Financial News

Unusual Options Activity Just Flashed on 3 Stocks: 2 Bull Calls, 1 Bull Put Income Play

All eyes were on Davos this week as President Trump delivered a speech at the World Economic Forum that seemed to calm investor concerns about military action in Greenland.

As for the S&P 500, it was down in early Friday trading, but had turned positive by late morning. Where it ends is anybody’s guess.

The index was down early because of Intel’s (INTC) weak guidance and manufacturing issues. The good news is that Q4 earnings reports have started to trickle in -- of the 40 that have reported already, 81% beat analyst expectations. Let’s hope the earnings season stays that way.

In yesterday’s unusual options activity, there were 1,573 unusually active options, with 58 calls and puts having Vol/OI ratios of 20.0 or higher.

Of the 58, three caught my attention. If you’re into limited-risk, limited-reward bets, here are two Bull Call Spreads and one Bull Put Spread to generate income.

Have an excellent weekend.

SAP (SAP)

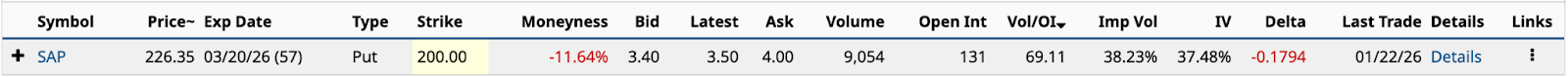

The first of three vertical spreads involves SAP (SAP), the German enterprise software leader. Its March 20 $200 put had the fourth-highest Vol/OI ratio yesterday at 69.11. Of the 9,054 contracts traded on the put, a single trade accounted for 8,000 (99.988%).

OTM (out-of-the-money) by 11.64%, the $200 put provides the foundation of the bull put spread shown below.

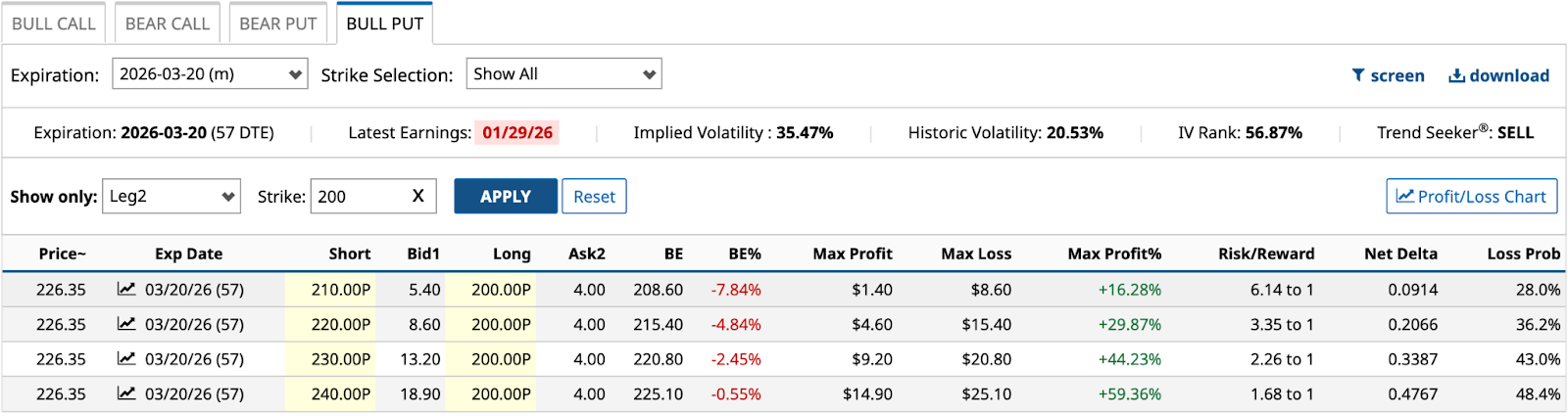

The bull put spread is inherently moderately bullish, providing investors and traders alike with an income opportunity with limited risk and profit potential.

