Financial News

As ServiceNow Partners with OpenAI, Should You Buy, Sell, or Hold NOW Stock?

In the ever-shifting world of enterprise software, a new catalyst has thrust ServiceNow (NOW) back into the spotlight: a multi-year strategic partnership with OpenAI designed to weave some of the most advanced artificial intelligence (AI) models into the very core of business workflows. This alliance has sparked fresh buzz among investors and analysts alike, even as the stock trades near significant lows amid broader volatility in the software market.

The partnership with OpenAI aims to bring advanced, custom-built AI capabilities to enterprise customers, enabling AI systems that can take end-to-end actions within complex business environments. The collaboration focuses on moving companies from AI experimentation to scaled deployment, combining the strengths of both platforms to deliver faster and more intuitive outcomes.

Key use cases include real-time speech-to-speech AI agents that can listen, reason, and respond naturally, as well as OpenAI’s computer-use models, which unlock new levels of IT automation by allowing AI to interact directly with enterprise systems.

While the promise of AI-driven automation and workflow intelligence is exciting, is NOW a Buy, a Sell, or simply a Hold today?

About ServiceNow Stock

ServiceNow is a leading enterprise software company that provides a cloud-based platform for automating and managing digital workflows across IT service management, customer service, HR, security, and other business functions. The company is headquartered in Santa Clara, California and has a market cap of $130.1 billion, reflecting its position as one of the most valuable enterprise software providers globally with recurring revenue and broad adoption among large organizations.

