Financial News

3 Options Strategies. 3 Unusually Active Options. 3 Long-Term Stocks to Buy.

World Series Game 6 in Toronto tonight. Go Blue Jays! A win would mean all three Blue Jays World Series clinching games in their 48-year history are Game 6s.

Enough about sports. You want to read about unusual options activity. I’m here to deliver.

I’m using a slightly different screening criterion for yesterday’s unusual options activity. Previously, my two screens were 1) options expiring in seven days or more (eliminating short-term expirations) and 2) Vol/OI (volume-to-open-interest) ratios of 1.24 or higher.

In today’s screen, the Vol/OI ratio is 1.0 or higher with options expiring in seven days or more. I’ve also set a minimum open interest of 500. We’ll see if I use this screen in the future.

In yesterday’s trading, 1156 options met the criteria with 727 calls and 434 puts, a relatively bullish indicator. The highest Vol/OI ratio was Quantum Computing’s (QUBT) Nov. 7 $14 put at 85.94. Including QUBT, there were 50 options with Vol/OI ratios of 10 or higher. I think that’s where I’ll focus today’s commentary.

When it comes to investing in stocks, I tend to be a buy-and-hold type, which is rare today, but it works for me, so I’m going to stick with it.

Therefore, my three selected options will be for companies I’m bullish about over the long term.

Have an excellent weekend.

Chipotle Mexican Grill (CMG)

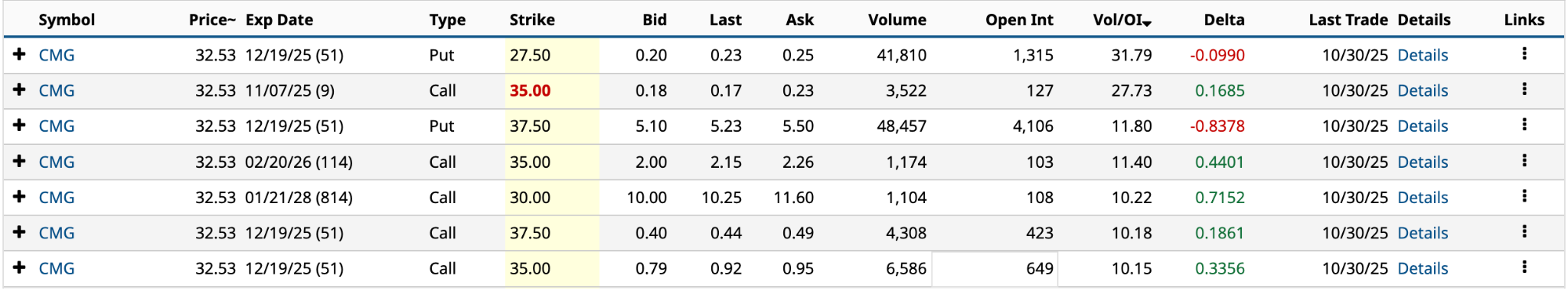

As shown above, Chipotle Mexican Grill had seven options with Vol/OI ratios above 10 yesterday. However, I’m focused on those with an open interest of 500 or more. That leaves me with the Dec. 19 $27.50 put, Dec. 19 $37.50 put, and Dec. 19 $35 call.

CMG stock has not had a good week. Over the past five trading days, its shares have lost nearly 23% of their value. That will happen when you cut your forecast for same-store sales growth because customers aged 25 to 35 (a key customer demographic) are visiting less.

I don’t see the scaling back on visits by its customers as a long-term issue. Instead, it’s a temporary one that could lead to increased volatility in the stock. That’s music to options investors’ ears.

Analysts still like Chipotle--although they also liked Fiserv (FI), and it got taken to the woodshed, losing 44% of its value in one day--with 25 out of the 33 analysts covering CMG rating it a Buy (4.42 out of 5) with a $53.84 target price, well above its current share price.

