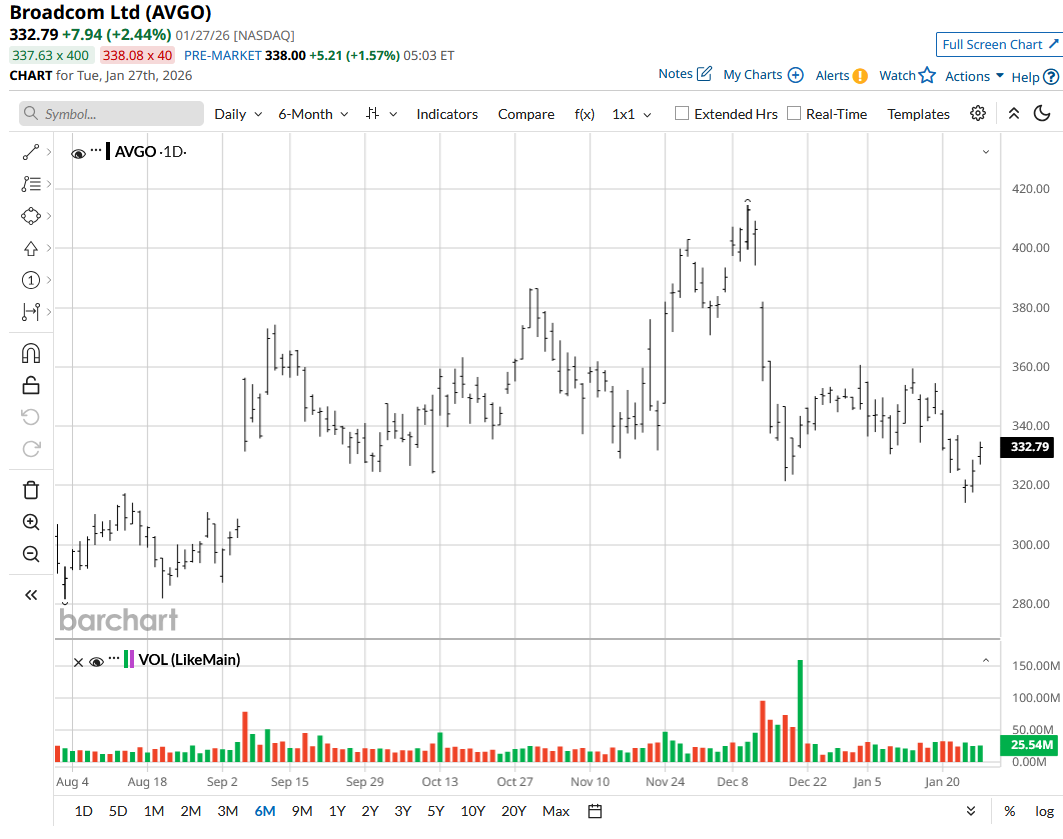

After a poor start to the year, AVGO is down about 3% year-to-date (YTD); the company’s stock is finally picking up pace. The Maia 200 developments are likely going to help it catch up to the iShares Semiconductor ETF (SOXX), which has already gained 18% so far this month.

Broadcom’s forward P/E went up significantly at the end of its previous fiscal quarter, but it now trades at a forward P/E of 33.22x. The Price to Sales ratio has similarly dropped to a more reasonable 25.28x. This is partly due to the recent stock price dip. It may not be fair to say that the stock is undervalued. However, if there was ever a time to ‘buy the dip’ on Broadcom, it is now, as the firm is trading 20% off its 52-week highs.

On the earnings call on Dec 11, Broadcom had announced that it had secured a fifth customer for its custom AI chips. It is quite possible that the company was referring to Microsoft. For context, it has already secured large orders from Alphabet (GOOG) (GOOGL), Meta (META), ByteDance, and Anthropic. Broadcom already has a $73 billion backlog, which should keep it busy for the next 18 months. Microsoft’s custom chip plans will keep the company even busier, but shareholders aren’t complaining.