The bull put spread is inherently moderately bullish, providing investors and traders alike with an income opportunity with limited risk and profit potential.

Analysts are generally optimistic about SAP stock. Of the 27 that cover it, 21 rate it a Buy (4.44 out of 5), with a $329.08 target price that is 45% above its current share price. Wall Street expects SAP to earn $7.01 per share in 2025 and $8.14 in 2026. Its shares trade at 32.3 and 27.8 times these estimates, respectively. While that seems expensive, it traded around 42 times its earnings for the next 12 months in March 2025; the 18% decline in its share price over the past 12 months has helped bring its valuation back to earth.

As for the four possible strike prices above for selling short a put for income to accompany buying a long $200 put, I see the $240 put as the best fit. While its maximum loss is $2,510, the maximum profit percentage (maximum profit divided by maximum loss) is highest at 59.36, while the risk/reward ratio is a palatable 1.68 to 1.

With the profit probability still above 50% and a 33.8% probability of achieving a maximum profit of $1,410, your annualized return based on maximum profit is 42.3% [$14.90 maximum profit / $226.35 share price * 365 / 57 days to expiration].

Texas Instruments (TXN)

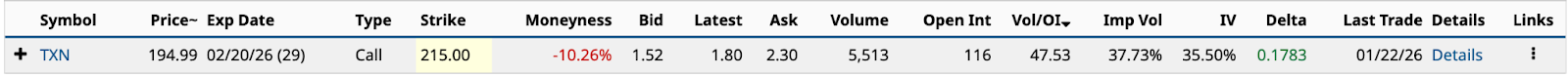

Texas Instruments’ (TXN) Feb. 20 $215 call had the 15th-highest Vol/OI ratio yesterday at 47.53. Among call options, it ranked eighth. Of the 5,513 contracts traded on the call, there wasn’t a single trade under 10 contracts, with one accounting for half the volume. Little fish weren’t driving this bus.

I can remember when Texas Instruments could do no wrong. The chip maker’s free cash flow in 2021 was well over $6 billion on $18.34 billion in revenue, a free cash flow margin of 34.3%. That margin today is 12.0% on $17.27 billion in revenue and $2.08 billion free cash flow.

Margins have shrunk considerably because the chip maker has accelerated its capital expenditures in the past three years, spending $5.07 billion, $4.82 billion, and $4.82 billion in the past three fiscal years, respectively, according to S&P Global Market Intelligence.

The company’s Q3 2025 results revealed that its growth engine was back on the table -- revenue was 14% higher than a year ago and 7% higher than in Q2 2025 -- suggesting that its free cash flow generation will improve in the coming quarters.

That’s the good news. The bad news is that analysts are slow to support this hypothesis -- 35 analysts cover TXN, only 13 rate it a Buy, with a target price of $195.48 -- right where it trades today.

Call me an optimist, but I’ve always found its dedication to free cash flow and focused capital allocation to be a strength, not a weakness. Someday, hopefully sooner, it will have another day in the investor spotlight.

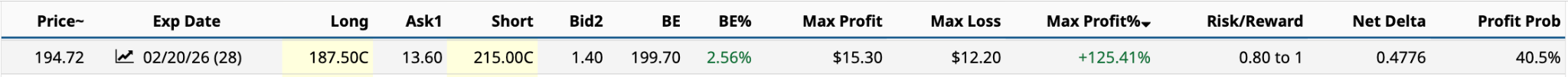

The first of two bull call spreads, based on yesterday's unusually active call option, relies on investors going long on the Feb. 20 $187.50 call and short the $215.00 call. Unlike the bull put spread, which creates a net credit position, the bull call spread creates a net debit.

