Financial News

As Tesla Stock Disappoints on Earnings Yet Again, CEO Elon Musk Shares That This 1 Thing Is ‘His Biggest Concern’

Tesla (TSLA) investors have grown accustomed to volatility, but the company’s latest earnings report once again tested their patience. For the fourth consecutive quarter, Tesla disappointed on earnings, even as it delivered a record number of electric vehicles (EVs). Rising costs, shrinking margins, and declining regulatory credit revenue weighed heavily on the bottom line, reinforcing concerns that the automaker’s once-impressive earnings engine is losing momentum amid shifting EV policies, trade headwinds, and ongoing geopolitical uncertainty.

Yet, amid the financial turbulence, CEO Elon Musk used Tesla’s third-quarter earnings call to talk less about quarterly numbers and more about the company’s long-term future—and, surprisingly, his own. While discussing Tesla’s Optimus humanoid robot, Musk surprised investors by revealing his “biggest concern,” one that has nothing to do with production or competition. With that, let’s take a closer look at what currently worries Musk most as Tesla enters a new era defined by artificial intelligence, robotaxis, and humanoid robotics.

About Tesla Stock

Tesla is a prominent innovator dedicated to accelerating the global transition to sustainable energy. The Elon Musk-led powerhouse designs, develops, manufactures, leases, and sells high-performance fully electric vehicles, solar energy generation systems, and energy storage products. It also offers maintenance, installation, operation, charging, insurance, financial, and various other services related to its products. In addition, the company is increasingly focusing on products and services centered around AI, robotics, and automation. TSLA has a market cap of $1.53 trillion.

Shares of the EV maker have gained 12.3% on a year-to-date (YTD) basis. TSLA stock started this week on an upbeat note, climbing 4.3% on Monday amid signs that the U.S. and China were nearing a trade deal. Notably, China made up over 20% of Tesla’s total sales in 2024. Despite some progress on a trade deal, TSLA stock is down about 4% in early morning trading today.

CEO Elon Musk Reveals His “Biggest Concern” as Tesla Embarks on Its Next Chapter

At the end of Tesla’s Q3 earnings call, CEO Elon Musk revealed his “biggest concern” as Tesla enters its next chapter focused on AI, robotaxis, and humanoid robots. For context, Tesla executives devoted much of the call to discussing AI, especially Optimus, the company’s AI-trained humanoid robot in development, which was mentioned 36 times on the call. Musk reiterated his belief that Optimus could ultimately become the biggest product of all time. You can read more about why Musk calls Optimus an “infinite money glitch” in my latest article on TSLA.

During the Q&A session, Musk was asked about the current challenges involved in bringing the Optimus robot to market. Musk remarked that Tesla was uniquely positioned for this, citing the company’s strengths in manufacturing and technology. He highlighted, for example, the extensive work put into developing a highly dexterous robotic hand. But then, he turned the discussion toward his own influence, expressing his “fundamental concern” about potentially being “ousted” after creating an “enormous robot army.”

“My fundamental concern with regard to how much voting control I have at Tesla is, if I go ahead and build this enormous robot army, can I just be ousted at some point in the future? That’s my biggest concern,” Musk told investors. Essentially, he defended his proposed $1 trillion compensation package. Still, the driving force here isn’t money, as it might seem at first glance, but rather Musk’s desire to maintain enough influence to guide Tesla’s next chapter. “It’s just, if we build this robot army, do I have at least a strong influence over that robot army, not current control, but a strong influence? ... I don’t feel comfortable wielding that robot army if I don’t have at least a strong influence,” he said.

Meanwhile, Tesla’s board announced the ambitious executive compensation plan for Musk in September. If approved at next week’s annual meeting, Musk will be eligible to receive over 420 million Tesla shares in incremental payouts—but only if he meets the company’s ambitious growth milestones, including reaching an $8.5 trillion market cap, deploying 1 million robotaxis, and delivering 1 million Optimus robots. As a result, Musk’s stake could increase from 13% to about 25%.

CFO Vaibhav Taneja called on Tesla shareholders to approve Musk’s compensation plan near the end of the conference call, prompting Musk to weigh in once more. He said that having voting control in the “mid-20%” range would allow him to secure “strong influence” while still giving shareholders the ability to fire him if he were to go “insane.” But Musk didn’t stop there.

He then turned his attention to his latest adversary: proxy advisory firms. “I just don’t feel comfortable building a robot army here and then being ousted because of some asinine recommendations from ISS and Glass Lewis, who have no freaking clue. I mean, those guys are corporate terrorists,” Musk said, referring to proxy advisory firms that have been urging investors to vote against the compensation plan.

“While we believe Elon is the only person capable of leading Tesla at this critical inflection point, changing the world is neither an overnight process nor the work of a single person,” Tesla’s board wrote in a letter to shareholders. “So, we also want your help in securing the team and strategy needed to achieve goals that others will perceive as impossible but that we know are possible for Tesla.”

Tesla Disappoints on Earnings Yet Again

While Musk frets over maintaining control of his future “robot army,” investors are digesting the company’s latest earnings report, which revealed some encouraging trends but also major negatives. You can read my detailed breakdown of the Q3 numbers in my previous TSLA article—here, I’ll focus more on the disappointing aspects.

Despite delivering a record number of EVs during the quarter, Tesla significantly disappointed on the profitability front. Its adjusted EPS stood at $0.50 in Q3, down 31% year-over-year (YoY) and missing expectations by $0.06. The results marked the fourth consecutive quarter of weaker-than-expected profit.