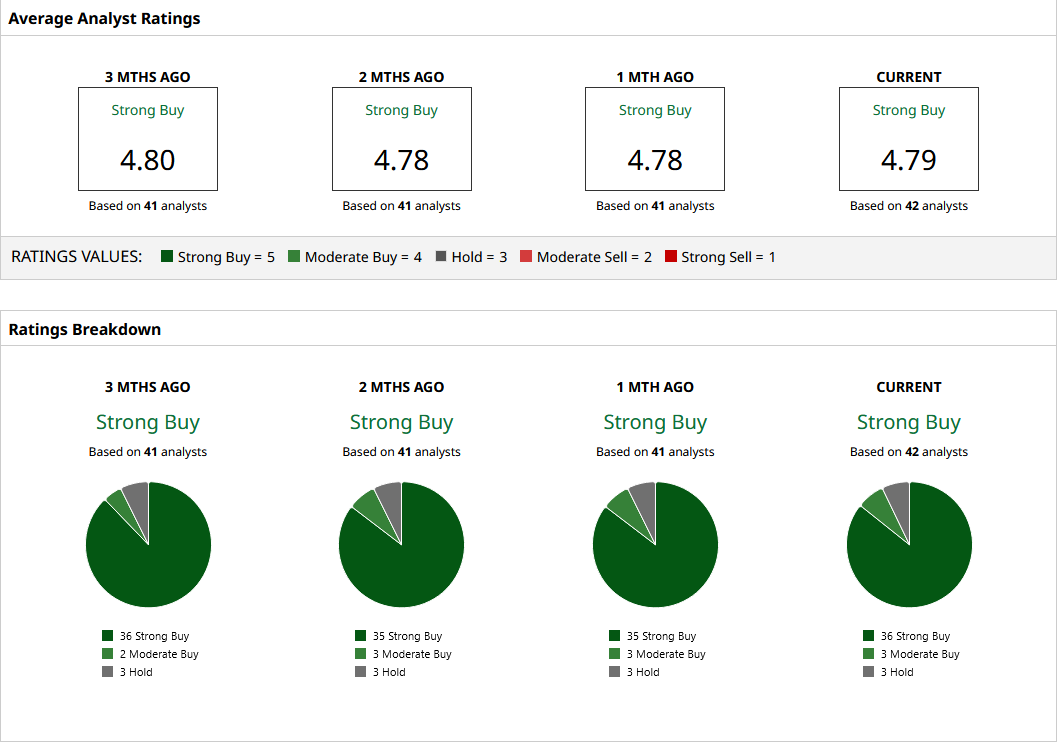

It is not surprising that 36 out of 42 analysts on Wall Street have a “Strong Buy” rating on the stock. The mean target price, according to these analysts, currently stands at $455.22, offering 34% further upside. One can reasonably expect this to go up in the coming days as analysts figure out the financial impact of the Microsoft developments.

AI Stock #2: Marvell Technology (MRVL)

Marvell Technology is a fabless semiconductor company with a global presence. It makes custom AI accelerators, just like the Maia 200 chip that Microsoft intends to make for its AI workloads. Apart from the chips, the company also sells software and networking equipment, especially to data centers.