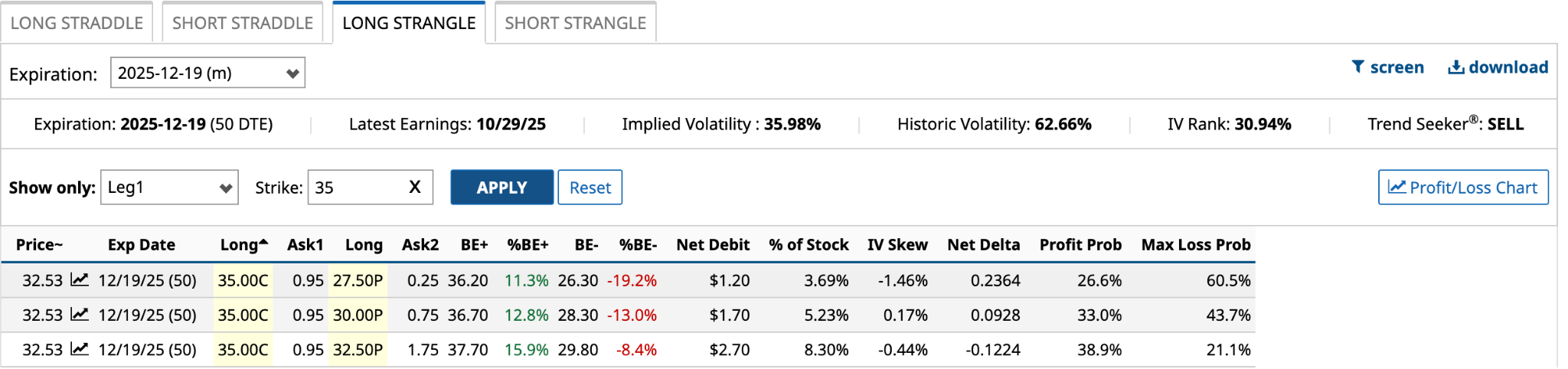

In hindsight, this could be a buy-on-the-dip moment. Two of the three options lay out nicely for a long strangle.

The long strangle involves buying a call (in this case, the Dec. 19 $35 call) and a put at a lower strike price (in this case, the Dec. 19 $27.50 put). The net debit is $1.20, or 3.69% of yesterday’s closing price of $32.53.

The long strangle involves buying a call (in this case, the Dec. 19 $35 call) and a put at a lower strike price (in this case, the Dec. 19 $27.50 put). The net debit is $1.20, or 3.69% of yesterday’s closing price of $32.53.

With a 26.6% profit probability, you make money if the share price is above $36.20 or below $26.30 at expiration in 50 days. With an expected move of 9.15%, it’s going to be tough to make money without some near-term catalyst, which is unlikely.

Therefore, a better bet for bullish investors might be to sell the $27.50 put for income and a potentially even better entry point. With a $0.20 bid price, the annualized return would be 5.3% [$0.20 bid price / $27.50 strike - $0.20 bid price * 365 / 50].

It’s not a massive return by any means, but it’s better than buying at current prices and watching it fall another $5.

Morgan Stanley (MS)

Morgan Stanley (MS) has always been the poor cousin of Goldman Sachs (GS). It never gets the same respect from investors. As a result, over virtually every comparison period, the latter outperforms the former.

However, if Q3 2025 results are any indication, Morgan Stanley’s business is doing great. It reported earnings on Oct. 15, and they were a home run.

On the top line, its revenues were $18.22 billion, 18.5% higher than a year ago and $1.52 billion above Wall Street’s estimate. On the bottom line, it earned $2.80 a share, 48.9% higher than Q3 2024 and 70 cents above the consensus estimate.

To keep the good times rolling, Morgan Stanley announced on Wednesday that it would acquire EquityZen, a platform that enables investors to buy and sell shares in private companies. The deal provides Morgan Stanley’s wealth management business with another tool to offer its growing client list.

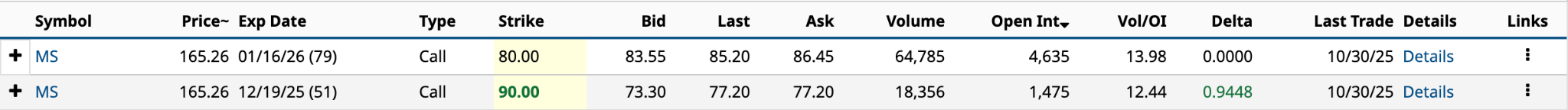

In yesterday’s options trading, Morgan Stanley had nine options with Vol/OI ratios of higher than 10 and a minimum open interest of 500. I won’t list all of them. Instead, I’ll go with the two with open interest above 1,000.

