Financial News

Jane Street Is Buying Up Cipher Mining Stock. Should You Grab CIFR Shares Here?

One of the more intriguing sectors for investors to consider right now has to be the Bitcoin (BTCUSD) mining space. Top crypto miners have seen significant volatility in recent weeks, as the price of Bitcoin and other top digital assets have fluctuated a great deal.

Much of this fluctuation is in the price of Bitcoin, with most crypto miners including Hut 8 (HUT), Bitfarms (BITF), Cipher Mining (CIFR) feeling the effects of fluctuations in Bitcoin prices. After hitting a high of around $120,000 per token just a month ago, Bitcoin is now trading down toward the $107,000 level. For Bitcoin miners like Cipher (which also has some high performance computing data centers), Bitcoin's price matters a great deal to the company's underlying profitability. That's true of most companies in this space, but even more so for companies that have announced large deals to expand their compute, particularly given where the price of chips has gone.

A recent note from trading firm Jane Street, which highlights a rather significant stake taken in Cipher Mining (and other Bitcoin miners) is one I think is worth a closer look. Let's dive into why Jane Street and other institutional investors may be looking at companies like Cipher right now.

Business Model Could Serve Cipher Well

Unlike other companies I'd put more in the “pure play” bucket of true Bitcoin miners (that's all they do), Cipher has diversified its operations nicely. The company still generates the vast majority of its revenue via mining Bitcoin, so that key price is going to be the biggest revenue and earnings driver for the company moving forward.

But in recent months, Cipher has continued to optimize its energy costs, reducing its reliance on fossil fuel-driven power centers and leaning into renewables. With a 15-year lease recently signed with Amazon (AMZN), there's a lot to like about Cipher's back-end upside, providing compute and power capacity to other companies looking to ramp up their AI workloads.

In this context, Jane Street's 5% ownership stake in Cipher mining certainly appears to make sense for investors who are bullish on Bitcoin, AI, or both trends playing out.

Fundamentals Still Leave Much to Be Desired

The whole Bitcoin mining game (and adding on additional compute for AI or any other mega trend, for that matter) is one that's inherently risky. If the price of Bitcoin plunges, or if demand for AI or an over-buildout of capacity leads to plunging margins in the AI space, we could all be due for a world of pain.

The thing about Cipher Mining that's interesting to me is this company's unique focus on acquiring the absolute lowest cost energy out there. That should support the company's fundamentals moving forward, so long as this build out goes according to plan.

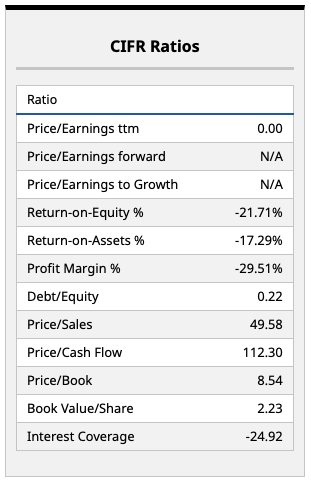

Looking at Cipher's fundamentals above, those negative margin and return on assets/equity numbers are concerning. Bitcoin mining has been a loss-generating business for some time, outside of truly incredible bull markets where Bitcoin doubles over and over. And while that's what some investors may expect to happen in the future, Bitcoin halving events and other factors will lead to margin deterioration over time, with some experts having suggested that it's a mathematically zero-sum game for miners over the very long term.

What Do the Analysts Think?

Aside from Jane Street, other analysts on Wall Street appear to be less bullish on Cipher Mining's long-term growth potential.

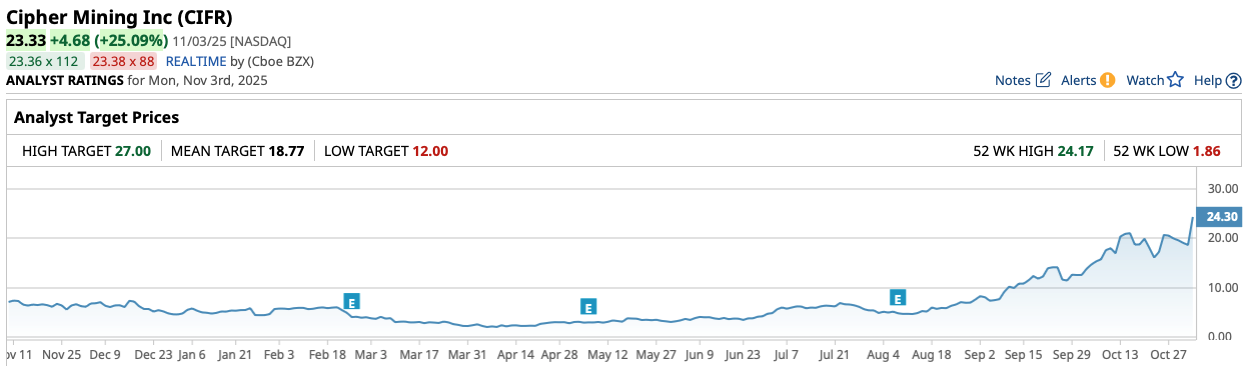

The consensus price target for CIFR stock sits at $18.77 per share at the time of writing. This price target implies downside of around 20% from current levels. That's certainly not a shining endorsement for the stock, and suggests that even after Cipher's recent run higher, not all on Wall Street are sold on the company's future growth and profitability potential.

Of course, this current price target may not be reflective of Wall Street's actual opinion of CIFR stock at present, given how hard the stock has rallied over the past couple months. Trading well below $10 per share up until mid-September, Cipher's recent rally indicates significant demand from momentum investors and others like Jane Street that see an opportunity here.

I'm not going to say the smart money doesn't have this one pegged down. But from a fundamentals perspective, there are plenty of other utility companies I'd consider investing in as ways to play rising AI demand (and compute demand tied to other trends like Bitcoin mining). Personally, I don't see the long-term efficacy of this investment, but perhaps this move from Jane Street isn't intended to be a long-term investment after all.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Jane Street Is Buying Up Cipher Mining Stock. Should You Grab CIFR Shares Here?

- Bitcoin’s Weekly Structure Shows Signs of a Failed Auction. It’s a Warning for the Long-Term Trend.

- Core Scientific Just Got a New Street-High Price Target. Should You Buy CORZ Stock Here?

- Bitcoin Whales Are Swimming Into ETFs. This Could Transform Crypto or End Up a Jagged Little Pill.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.