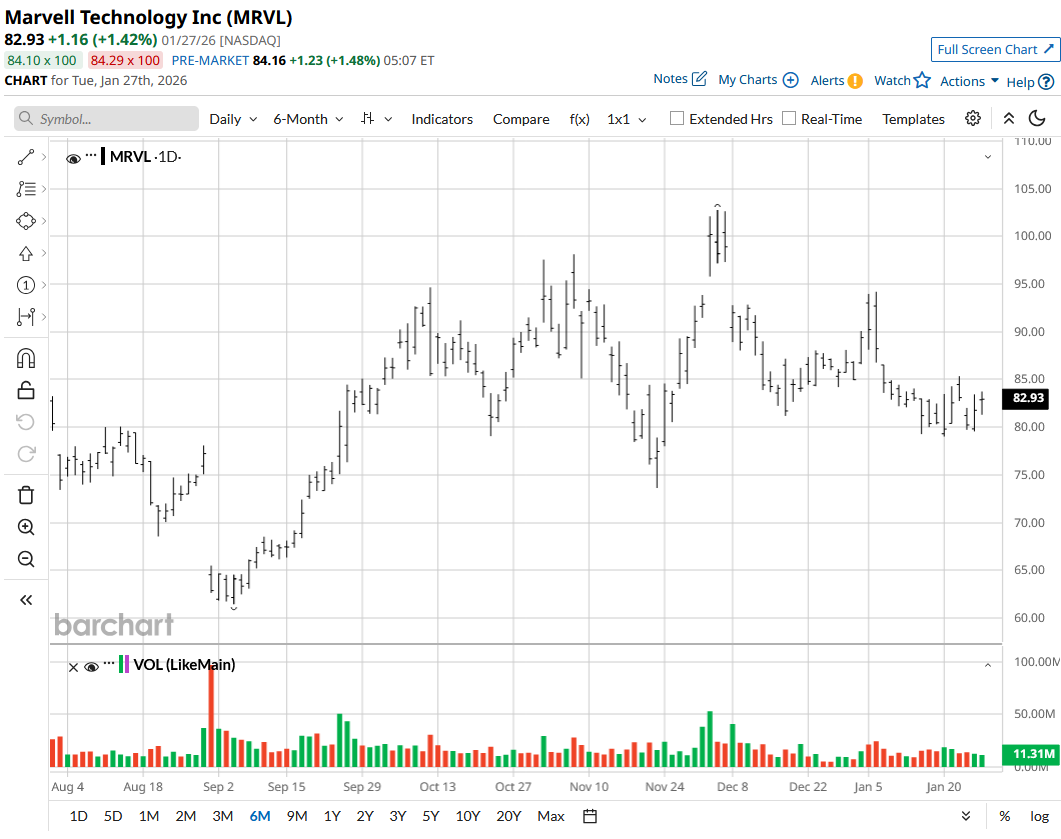

One-year returns of -19% do not do justice to the company’s critical position in AI infrastructure and technical expertise. Things could change once the market realizes that the same companies that helped build AI training infrastructure will also power the inference boom. For now, investors will need to show more patience than should have been necessary, but some of that is in part due to the higher valuation at the beginning of last year.

Thanks to the stock price dip, MRVL is now trading at a forward P/E of 29.3x, much lower than its five-year average forward P/E of 37.2x. The forward price-to-sales ratio is now at an 11% discount, while the forward EV/EBIT of 25.09x is at a 25% discount to the five-year average. This discount offers a great entry point as AI inference gains traction and investors want a part of it.

Marvell announced its Q3 earnings on Dec. 2, reporting a revenue of $2.075 billion, a 37% YoY growth. This was above the midpoint of the guidance the company had previously provided. The data center demand continues to stay strong. The acquisition of Celestial AI will help the company address future AI requirements and thus take its fair share of the spending on future AI datacenter infrastructure.

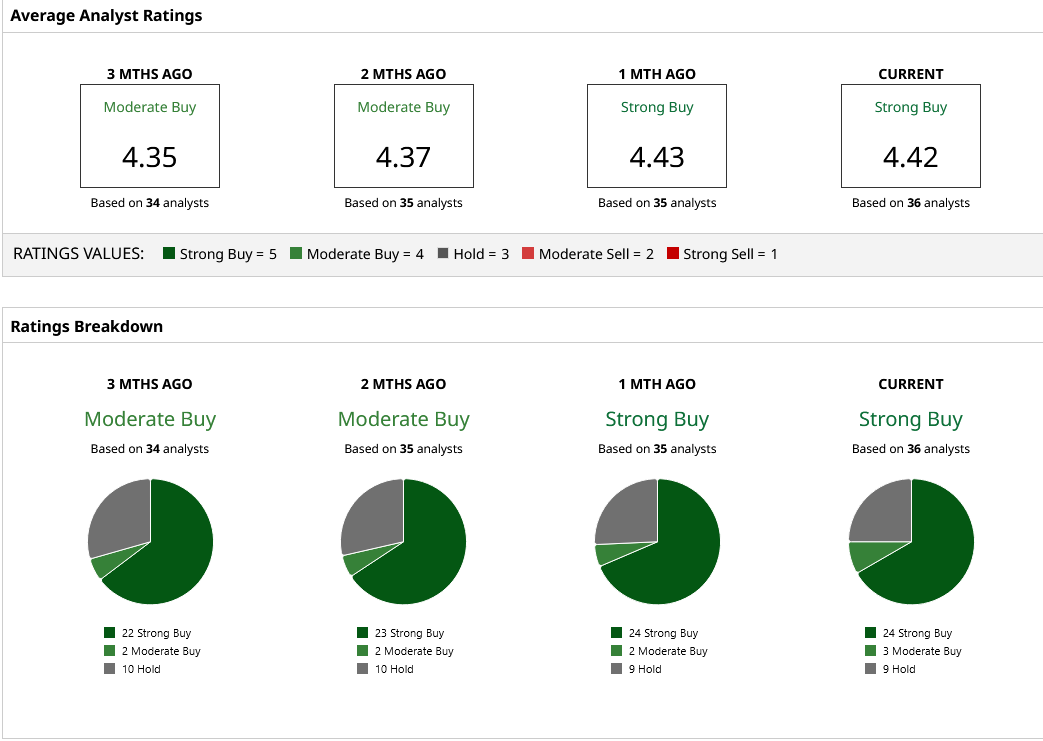

Analysts seem to have a mixed opinion on the stock, with 24 “Strong Buy” ratings, three “Moderate Buy” ratings, and nine “Hold” ratings. The stock’s one-year performance may have prompted some analysts to take a neutral stance. However, the mean price target of $118.31, offering upside of 41%, shows that bullish sentiment is still dominating.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Get Ready for ASIC Shipments to Triple With This Leading AI Stock

- Dear Palantir Stock Fans, Mark Your Calendars for February 2

- Dear SoFi Stock Fans, Mark Your Calendars for January 30

- 2 Stocks to Buy as Microsoft Announces Its New Maia 200 AI Chip (Hint, Neither Is MSFT)

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.