Both are calls and expire in over a month. Both are deep ITM (in the money). People buy deep ITM calls because the deltas are generally high, mimicking stock price movements at a lower cost. I’m not sure why the delta is not showing for the $80 call strike. According to the 12 contracts traded today, it’s 0.9750. I’ll go with that.

So, the $80 call is 52.3% of yesterday’s closing price, while the $90 call is 46.7%. The trade-off is $925 on the outlay [$86.45 ask price - $77.20 ask price * 100] for 28 days of additional time for the share price to move higher. The expected move for the Jan. 16/2026 $80 call is $14.69, while it’s $11.29 for the Dec. 19 $90 call.

Assuming the expected moves happen the day before expiration and you sell the calls, closing out your positions, the annualized returns would be 76.7% [$14.69 expected move / $86.45 ask price * 375 / 79] and 99.0% [$11.29 expected move / $77.20 * 365 / 51].

In this situation, I’d go with the Dec. 19 $90 call. The outlay is $905 less, while the profit probability is slightly higher at 50.95%.

Palantir Technologies (PLTR)

Palantir Technologies (PLTR) has significantly benefited from its AI platform.

Its shares are up 168% in 2025 and 389% over the past 12 months. As recently as May 2023, PLTR stock traded in single digits. They’re up 2,035% since then.

Analysts remain skeptical. Of the 29 covering PLTR stock, only seven rate it a Buy (24%), with a median target price of $165, 19% below its current share price.

I’ve been bullish about Palantir CEO and co-founder Alex Karp for some time. He’s a very bright individual who isn’t afraid to speak his mind. A recent CNBC article discussing the company’s shift in political support from Democrats to Republicans is something to worry about —but not for the reasons you might think.

The company generates 55% of its revenue from government business. It just signed a long-term contract with the U.S. Army worth up to $10 billion over the next decade.

Openly choosing sides could go against the company when the political landscape changes — and it always does — potentially affecting its ability to secure new government contracts.

Will it happen? Probably not, but it’s something to keep in the back of your mind if you’re bullish, as I am, about Palantir’s future.

In March, I discussed a possible Covered Strangle for aggressive investors, which involves owning Palantir shares, selling an OTM (out-of-the-money) put, and selling an OTM (out-of-the-money) call. The two options have the same expiration date.

At the time, its share price was $96.75. Both the call and put expired a month later without assignment. It worked out.

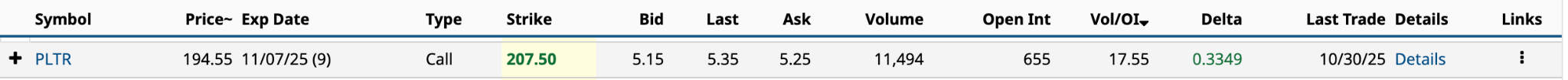

In yesterday’s trading, PLTR had several unusually active options with Vol/OI ratios of 1.0 or higher, but only one with option interest higher than 500.

The most obvious strategy that jumps out at me is the Covered Call. The approach involves buying 100 shares of Palantir at $194.55, an outlay of $19,455, and simultaneously selling one $207.50 call for $515 in premium.

With nine days to expiration, you want the share price to be at $207.50 on Nov. 7. The downside of this strategy is that you cap your upside at $207.50. If it goes higher than that, you would have to cover the short call by selling your shares.

Assuming the share price is $207.50 at expiration, your return is 9.6% [$5.15 bid price + capital gain ($207.50 strike price - $194.55 share price) / $194.55 share price - $5.15 bid price]. That’s an annualized return of 438%.

Not bad at all.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Analyst Just Slashed His Fiserv Stock Price Target by 55%. Should You Jump Ship Now?

- 'Aggressive' Spending Spooks Meta Platforms Investors. Should You Buy the Dip in META Stock?

- A $135 Billion Reason to Buy Microsoft Stock Now

- 3 Options Strategies. 3 Unusually Active Options. 3 Long-Term Stocks to Buy.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.