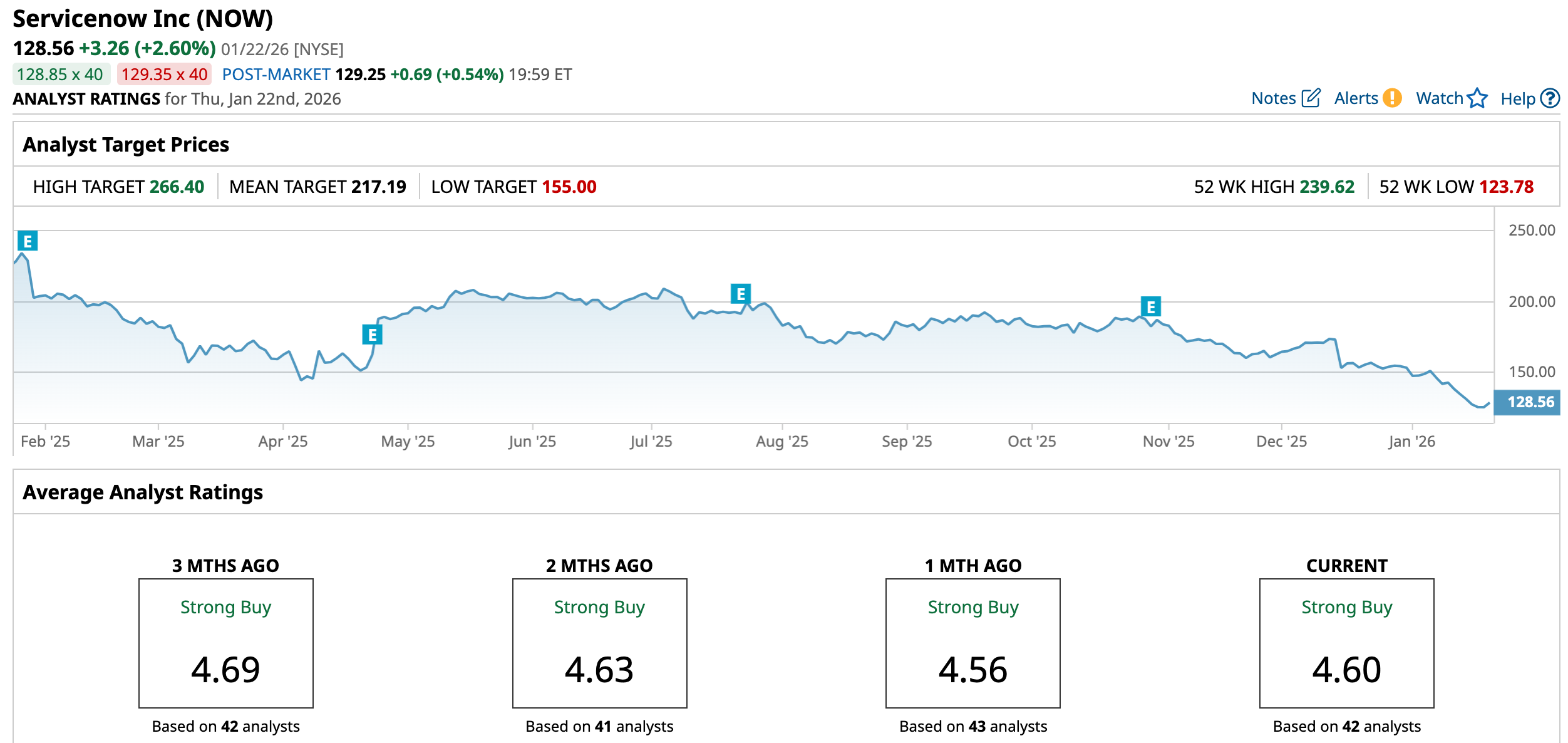

ServiceNow’s stock performance in recent periods has been marked by notable volatility and a sharp pullback. After a period of strong gains through much of 2024, where the shares climbed significantly alongside broad enthusiasm for enterprise software and AI-driven growth, NOW began to slide through 2025 and into 2026, pressured by sector-wide headwinds and shifting investor sentiment around software valuations.

This weakness has brought the stock down sharply from its peaks, with shares recently hitting a 52-week low of $123.78 on Jan. 21, despite the partnership news. The stock is down 42.87% over the past 52 weeks.

NOW is experiencing significant pressure this year as well, already slumping 18.2% amid fears about AI disrupting traditional software models. Nevertheless, experts like tech investor Orlando Bravo of Thoma Bravo dismissed fears that AI will disrupt or replace the software industry.

The stock is trading at 52.9 times forward earnings, which is higher than the sector median but below its own historical average.

Steady Q3 Results

The company released its third-quarter earnings on Oct. 29, covering the period ended Sept. 30, 2025. Subscription revenues climbed to $3.3 billion, up 21.5% year-over-year (YOY), while total revenues reached $3.4 billion, marking a 22% increase compared with the same quarter in 2024.

Current remaining performance obligations (cRPO), a key indicator of future revenue, were $11.4 billion, up 21% YOY, and total RPO grew around 24%, signaling strong backlog and contract strength. Adjusted EPS came in at $4.82, a 29.6% rise YOY, beating consensus estimates and highlighting strong profitability expansion.

ServiceNow raised its full-year 2025 guidance, increasing its subscription revenue outlook to around $12.835 billion to $12.845 billion and forecasting margin expansion, including a targeted 31% non-GAAP operating margin and 34% free cash flow margin, reflecting confidence in continued growth and operational leverage. Q4 guidance called for subscription revenues in the $3.42 billion to $3.43 billion range with sustained YOY growth.

ServiceNow is expected to release its Q4 2025 earnings results after the market closes on Wednesday, Jan. 28. Its EPS for the fourth quarter is expected to come in at $0.48, which is a 23.1% rise YOY. Analysts project the company’s EPS to rise 36.1% YOY to $1.96 in fiscal 2025 and grow 20.9% to $2.37 in fiscal 2026.

What Do Analysts Expect for ServiceNow Stock?

Recently, RBC Capital reiterating an “Outperform” rating and a $195 price target, viewing the OpenAI partnership as strategically positive for enterprise adoption.

On the other hand, BMO Capital lowered its price target on ServiceNow to $175 from $230 while maintaining an “Outperform” rating, amid broader software valuation compression and challenges linked to recent M&A activity. Also, Oppenheimer cut its price target on ServiceNow to $175 from $200 while maintaining an “Outperform” rating, citing investor concerns around the company’s increased M&A activity.

