Financial News

Three Hot Options Plays, Each with Its Own Twist

Greenland took center stage at the World Economic Forum in Davos yesterday.

Before President Trump’s speech, the markets were up. Then they were down as the speech dragged on for what must have felt like days for those actually in the room. Then it was up again after the president said the U.S. would not use force to acquire Greenland. Ultimately, the S&P 500 closed up 1.16% on the day.

After the markets closed, Trump posted on Truth Social that he had “the framework of a future deal with respect to Greenland.” The markets are up midday on Thursday as I write this.

The devil is in the details, goes the saying. Very little about the deal is known, and there remains significant skepticism about the possibility of an agreement that is amenable to Greenland and Denmark. I guess we’ll find out soon enough.

In the meantime, there were 1,425 unusually active options in Wednesday’s trading, with the Netflix (NFLX) Jan. 30 $84 call possessing the highest volume-to-open-interest (Vol/OI) ratio at 149.57; the highest Vol/OI ratio for put options was Micron’s (MU) May 15 $350 strike at 99.55.

While both of these options have their merits, I’ve locked on to three other unusually active options from yesterday, each with its own twist.

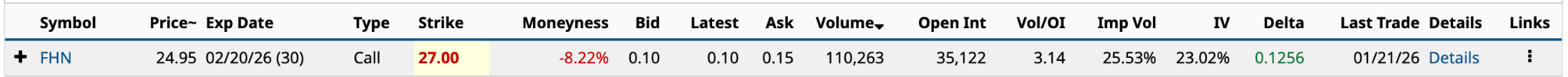

The Highest Volume Goes To First Horizon

Tennessee-based regional bank First Horizon’s (FHN) Feb. 20 $27 call had the highest volume yesterday among the 1,425 unusually active options at 110,263, 3.14 times its open interest. The second-highest volume was Nvidia’s (NVDA) Jan. 30 $190 call at 64,490.

What is going on at First Horizon to merit such volume for a single call? Three things jump out for me.

First, its stock is on a big-time roll, up 64% since hitting a 52-week low of $15.19 in April 2025. Yesterday, it hit its 29th new 52-week high over the past 12 months at $25.08. The Barchart Technical Opinion is a 100% Strong Buy in the near-term, suggesting double-digit gains over the next 30 days are more than possible.

Secondly, a week ago today, the regional bank reported its Q4 2025 results; they were better than analyst expectations. On the top line, its revenue was $891 million, 3.2% above Wall Street’s consensus and 8.1% higher than Q4 2024. On the bottom line, its adjusted earnings per share were $0.52, six cents better than the analysts’ estimate. Based on the $1.87 a share it earned in 2025, its stock trades at a reasonable 13.4 times that number.

Lastly, its average loans grew by 1% in 2025, to $62.6 billion, while its net interest margin was 3.47%, 12 basis points higher than a year ago. With a healthy dividend yield of 2.4%, it’s hard to think of any deal-breaking reasons why not to own FHN for the long haul.

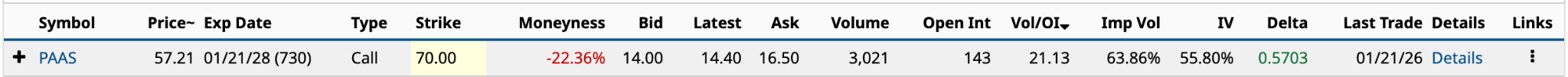

A LEAP of Faith for Pan American Silver

The Vancouver-based silver and gold producer’s Jan. 21/2028 $70 call was tied with 10 other call contracts with 730-day DTEs (days to expiration). While the volume for the PAAS call wasn’t massive at 3,021, it was 21.13 times the open interest, and the highest of the 18 LEAPS (long-term equity anticipation securities) expiring in two years.

Silver and gold prices were hotter than a pistol in the past year, gaining approximately 150% and 64%, respectively. That’s a revenue and profit accelerant for silver and gold miners like Pan American Silver (PAAS). Not surprisingly, PAAS stock is up 157% over the past 12 months.