However, like the bull put spread, the bull call spread has limited profit and loss, keeping risk finite. In this example, the maximum loss of $12.20 has a risk/reward ratio of 0.80 to 1 with a profit probability (the percentage chance the share price expiration will be above the $199.70 breakeven) of 40.5%.

In my opinion, anytime you have a net debit (maximum loss) that’s less than 10% of the share price, your capital management is on point. Sometimes, it’s more about reducing risk than increasing reward. This particular set-up provides a good balance between the two.

Texas Instruments reports its Q4 2025 results on Tuesday after the markets close. Good news will surely boost the share price to, or above, the $199.70 breakeven.

Amer Sports (AS)

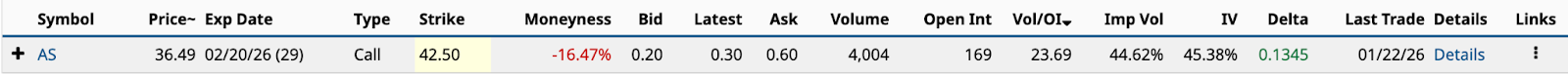

Amer Sports’ (AS) Feb. 20 $42.50 call had the 45th-highest Vol/OI ratio yesterday at 23.69. Among call options, it ranked 15th. Of the 4,004 contracts traded on the call, 71% were for orders of fewer than 10, indicating that the sporting goods company was attracting more retail investors than institutional investors.

I have to admit that Amer’s stock has performed far better than I expected since going public two years ago at $13 a share. It’s up 179% from its IPO on Jan. 31, 2024, IPO.

My most recent coverage of the owner of Salomon, Wilson, Louisville Slugger, Arc’teryx, and others was last September.

“While I am generally positive about the company and its business, in May, I suggested that some profit-taking was in order, as its stock would likely experience a cooling off in the second half of the year,” I wrote at the time.

Between my May and September articles, the share price fell by 11%, effectively ending its momentum. Over the next six weeks, through early November, it fell from its August all-time high of $42.36 to below $30. In the three months since, it’s regained most of those losses.

It’s more resilient than I gave it credit for. I missed the importance of Arc’teryx’s global success -- in September, Arc’Teryx CEO Stuart Haselden set a 2030 sales goal of $5 billion, $3 billion higher than its 2024 result -- but valuation concerns remain. Amer’s shares trade at 31.7 times the 2026 EPS estimate of $1.15.

Regardless of valuation, I remain positive about its group of businesses. The sporting goods industry delivers stable, but consistent growth. However, where you buy AS stock is critical to making money on AS stock, in my experience.

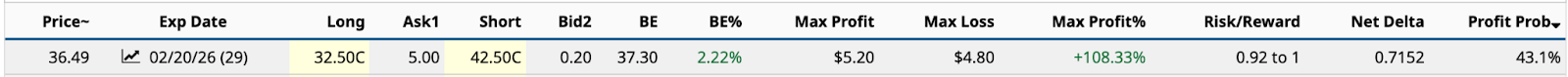

Setting up the bull call spread, the $42.50 call is short, while the $32.50 call is long, for a net debit of $4.80, a maximum profit of $5.20, a 0.92-to-1 risk/reward ratio, and a 43.1% profit probability.

In this situation, Amer reports its Q4 2025 results on Feb. 24, four days after the calls for this bull call spread expire. Although the net debit is 13.2% of the share price, above my target of below 10%, the fact that a strong holiday report will likely push the share price to an all-time high makes the risk worth it.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Micron’s 2026 Earnings Upside Makes MU Stock Hard to Ignore

- Blue Origin Is Gunning for AST SpaceMobile. Should You Sell ASTS Stock Now or Keep Betting on Gains?

- Down 25% in 2026, Morgan Stanley Says You Should Buy the Dip in This 1 Tech Stock

- Is Warren Buffett’s 1994 Berkshire Hathaway Prediction Finally Coming True? He Warns ‘A Fat Wallet is the Enemy of Superior Investment Results’

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.