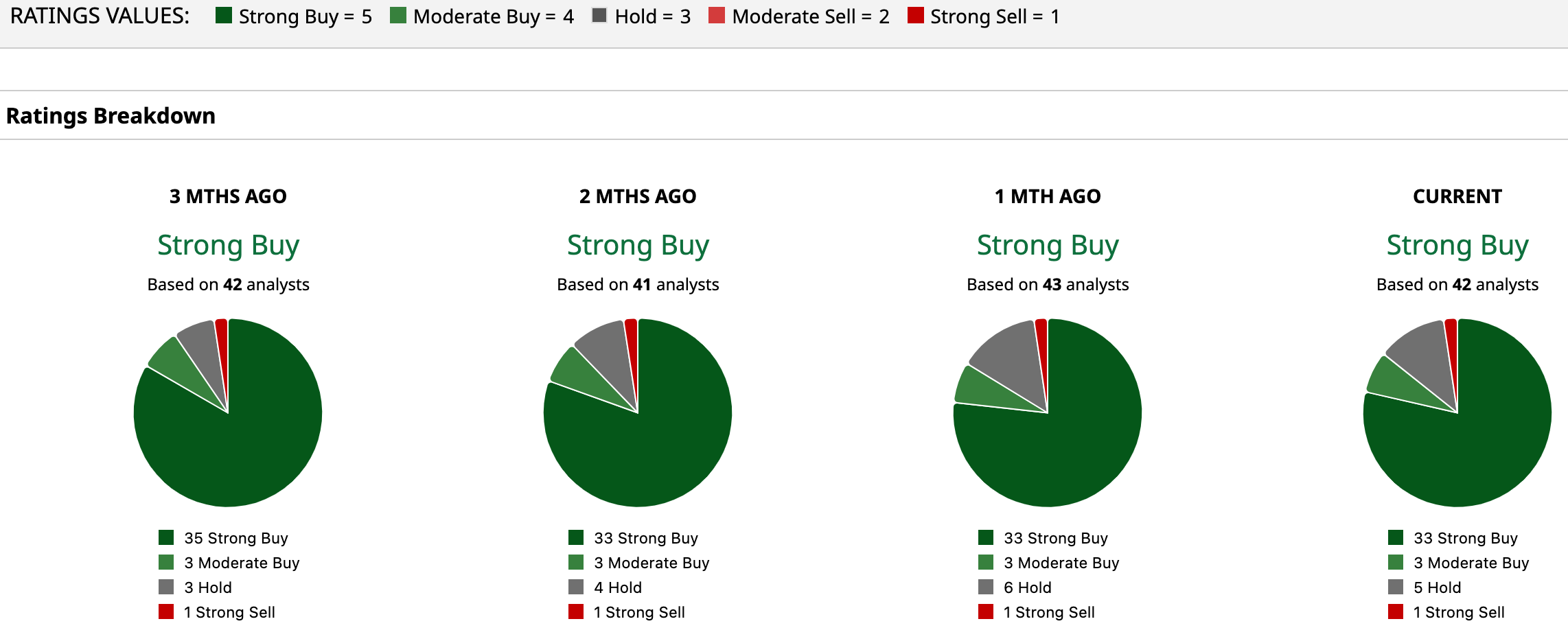

NOW has a consensus rating of a “Strong Buy” overall. Of the 42 analysts covering the stock, 33 advise a “Strong Buy,” three suggest a “Moderate Buy,” five analysts give it a “Hold” rating and one “Strong Sell.”

While NOW’s average price target of $217.19 suggests an upside of 68.9%, the Street-high target of $266.40 signals that the stock could rise as much as 107.2% from current levels.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Apple Builds Its New Campos Chatbot, Should You Buy, Sell, or Hold AAPL Stock?

- Our Top Technical Strategist Explains How to Invest in the 'Age of Electricity'

- Mizuho Says You Should Buy the Dip in Arm Stock. Why?

- As ServiceNow Partners with OpenAI, Should You Buy, Sell, or Hold NOW Stock?

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.