Tesla’s margins fell across the board amid rising costs and lower regulatory credit revenue, highlighting that the company isn’t immune to the cost pressures spreading through the auto industry as President Donald Trump reshapes U.S. policy. GAAP gross margin tumbled 185 basis points YoY to 18%, and operating margin cratered 501 basis points YoY to 5.8%. Tesla’s operating expenses surged 50% YoY to $3.4 billion, driven in part by heavy investments in AI and “other R&D projects.” Notably, Tesla incurred roughly $400 million in tariff-related costs during the quarter, divided between its automotive and energy segments. In addition, revenue from regulatory credit sales, which goes straight to the bottom line, plunged 44% YoY to $417 million after the Trump administration officially phased out the emissions credit market earlier this year. As a result, all of these hit the company’s margins and bottom line. And Musk provided little clarity on how Tesla plans to revive its core EV business.

When it comes to the outlook, the company repeated its previous-quarter statement that it is “difficult to measure” how changing global trade and fiscal policies will affect its business and operations. Still, CFO Vaibhav Taneja acknowledged that both competition and tariffs pose challenges for the company.

What Do Analysts Expect for TSLA Stock?

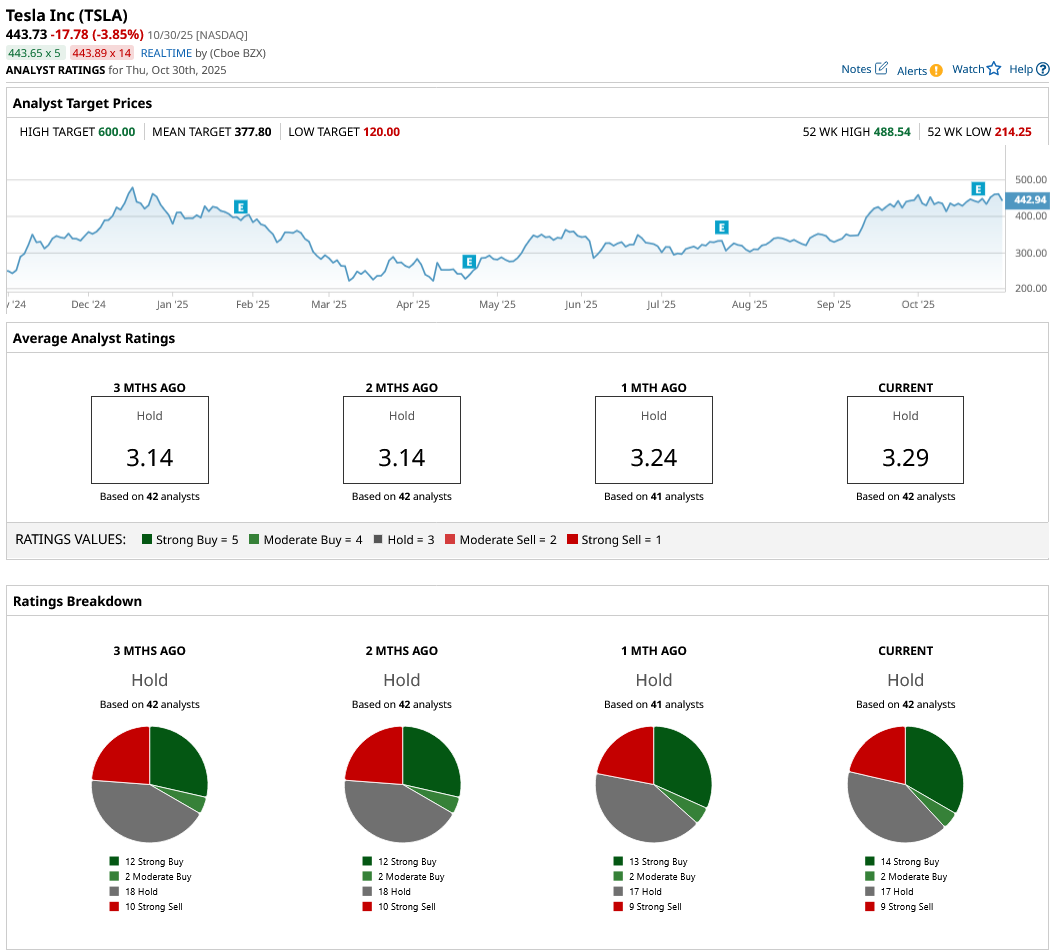

Wall Street analysts remain divided on TSLA, as reflected in the stock’s consensus “Hold” rating. While 14 analysts rate it a “Strong Buy” and two a “Moderate Buy,” 17 recommend holding the stock, and nine assign a “Strong Sell” rating. Tesla bulls remain upbeat on Musk’s ambitious vision for AI, robotics, and self-driving technology, while bears highlight ongoing profitability challenges with more weakening ahead, a stretched valuation (278.22x forward non-GAAP P/E), and a damaged brand image. Following a recent run, TSLA stock is now trading above its average price target of $377.80.

On the date of publication, Oleksandr Pylypenko did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Jensen Huang Says AI Is ‘Work,’ Not a ‘Tool.’ This 1 Blue-Chip Dividend Stock Is Bringing that Work to America

- A $9.5 Billion Reason to Buy This High-Performance Computing Stock

- This Data Center Stock Is Up 1,300% in Just 3 Years

- As Tesla Stock Disappoints on Earnings Yet Again, CEO Elon Musk Shares That This 1 Thing Is ‘His Biggest Concern’

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.