The company’s revenue in the trailing 12 months ended Sept. 30, 2025, according to S&P Global Market Intelligence, was $3.25 billion, with $817.9 million in operating income, both of which are higher than they’ve ever been. The company set these records due to higher gold and silver prices and an increase in silver production.

The question, when considering this particular LEAP, is whether the good times will last into 2028 for silver and gold prices, generally, and Pan American, specifically. Pan American’s options volume yesterday doesn’t scream LEAPS -- four trades accounted for 98.8% of the Jan. 21/2028 $70 call’s volume -- but it’s enough institutional interest to feel good about the call’s risk/reward proposition.

Analysts expect Pan American to earn $2.20 per share in 2025 and $3.50 in 2026. Its current share price is 26.0 times its 2025 EPS estimate and 16.3 times its 2026 EPS. That’s a reasonable forward valuation.

In 2026, its production guidance is for 26.0 million ounces of silver at the midpoint and 725,000 ounces of gold. That’s down 2% from its 2025 gold production (742,000 ounces), but up 14% from its 2025 silver production (22.84 million ounces).

If silver and gold prices hold, revenues and profits should set records again in 2026. The $16.50 ask price is 28.8% of yesterday’s $57.21 closing price. Given the two-year duration, that’s a reasonable use of leverage.

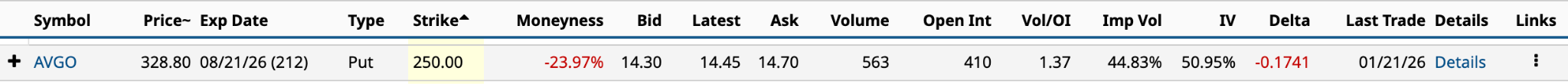

Broadcom Provides an Attractive Entry Point

If you feel as though you’ve missed the boat on Broadcom (AVGO) stock -- up 37% and 611% over the past 12 months and five years -- yesterday’s Aug. 21 $250 put provides sellers with attractive income in the near term and potentially, a much better entry point to ride the silver and gold wave.

Analysts love AVGO stock.

Of the 42 that rate it, 39 give it a Buy (4.79 out of 5), with a $455.22 target price. Now, god knows, analysts are often overly enthusiastic about a stock’s upside when they’re bullish about it. Still, you can’t help but admire how well CEO Hock Tan has run the provider of semiconductor devices and infrastructure software solutions since becoming Avago's chief executive in March 2006. It got its current name in February 2016 after acquiring Broadcom for $37 billion in cash (46%) and stock (54%).

I’m not a big techie, but Tan seems unafraid to make significant acquisitions such as the Broadcom purchase a decade ago. Since taking the reins at Avago, he’s made four acquisitions of $10 billion-plus: Broadcom, CA Technologies ($18.9 billion), Symantec ($10.7 billion), and VMware ($61.0 billion) in 2023.

In 2015, before the Broadcom buy, it had $6.82 billion in revenue; in the 12 months ended Nov. 2, 2025, it was $63.89 billion, a compound annual growth rate (CAGR) of 25.1%. Over the same period, its cash flow from operating activities has a 28.1% CAGR.

Tan has put the company’s spotlight for growth on artificial intelligence (AI). His potential compensation should keep him focused until the end of fiscal 2030, the service requirement to receive a target amount of 610,521 performance stock units (PSUs). To receive this amount, Broadcom must generate annual AI-related revenue of $90 billion by 2030; if this AI revenue is $105 billion, Tan gets 1.22 million PSUs, and if $120 billion or more, 1.83 million.

I like his odds.

As for selling the Aug. 21 $250 put, the $1,430 in premium income you would receive is an annualized return of 10.5%. That’s not massive, but it’s attractive enough to be paid to wait to obtain the right to buy 100 shares at $250, an attractive entry point, indeed.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Trade Microsoft Stock Before Earnings With This Bull Call Spread

- Three Hot Options Plays, Each with Its Own Twist

- How This Options Expert Screens for High-Probability Spread Trades, Step-by-Step

- How Volatility Skew Could Be Favorably Mispricing Expand Energy (EXE) Call Options

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.